The Lucky Seven is a swing-trading biotechnology portfolio of seven stocks listed in a way to reflect top picks and risk tolerance. The first three picks are the top picks (in no particular order). Risks are increased the further away a stock sits from #4 (the least risky stock).

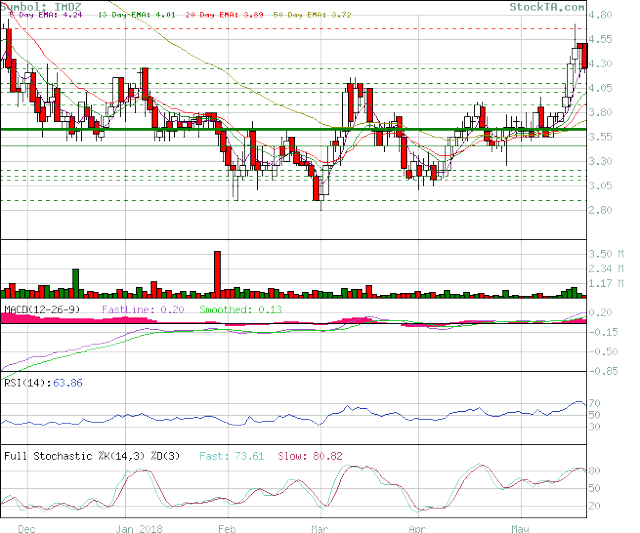

1. Immune Design (IMDZ)

Price: 3.80/Gain 11.8%/Day 6

Immune Design crossed the 15% threshold on May 16, intraday. Therefore, it is a "win". We are continuing to hold based on (1) conviction of data, (2) insider confidence, and (3) technical indicators. While we saw shares in Immune Design take a breather after the intraday high on the 16th, we feel there's still room for additional appreciation:

Chart courtesy of StockTA.com

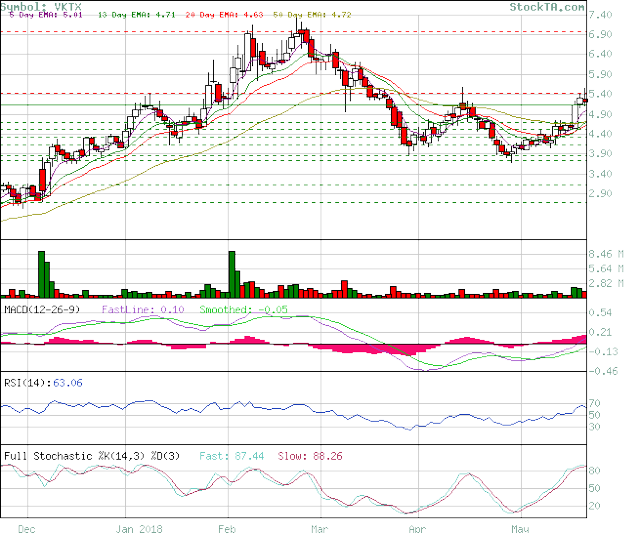

2. Viking Therapeutics (VKTX)

Price: 4.58/Gain 13.6%/Day 3

In addition to an Immune Design win, Viking rose over 15% intraday, May 17, for a win. Indicators are bullish in the near-term. A push over 5.40 may not see any additional resistance until 6.90 based on its prior movements. Note: It's likely that Madrigal (MDGL) data will be released next week.

Chart courtesy of StockTA.com

3. Array BioPharma (ARRY)

Price: 13.75/Gain 14.5%/Day 13

While Array already reached the 15% threshold, I believe it can hit the 30% threshold within a month or two. We will continue to hold.

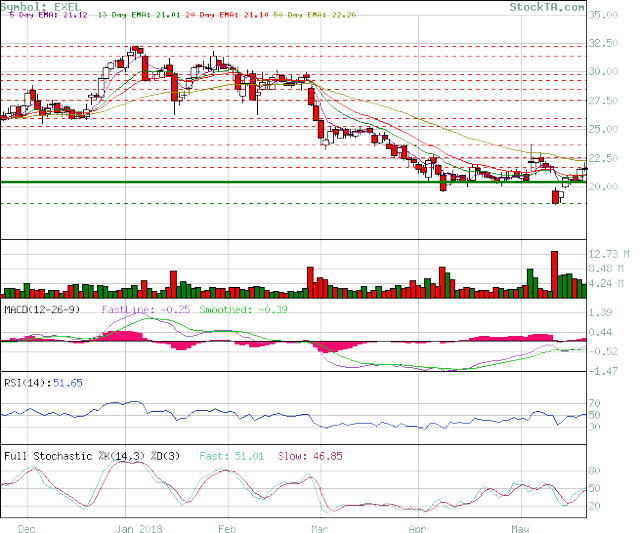

4. Exelixis (EXEL)

Price: 21.77/Loss 0.8%/Day 14

Exelixis has made up nearly all of its losses after disappointing phase 3 data for its far less prominent and profitable cancer drug. We believe now is a great time to hold shares in Exelixis, as the $20.43 mark has served as massive support in the past (see chart below). Now appears to be a great opportunity to ride Exelixis' next phase of growth going forward.

Chart courtesy of StockTA.com

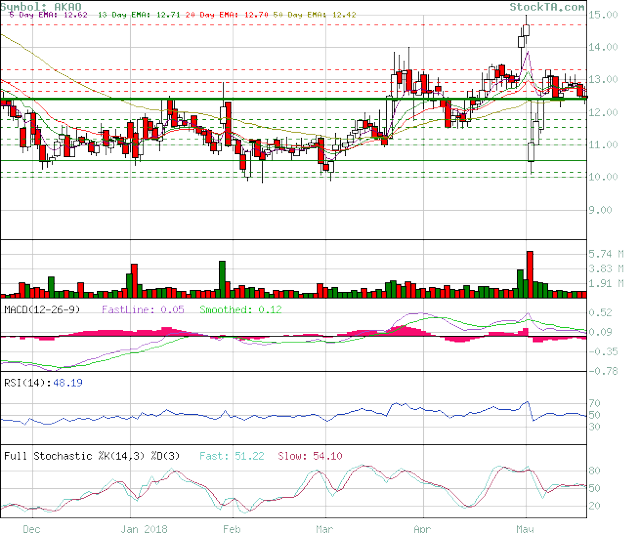

5. Achaogen (AKAO)

Price: 12.58/Loss 1%/Day 6

Shares of Achaogen closed at 12.45 on Friday. 12.40 has served as great support in the past. If Achaogen closes under 12.40, consider it sold for a loss at EOD price. It's probable shares will hang around the 12.40 support for a while before making a definitive move weeks from now.

Chart courtesy of StockTA.com

6. ChemoCentryx (CCXI)

Price: 11.45/Gain 7.3%/Day 3

ChemoCentryx appears to be the most encouraging chart, technically-wise, for near-term appreciation:

Chart courtesy of StockCharts.com

7. Global Blood Therapeutics (NASDAQ:GBT)

Price: 44.75/Gain 3%/Day 13

As predicted, shares in Global Blood bled late into last week. We are holding based on our conviction of phase 3 data.

I often utilize a presentation by BIO Industry Analysis that provides in-depth statistics on clinical development success rates from 2006-2015. It puts things in perspective. Some voxelotor-related points:

Hematology drugs have the highest probability of phase 2 and 3 success, compared to all other disease areas, with 57% and 75% success rates, respectively. Although common and chronic, SCD is actually considered an orphan/rare indication. Rare diseases have a higher probability of phase 3 success compared to chronic, high prevalence ones (73% vs. 58%). A downside: voxelotor is a new molecular entity. Such drugs have significantly greater difficulty in advancing through phases and earning a thumbs-up from regulators. However, FDA's decision to "back" voxelotor is likely to diminish the power of this statistic.Considering the FDA has already peeked at data from Part A of the phase 3 HOPE study and was, apparently, favorable towards it, the likelihood of phase 3 success and subsequent NDA approval is very high. I think it's more than reasonable to assign an 80%+ chance of phase 3 success in adults and a 65%+ chance of phase 2 pediatric success.

Investing in biotechnology must be based on reason and odds and not of emotion. Although it is not guaranteed to be a successful trade, we are placing our bet on it based upon sound reasoning and odds. With those odds, more time than not, we will win and that will be made evident over time.

It's also of note that the "bleeding" last week was accompanied with low volume. Shares of Global Blood are not trading in a strange way:

Chart courtesy of StockCharts.com

This two-year chart demonstrates that although Global Blood sees legs up, it usually crouches its way back to its 200-day moving average. Positive phase 3 part A data will almost certainly send the stock to new highs that will again probably make its way back to its 200-day MA with time.

Lucky Seven ScorecardRecord: 4-1-3; Gain: 11.4% (theoretical - if we sold at 15%)

Loss/Synlogic, Inc. (SYBX)/sold 5/8/18, -1.6%/3 days

Win/Omeros Corp. (OMER)/sold 5/11/18, 34.5%/8 days

Gain/Viking Therapeutics (VKTX)/sold 5/11/18, 5.8%/8 days

Win/Array BioPharma (ARRY)/reached threshold 5/14/18, 15%/9 days

Gain/NovoCure (NVCR)/sold 5/15/18, 4.9%/10 days

Gain/Avid Bioservices (CDMO)/sold 5/15/18, 2.2%/8 days

Win/Immune Design (IMDZ)/reached threshold 5/16/18, 15%/4 days

Win/Viking Therapeutics (VKTX)/reached threshold 5/17/18, 15%/1 day

Author's note: For further insight into biotechnology stocks, please follow Clover Biotech Research.

Disclaimer: The intention of this article is to provide insight, not investment advice. One must consider one's own financial standings, risk tolerance, research, etc. before making a decision to buy shares in a company. Many of my articles detail biotechnology companies with little or no revenue. These stocks are, therefore, speculative and volatile. Even when prospects seem promising, there is no predicting the future. Losses incurred may be significant.

Disclosure: I am/we are long VKTX, GBT, IMDZ, CWBR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment