Best Stocks Broker Blog For 2013, Top Stocks For 2013

Tuesday, April 30, 2013

Can American Capital Agency Keep Fighting the Fed?

On Thursday, American Capital Agency (NASDAQ: AGNC ) will release its latest quarterly results. The key to making smart investment decisions on stocks reporting earnings is to anticipate how they'll do before they announce results, leaving you fully prepared to respond quickly to whatever inevitable surprises arise. That way, you'll be less likely to make an uninformed, kneejerk reaction to news that turns out to be exactly the wrong move.

Mortgage REITs like American Capital Agency have prospered for years, paying double-digit dividends as they took advantage of low short-term interest rates to make the most of their leveraged portfolios. But the Federal Reserve's move to use mortgage-backed securities to implement its quantitative easing program has threatened to crowd out mortgage REITs hungry for the same securities. Let's take an early look at what's been happening with American Capital Agency over the past quarter and what we're likely to see in its quarterly report.

Stats on American Capital Agency

| Analyst EPS Estimate | $1.13 |

| Change From Year-Ago EPS | (58%) |

| Revenue Estimate | $377.1 million |

| Change From Year-Ago Revenue | (7.6%) |

| Earnings Beats in Past 4 Quarters | 2 |

Source: S&P Capital IQ.

Can American Capital Agency keep the growth flowing this quarter?

Analysts have become increasingly cautious about American Capital Agency's earnings prospects, as their long-range projections have earnings remains flat to slightly lower in 2014 and 2015 compared to this year's projections. The stock, though, has managed a total return of about 9% since late January.

What's especially noteworthy about American Capital Agency's share-price performance is that the company made a huge secondary offering back in March, with 50 million shares issued to ordinary investors and 7.5 million more offered to underwriters. Yet as with past offerings, the March issue didn't hurt the stock price, and with shares trading near book value, the issuance didn't dilute the value of existing shareholders' stock.

At some point, though, American Capital Agency will get so large that it will create concerns about systemic risk in the mortgage-security space. Between it and rival Annaly Capital (NYSE: NLY ) , the two largest mortgage REITs own $235 billion in assets, showcasing the amount of leverage available to the major industry players. If Congress takes away favorable tax-status for mortgage REITs, it could send effective dividend yields plunging, and other measures could even limit the ability of American Capital Agency and its peers to use as much leverage as they currently have.

Still, one advantage investors have with American Capital Agency is the expertise of CEO Gary Kain. As a former employee at Freddie Mac, Kain earned more than 20 years of experience with mortgages and mortgage-backed securities. With an understanding of likely Fed policy, Kain has positioned American Capital Agency to take advantage of current conditions, sporting a much lower prepayment rate and using esoteric strategies like the dollar-roll market to reap extra profits.

In American Capital Agency's quarterly report, look closely to see what measures the mortgage REIT has in place to hedge its exposure to interest rate risk. With an improving economy having pushed up the probability of interest rate hikes within the next couple of years, now's the time for American Capital Agency to take steps to protect itself from the damage that higher rates could cause to its leveraged portfolio.

One reason many investors like American Capital Agency better than Annaly is that they don't count on Annaly's payout sticking around in the face of the Federal Reserve's interest rate policies. In The Motley Fool's premium research report on Annaly, senior analysts Ilan Moscovitz and Matt Koppenheffer uncover the key challenges the company faces and divulge three reasons investors may consider buying it. Simply click here now to claim your copy today!

Click here to add American Capital Agency to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

Why the Street Should Love Hill-Rom Holdings's Earnings

Although business headlines still tout earnings numbers, many investors have moved past net earnings as a measure of a company's economic output. That's because earnings are very often less trustworthy than cash flow, since earnings are more open to manipulation based on dubious judgment calls.

Earnings' unreliability is one of the reasons Foolish investors often flip straight past the income statement to check the cash flow statement. In general, by taking a close look at the cash moving in and out of the business, you can better understand whether the last batch of earnings brought money into the company, or merely disguised a cash gusher with a pretty headline.

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Hill-Rom Holdings (NYSE: HRC ) , whose recent revenue and earnings are plotted below.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. FCF = free cash flow. FY = fiscal year. TTM = trailing 12 months.

Over the past 12 months, Hill-Rom Holdings generated $177.9 million cash while it booked net income of $108.9 million. That means it turned 10.5% of its revenue into FCF. That sounds pretty impressive.

All cash is not equal

Unfortunately, the cash flow statement isn't immune from nonsense, either. That's why it pays to take a close look at the components of cash flow from operations, to make sure that the cash flows are of high quality. What does that mean? To me, it means they need to be real and replicable in the upcoming quarters, rather than being offset by continual cash outflows that don't appear on the income statement (such as major capital expenditures).

For instance, cash flow based on cash net income and adjustments for non-cash income-statement expenses (like depreciation) is generally favorable. An increase in cash flow based on stiffing your suppliers (by increasing accounts payable for the short term) or shortchanging Uncle Sam on taxes will come back to bite investors later. The same goes for decreasing accounts receivable; this is good to see, but it's ordinary in recessionary times, and you can only increase collections so much. Finally, adding stock-based compensation expense back to cash flows is questionable when a company hands out a lot of equity to employees and uses cash in later periods to buy back those shares.

So how does the cash flow at Hill-Rom Holdings look? Take a peek at the chart below, which flags questionable cash flow sources with a red bar.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. TTM = trailing 12 months.

When I say "questionable cash flow sources," I mean items such as changes in taxes payable, tax benefits from stock options, and asset sales, among others. That's not to say that companies booking these as sources of cash flow are weak, or are engaging in any sort of wrongdoing, or that everything that comes up questionable in my graph is automatically bad news. But whenever a company is getting more than, say, 10% of its cash from operations from these dubious sources, investors ought to make sure to refer to the filings and dig in.

Hill-Rom Holdings's issue isn't questionable cash flow boosts, but items in that suspect group that reduced cash flow. Within the questionable cash flow figure -- here a negative-- plotted in the TTM period above, other operating activities (which can include deferred income taxes, pension charges, and other one-off items) constituted the biggest reversal. Overall, the biggest drag on FCF came from capital expenditures, which consumed 29.1% of cash from operations.

A Foolish final thought

Most investors don't keep tabs on their companies' cash flow. I think that's a mistake. If you take the time to read past the headlines and crack a filing now and then, you're in a much better position to spot potential trouble early. Better yet, you'll improve your odds of finding the underappreciated home-run stocks that provide the market's best returns.

If you're interested in companies like Hill-Rom Holdings, you might want to check out the jaw-dropping technology that's about to put 100 million Chinese factory workers out on the street – and the 3 companies that control it. We'll tell you all about them in "The Future is Made in America." Click here for instant access to this free report.

We can help you keep tabs on your companies with My Watchlist, our free, personalized stock tracking service.

Add Hill-Rom Holdings to My Watchlist.Monday, April 29, 2013

4 Things That Can Go Wrong for Apple Next Week

Apple (NASDAQ: AAPL ) isn't doing very well these days.

The stock broke below $400 on Wednesday, and today the shares are trading at their lowest level since late 2011.

The bearish trend comes just as the consumer tech giant is ready to report quarterly results next Tuesday. At prices this low, one would think that even ho-hum news will be applauded by the market next week, but things can always get worse.

Let's go over a few things that can send this already battered stock even lower.

1. Earnings can fall short of expectations -- again

Investors have known for months that Apple will be reporting lower quarterly earnings -- something that hasn't happened in 10 years.

The vinegar salt in the wound is that analysts have been scrambling to lower their profit expectations in recent weeks. As secondhand reports suggest a softening of tablet, smartphone, and PC sales, projections have been hosed down.

Wall Street's betting on a profit of $10.13 a share out of Apple. The target was $10.18 a share last month, $10.24 a share two months ago, and $11.84 a share three months ago.

Since the trend is heading lower, it means that the fresher updates have been negative. This suggests that Apple may miss on the bottom line, and that in of itself wouldn't be a surprise. Apple has missed Wall Street's income estimates in three of the past five quarters. It would still be a blow to some bulls lamenting the days of Steve Jobs when Apple would consistently trounce the market.

2. Revenue growth can decelerate too fast

The bearish case against Apple revolves largely around deteriorating margins, so even worrywarts may not realize that analysts now see Apple's top line growing in the single digits this quarter. Wall Street's eyeing just 8.9% in revenue growth to $42.68 billion.

A miss here would probably be even more catastrophic than a sharper decline in profitability.

Did you see Nokia (NYSE: NOK ) today? The wireless handset pioneer was crushed after reporting quarterly results. It actually beat expectations on the bottom line by posting a narrower deficit than what analysts were projecting. The rub at Nokia is that shipments and revenue fell well short of market forecasts.

Even if Apple delivers on the bottom line, if revenue comes in weak, you can expect a fresh wave of analyst downgrades as Apple's relevance takes another hit.

3. Apple may not raise its dividend

Apple has more cash on its balance sheet than any other company, but it's been stingy.

A cascading share price has helped prop its yield above 2.6%, but investors believe that Apple should just crack open its billfold to push its quarterly dividend even higher. At the very least, Apple should be aggressively buying back its stock at this point.

If Apple doesn't push up its payouts, investors will wonder why it's being so protective of its dormant cash. Even if it has to take a repatriation tax hit by bringing some of its overseas cash home, Apple not putting its money where its mouth is here and returning money to shareholders would be a disappointment.

4. Innovation in hibernation

Revolutionary products have gotten Apple out of lulls in the past, but what will the next iPod, iPhone, or iPad be? We know that Apple isn't out of ideas, but what if potential catalysts are delayed?

Apple has to realize that there's a crisis among investors here.

If the tech bellwether can't at least suggest that there are reinforcements of the iOS army on the way, why would anyone believe that Google isn't cornering the market?

It's merely a coincidence that Apple will report just days before seven domestic wireless carriers begin stocking the bar-raising Samsung Galaxy S4. This is the part where the preacher at a church wedding turns to the crowd, asking them if anyone has a reason why a smartphone buyer shouldn't hook up with Samsung's new Android-fueled smartphone. It's not a moment for Apple to be silent.

If there was ever a time for Apple to give shareholders and consumers hope, Tuesday afternoon would be it.

The clock's ticking higher. The shares are ticking lower. Something's got to give.

Got Apple? Get smart.

There's no doubt that Apple is at the center of technology's largest revolution ever, and that longtime shareholders have been handsomely rewarded with over 1,000% gains. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on both reasons to buy and reasons to sell Apple, and what opportunities are left for the company (and your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

Netflix Is Changing Fast

Netflix (NFLX) is an interesting business to investigate, as its revenue and stock price have been quite volatile. A look into the Q1 2013 results for Netflix NFLX shows that their three avenues of business (domestic streaming, international streaming and domestic DVD) have changed quite a lot over just the past year. And while in the past NFLX concentrated on their domestic markets (streaming and DVD), it is now also working hard to bring its international streaming revenue up to scratch. We can see that there is now a clear trend of declining domestic DVD revenues, increasing domestic streaming revenues, and increasing international streaming revenues.

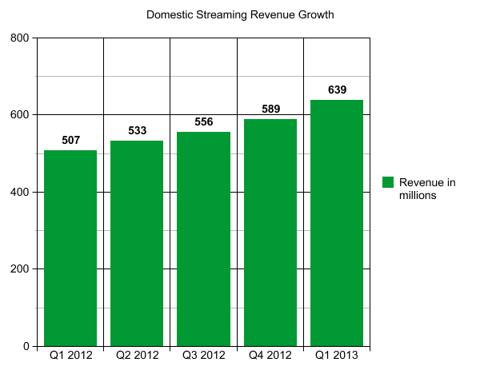

Domestic Streaming Revenue Growth

(click to enlarge)

In regards to its domestic streaming segment, it would appear that NFLX has been making all the right moves lately. In Q1 2013, for the first quarter ever, profits from domestic streaming ($131 million) exceeded profits from domestic DVD's ($113 million). This could partly be attributed to NFLX's exclusive content (especially the new show House of Cards) that brought in many new members, and improved member satisfaction as NFLX continues to improve their service. I believe that making a multi-year deal with Time Warner (TWX) for new shows will be a large driving force for retaining members and attracting new members and we will see numerous shows available for streaming on NFLX in future, including Revolution (NBC), The Following (Fox), Longmire (A&E) and Political Animals (USA). NFLX management predicts that domestic streaming revenue will continue to increase in Q2 2013.

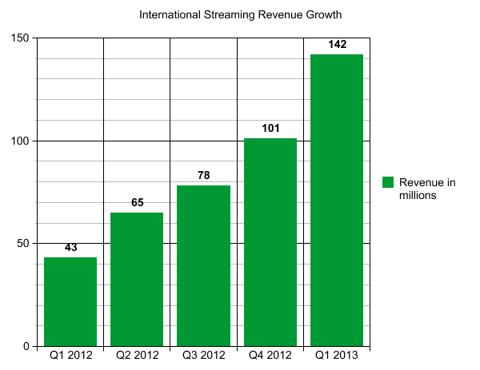

International Streaming Revenue Growth

(click to enlarge)

The newest segment for NFLX, international streaming represents an enormous new market, as roughly only 10% of the world's ~2.4 ! billion total internet users are based in the USA. NFLX has been aggressively marketing their international streaming service and has grown their international streaming revenue very quickly: in Q1 2012, international revenue was only $43 million, whereas in Q1 2013 it was $142 million. Perhaps most importantly, the losses for international streaming have declined, with $77 million lost in Q1 2013 compared to $103 million lost in Q1 2012. It is to be expected that losses will take place during the early stages of a new service being introduced - NFLX was, in fact, losing money for a long time before they reached profitability with their main domestic services. But if the trend for international streaming continues, we could see this segment of NFLX become profitable within the next couple of years, and then it could become one of the main money-makers for NFLX. NFLX management forecasts losses of $65 million to $81 million for international streaming in Q2 2013, and I expect this to decline in further quarters.

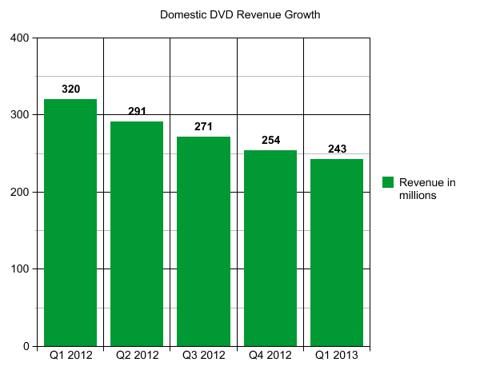

Domestic DVD Revenue Growth

(click to enlarge)

The domestic DVD segment of NFLX enjoys very high profit margins (in Q1 2013 the contribution margin for Domestic DVD was 46.6%, representing contribution profit of $113 million) compared to domestic streaming. But while domestic DVD is a very important segment for NFLX that has brought in very healthy profits, it has very clearly declined over the past year, and it seems very likely that it will continue to decline (NFLX management forecasts domestic DVD contribution profit of $100 million to $112 million in Q2 2013). I cannot think of how NFLX could improve this segment of their business and turn the trend around to bring up domestic DVD revenue to its previous highs.

What's In Store For NFLX?

The numbers for NFLX tell a very clear story - streaming is growing, while the older domestic DVD segment is declining. I believe ! technolog! y is the main cause for this shift. Broadband internet has become far more common since NFLX first started, and consumers now have access to far cheaper internet plans with faster speeds and higher data allocations. That allows them to stream television shows with ease, and watch shows immediately. Having a DVD sent in the mail is, by comparison, slow, expensive and cumbersome. We have already seen how the internet has affected traditional video-rental stores such as Blockbuster from DISH Network (DISH). Just like the music industry (where record stores and album sales were dominant before internet use was widespread), the industry for NFLX has changed substantially since its inception, and NFLX has to recognize these changes and adapt.

For NFLX investors, the most exciting segment of the business to watch for the remainder of 2013 and beyond will be international streaming. This will represent the strongest growth potential compared to the already relatively mature domestic streaming and DVD revenues. NFLX is present in Latin America, Europe and Canada, and these markets should supply millions of new customers in the coming years. But just as how it took many years for its domestic streaming and domestic DVD segments to become profitable, international streaming is very unlikely to become a huge success for NFLX in the short term. NFLX shareholders will therefore need to remain patient as international streaming grows for NFLX and slowly begins to add to its bottom line.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Sunday, April 28, 2013

Area Codes Become a Weapon in the Telecom War

If Vonage (NYSE: VG ) has its way, the days of AT&T (NYSE: T ) , Verizon (NYSE: VZ ) , and their big-carrier peers controlling the way area codes are assigned are coming to an end.

The VoIP upstart is lobbying regulators to allow for sales of premium area codes such as 212 for Manhattan, 617 in Boston, or 213 in L.A., on the theory that some will pay up for access in the same way some pay up for custom license plates.

Business owners might also enjoy the option, especially home workers who pay for premium VoIP telephony from the likes of 8x8 (NASDAQ: EGHT ) , says Tim Beyers of Motley Fool Rule Breakers and Motley Fool Supernova in the following video.

Startups often invest in infrastructure gimmicks to help attract large, professional clients. Investing in a premium area code isn't much different. Vonage and its peers, meanwhile, get the benefit of upselling a service that previously had been off-limits. Everyone but the incumbent carriers win, Tim says.

Should Vonage be allowed to sell premium area codes? Please watch this short video to get Tim's full take, and then leave a comment to let us know which telecom stocks you like most right now.

The mobile revolution is still in its infancy, but with so many different companies it can be daunting to know how to profit in the space. Fortunately, The Motley Fool has released a free report on mobile named "The Next Trillion-Dollar Revolution" that tells you how. The report describes why this seismic shift will dwarf any other technology revolution seen before it and also names the company at the forefront of the trend. You can access this report today by clicking here -- it's free.

3 Reasons to Worry About SandRidge

In this video, Joel South highlights three reasons to worry about SandRidge Energy.

Numerous shifts in its business strategy that later forced it to sell assets to pay off debt. If production from its Mississippian Lime play doesn't produce needed revenues, SandRidge may need to sell more assets. Speaking of the Mississippian Lime, it's had more natural gas than originally expected, and even though natural gas prices have come off their lows, the real revenue drivers are oil and liquids, and these may not deliver as needed. CEO Tom Ward is in the crosshairs of the board and activist shareholders. Will Ward go? If so, how expensive will his departure be?Check out the video for more details.

Investors were startled after SandRidge plummeted when natural gas prices reached 10-year lows, but with the company focusing on growing liquids production, the future looks optimistic. If you are unsure about the future of this emerging oil and gas junior and are looking to find out more about its strengths and weaknesses, then check out The Motley Fool's premium research report detailing SandRidge's game plan and what to expect from the company going forward. To get started, simply click here now!

Did Berkshire's Poaching Just Send AIG Back Into the Abyss?

Executives move from from one company to another all the time -- that's a normal proceeding of the business world. But when several high-ranking executives leave all at once for the same company, we're often seeing a piece of a larger puzzle. That's what we saw this past Friday, when it was announced that four top employees were defecting from AIG (NYSE: AIG ) to join the team at Berkshire Hathaway (NYSE: BRK-A ) (NYSE: BRK-B ) .

The moves pose several questions for AIG investors: Are the people in the know fleeing because they know something we don't? Does this leave AIG vulnerable? How will the company move forward? Let's look at the people that left, how it may effect AIG, and what you should consider for your investment.

Name that executive!

A quick lineup of the defecting executives gives you a good idea of how Berkshire will be using their talent:

Berkshire is ranked seventh overall in the property-casualty providers as of year-end 2012, with 3.88% of the market share, while AIG is ranked fifth with 4.58%. So with three of the new employees heading major P&C units for AIG, their knowledge will surely help Berkshire to expand where necessary. The final member, Bresnahan, led the excess and surplus operations -- one of AIG's most successful segments, with the company dominating the market with an estimated 20% share. Berkshire's E&S operations are only a fraction of AIG's, with an estimated 1.6% of the $25 billion market.

So with that info, we can see what Berkshire's objectives might be, but where does that leave AIG? The company itself has stated that it possesses a "deep bench," with lots of talented and capable people willing to step up and take over added responsibilities after the departures. Since the business operations of the P&C and E&S divisions are so established, there is little to fear that the whole house of cards will fall because of the changes in personnel. But regardless, the move is a big hit to AIG whether it realizes it or not.

It's all a matter of perception

In investing, perception of a company can oftentimes sway someone's opinion enough to make or abstain from a buy. With AIG, the company's involvement in the financial crisis has created a lasting impression on investors that the company is bad, weak, deceiving, and the like. And with the news that four top players are leaving, investors' perception of the company may be sustaining that impression further.

If you note the timing of this news, it's easy to guess that these executives stayed with AIG throughout the resolution of the bailout and now think it's an appropriate time to seek new positions since the company has paid off all of the governmental money. In that case, their loyalty to the cause is admirable and gives them every right to leave without there being an underlying problem. But since there hasn't been any formal comment, there is little support that will keep investors on that track of thinking.

Looking forward

As a long-term investor, whether you hold AIG stock now or are thinking about buying some shares, keep in mind that you should really focus on whether this will effect the fundamentals of the company. With established operations, there may be little change with new management, or a new leader could step up and change things for the better (or worse). This is where you have to decide what's important to you and your portfolio. AIG will be reporting its first-quarter earnings on Thursday, so keep and ear out for whether the company discusses any of the recent personnel moves and how AIG will move forward.

At the end of last year, AIG was the favorite stock among hedge fund managers. Have they identified the next big multi-bagger, or are the risks facing the insurance giant still too great? In The Motley Fool's premium report on AIG, financials bureau chief Matt Koppenheffer breaks down the key issues that you need to know about if you want to successfully invest in this stock. Simply click here now to claim your copy, and you'll also receive a full year of key updates and expert analysis as news continues to develop.

3 Companies Muffling Shareholders' Voices

Many corporations tout the benefits of collegial, efficient boards with a unified vision for the company and worry that shareholder-nominated directors will disrupt this environment by bringing in conflicting agendas.

But is an efficient board with a unified vision always in the best interests of shareholders? Not necessarily.

Shareholders, keep out

A few years ago, when the SEC considered introducing a new regulation requiring public companies to include some shareholder-nominated candidates for the board of directors on their proxy statements, Chevron (NYSE: CVX ) objected.

In a letter to the SEC, Chevron claimed the proposed regulation would "create an adversarial aspect in director interactions," and argued that it's better to have a governance structure that promotes "consensus-driven leadership and oversight resulting from the free and open exchange of knowledge and perspective by a board of directors working in a collegial manner for the good of the stockholders."

That's all well and good ... if we can count on the board of directors to work in a collegial manner for the good of stockholders. But we can't always count on them to do this. Sometimes directors make self-serving decisions that put their own interests, and the interests of company management, before those of shareholders. In such cases, shareholders have reason to bring in board members that disrupt consensus and collegiality when it doesn't promote shareholder interests.

Score one for disruption

We don't need to look far to see why board disruption can be a good thing. Just look at two other energy companies: Chesapeake Energy (NYSE: CHK ) and Nabors Industries (NYSE: NBR ) .

Chesapeake gained infamy for its poor corporate governance when founder and ex-CEO Aubrey McClendon was exposed for taking out $1.1 billion in loans against his personal stake in company-owned wells. And the company looked even worse after its board claimed that this action posed no conflicts of interest. Other scandals included McClendon's operation of a private hedge fund with significant positions in natural gas futures, and the company's decision to purchase McClendon's personal map collection for $12 million, which was significantly above its assessed value.

When Chesapeake shareholders fought back by submitting a proposal in the company's 2012 proxy pushing the company to list some shareholder-nominated directors on future proxies, Chesapeake's objection resembled Chevron's. It wrote, "Our Board is characterized by frank and open dialogue with management, the primary goal of which is to advance the long-term interests of our shareholders. Proxy access threatens to create a politicized environment, straining relationships among directors and between management and the Board."

Nabors Industries, meanwhile, has been embroiled in scandals of its own. It earned the ire of shareholders when it granted its former CEO, Eugene Isenberg, a $100 million severance package for relinquishing his CEO role, even as Isenberg remained as the company's chairman. Before that, a majority of Nabors' shareholders voted against the board's say-on-pay proposal. While Isenberg later agreed to forgo this severance, the board's questionable compensation decisions undermined shareholders' trust.

When shareholders fought back by submitting a proposal in the company's 2012 proxy pushing the company to list some shareholder-nominated directors on future proxies, the Nabors board responded with worries about "disruption" similar to the arguments from Chevron and Chesapeake: "Ultimately, the proposal could lead to a divided board of directors with competing factions that make it difficult for the Company to pursue a successful and consistent business strategy. The best results for shareholders are obtained when directors, elected to make significant strategic decisions, act together constructively to create shareholder value."

The Foolish takeaway

The conduct of the boards at Chesapeake and Nabors inspired shareholders at both companies to vote in favor of the shareholder proposals pushing for greater proxy access. While Nabors has resisted pressure to take further action on the non-binding resolution, Chesapeake is responding to the non-binding proposal by sponsoring its own proposal.

This is a positive step, as it gives shareholders more power to hold the corrupt and inept board members accountable at companies that have proved themselves untrustworthy. It also allows investors to introduce directors who offer different perspectives on what's best for the company.

But investors should ask themselves: Should it take a headline-grabbing scandal to push for more power over board elections? In an environment where egregious executive pay packages and conflicts of interest have become commonplace, I'd like to see more "disruption" introduced into boards before these scandals arise.

Chesapeake Energy's share price depreciated after negative news surfaced concerning the company's management and spiraling debt picture. While the debt issues still persist, giant steps have been taken to help mitigate the problems. To learn more about Chesapeake and its enormous potential, you're invited to check out The Motley Fool's brand-new premium report on the company. Simply click here now to access your copy.

Saturday, April 27, 2013

Ford Earnings Report Delivers the Goods!

Opening of a new era at Flat Rock Assembly Plant. Photo credit: Ford.

Over the last few years Ford (NYSE: F ) has had a trend of rallying through the early parts of the year, only to swoon during summer. Today's earnings could play a pivotal role in whether we see another summer swoon from Ford, or if it sets on a path to test its 52-week high of $14.30 on Jan. 1. Personally, I'd love to see the latter, and Ford has a great chance to do so with today's numbers. North America led the way with strong profits, and Europe losses were lower than I expected. Let's break it down and watch as the stock price reacts throughout the day.

Expectations

We knew going in to this conference call what to expect. We knew that record sales for the quarter had been set by Ford's Fusion, Escape, and Explorer. The F-Series – Ford's profit driver – also sold extremely well and even had plants running a third shift to keep up with demand. Expectations were for strong North American profits, but worries about losses in Europe continued to pile up, worries that were quickly forgotten this morning as strong profits definitely offset Europe. Analysts expected about $0.37 earnings per share, which Ford topped, reporting EPS of $0.40 on $1.6 billion after tax profits. That compares favorably versus last year that came in at EPS of $0.35 on $1.4 billion. Wait – it gets better!

Europe

Last year Ford lost $1.7 billion in Europe, averaging out to be $425 million per quarter. Unfortunately the losses increased as the year went on, with the losses topping $732 million in the fourth quarter – ouch. Today is great news on the European front where it appears some of the cost savings have taken hold. Ford reported the loss in Europe at $462 million: It seems odd to be excited about a $462 million dollar loss, but this is good news – trust me. In addition to that, one thing that helped offset losses in Europe last year was Ford's financial division – which brought in $1.7 billion in profit for 2012. In the first quarter, profits from that division hit $503 million and outpaced losses in Europe itself. If Ford can keep losses in check – or even improve on them – 2013 will be a great year for the folks at the Blue Oval.

Margins

I heard rumblings and rumors of margins that could hit up to 12% this quarter, which is a lofty expectation in the auto industry. The reason for the high expectations was that plants were running at maximum capacity. Each third shift that produces a popular Fusion or F-Series is much more profitable to the bottom line – as overhead costs are minimized. The North American operating margins came in at 11%, which is slightly below the first quarter in 2012, but still very strong.

Incentives and pricing

In other good news, Edmunds.com shows the average people paid for Ford's vehicles is up 3.7% for an average of just over $33,000. That favors comparably to $31,900 last year and is simply due to the fact that people want to buy Ford's newer, more popular vehicles. Ford also saw its incentives per vehicle sold shift down to $2,700, or 2.2%. It's unclear whether this trend can continue, especially for the profit-driving F-Series that will have to match up against the new 2014 Chevy Silverado this spring.

Spring bloom or swoon?

It's unclear how the stock price will react during this morning, as investors are finicky creatures. As a long-time shareholder and one who covers the auto industry for a living – I'm very pleased with the quarterly report. I'm optimistic that the future of Ford in Europe will be profitable ahead of schedule and excited at how well Ford's vehicles are selling in North America. Margins are solid, incentives are down, and overall pricing is trending upwards. Did I mention that Ford still trades at a favorable P/E ratio? I expect Ford to buck the trend of its historical summer swoons and keep driving profits all year long.

Worried about Ford?

If you're concerned that Ford's turnaround has run its course, relax – there's good reason to think that the Blue Oval still has big growth opportunities ahead. We've outlined those opportunities in detail, in the Fool's premium Ford research service. If you're looking for some freshly updated guidance to Ford's prospects in coming years, you've come to the right place – click here to get started now.

5 Ways Dividend Stocks Can Come Back to Bite You

Low interest rates have put pressure on millions of investors who rely on bank CDs and other safe investments for their income. In response, many of them have replaced some of their former exposure to fixed-income investments with dividend stocks. Although making that move will get you a lot more income than a bank CD will, you need to understand the risks you're taking by boosting your holdings of dividend stocks as your primary source of income.

The best way to understand the risks of dividend stocks is to see actual stories of how investors got hurt by owning them. Let's look at five ways that dividend stocks are far riskier than pure income investments.

1. Dividends can get cut.

With bank CDs, you know upfront exactly how much and when you're going to get income payments. Like clockwork, interest comes in every month or every quarter, either paid out to you directly or added to your CD account balance. Bonds and other fixed-income investments tend to be similar, with quarterly or semi-annual payments being the norm, and with fixed interest rates that tell you how much income you'll get.

With dividend stocks, however, you have no guarantee that there's no assurance that you'll receive a dividend. For instance, Spanish telecom company Telefonica (NYSE: TEF ) chose last year not to pay its planned dividend for 2012, saying it would restore half the payout later this year. Even stalwart blue-chips General Electric (NYSE: GE ) and Pfizer (NYSE: PFE ) had to reduce their dividends dramatically during the financial crisis, and even now, they haven't risen back to their pre-crisis levels.

2. Dividend-paying companies can see their stock prices fall.

Bank CDs never drop in value. You may need to pay a penalty if you need to get at your money early, but they're not subject to market fluctuations. Even if your bank fails, bank CDs are insured by the FDIC.

Dividend stocks, on the other hand, move just as much as ordinary stocks. With volatile share prices, you may suffer substantial losses, and although you might still receive the same dividend payments, the stock can stay depressed for a long time if business conditions don't improve.

3. Dividend stocks never mature and return your principal.

With bank CDs, Treasury bonds, and other low-risk income investments, you know exactly when you'll get your principal back. Moreover, with bank CDs and Treasuries, your principal is backed by the full faith and credit of the U.S. government.

Dividend stocks, on the other hand, don't have any fixed maturity date on which you're guaranteed to have your original investment returned to you. If share prices fall and stay low, you may never get your principal back.

4. Fixed income can survive bankruptcy when stocks don't.

Even in the worst-case scenarios, fixed-income securities can give you protection that stocks don't. Even for corporate bonds, which don't have government insurance protection and therefore are subject to risk of default, a bankruptcy can sometimes lead to a partial recovery. For instance, bondholders in the old pre-bankruptcy General Motors (NYSE: GM ) didn't get all their money back, but they did get equity interests in the new company. Old shareholders, on the other hand, got wiped out.

5. Dividend stocks have expensive valuations right now.

Lately, so many investors have bought dividend stocks that their valuations are extremely high. According to one analyst, dividend stocks trade 50% above their normal valuation levels, making them potentially more vulnerable to pullbacks if they return to more typical levels.

Stay aware of risk

To many, dividend stocks have provided income where other investments have failed recently. But with extra income comes extra risk, and you have to take that risk into account in deciding how much of your portfolio you can afford to invest in dividend stocks.

Few companies lead to such strong feelings as General Motors. But ignoring emotions to make good investing decisions is hard. The Fool's premium GM research service can help, by telling you the truth about GM's growth potential in coming years. (Hint: It's even bigger than you think. But it's not a sure thing, and we'll help you understand why.) It might help give you the courage to be greedy while others are still fearful, as well as a better understanding of the real risks facing General Motors. Just click here to get started now.

The End of Tax-Free Online Shopping Is Near

A new federal law is being debated that would allow states to force Internet retailers to collect sales taxes. Amazon.com (NASDAQ: AMZN ) supports the bill, while eBay (NASDAQ: EBAY ) wants it changed. In the following video, Fool contributor Demitrios Kalogeropoulos discusses what the two companies stand to lose from the coming state sales tax changes, and what consumers could gain.

Everyone knows Amazon is the king of the retail world right now, but at its sky-high valuation, most investors are worried it's the company's share price that will get knocked down instead of its competitors'. The Motley Fool's premium report will tell you what's driving the company's growth, and fill you in on reasons to buy and reasons to sell Amazon. The report also has you covered with a full year of free analyst updates to keep you informed as the company's story changes, so click here now to read more.

What Happens If We Let the Financial System Collapse?

Some wish that we were tougher on Wall Street in 2008. AIG (NYSE: AIG ) shareholders were almost wiped out. AIG bondholders didn't get touched. That was dangerous. Bondholders should have taken a hit, they say.

Others counter that making bondholders take a hit would cause a virtual bank run on the financial system. Indeed, there's good precedent for that after Lehman Brothers went bankrupt.

I asked Joseph Stiglitz, the Nobel prize-winning economist, to reconcile the two opinions. Here's what he had to say (transcript follows).

Morgan Housel: When I think back to 2008, one example I think of is the Reserve Primary Money Market Fund. It owned some Lehman Brothers' debt. Lehman Brothers went bankrupt, and it caused a run on the money market fund, as Reserve Primary broke the book, which instantly overnight caused the corporate credit paper market to freeze up, which had real-world impacts on growth restorers and automakers. So it does seem like 2008 did give us examples of a bank run on debt that had real-world consequences.

Joseph Stiglitz: Yeah, now that's a very interesting example. That illustrates the doctrine that was prevalent before the crisis, that you could allow the shadow banking system to go on and that it didn't represent any systemic risk and therefore we didn't have to closely regulate it. That doctrine was wrong. And so going forward, we are now in a position to realize how wrong we were. We need to regulate the shadow banking system so exactly the kind of thing that you described doesn't occur.

But even then, the issue was we could have protected the depositors in the shadow banking system without throwing so much money at the bankers or the shareholder and the bondholders; let's target the money where we needed to target the money to keep the flow of credit going. The irony in all this was we said we were doing this to keep the flow of credit going, and in the end, we did it in such a way that we didn't put any pressure on the banks to maintain the flow of credit, and too many of them didn't do that.

Friday, April 26, 2013

Pennsylvania REIT Reports Results, Increases Full-Year Guidance

Pennsylvania Real Estate Investment Trust (NYSE: PEI ) reported first-quarter results yesterday that were below consensus expectations on the top line but came in ahead on the bottom line, causing the company to raise guidance for the full year.

Pennsylvania REIT reported revenues for the three months ended March 31 of $106 million, up 3% from the same period last year when it recorded revenues just under $103 million. With funds from operations (FFO) of $24.2 million recorded in the first quarter, down $0.8 million from last year, the REIT now expects full-year FFO to be in the range of $2.00 to $2.08 per share, some 2% ahead of the $1.95 to $2.05 per share it previously pegged FFO to come in at.

Pennsylvania REIT CEO Joseph F. Coradino said, "We are off to a strong start in 2013. During the first quarter, we delivered strong operating results, increased the dividend on our common shares, refinanced property-level debt at lower interest rates, disposed of non-core assets improving the quality of our portfolio, and last week refinanced our credit facility on highly favorable terms."

The REIT's portfolio sales per square foot rose to $381; its same store occupancy rates at malls including its anchor stores was 93%, ahead of last year's 91.7% occupancy rate. Even without the anchor stores, rates were above the year-ago period. The company's portfolio of 46 properties consists of 36 shopping malls, seven community and power centers, and three development properties.

link

Should I Buy Vodafone Group or BAE Systems?

LONDON -- BAE Systems (LSE: BA ) (NASDAQOTH: BAESY ) and Vodafone Group (LSE: VOD ) (NASDAQ: VOD ) operate in completely separate industries, but both companies have an attractive track record of providing high dividend yields.

The two firms also have another similarity -- both depend quite heavily on the substantial income they receive from their American businesses, without which they might struggle to fund their coveted dividend payouts.

I own both shares myself, but am looking top up some of my holdings -- so which of these two high yielders looks the best buy today?

Vodafone vs. BAE Systems

I'm going to start with a look at a few key statistics that can be used to provide a quick comparison of these two companies, based on their most recent annual results:

| Price to earnings ratio | 14.2 | 11.7 |

| Dividend yield | 6.9% (4.9% without special dividend) | 5.1% |

| 5-year average dividend growth rate | 7.1% | 8.8% |

| Net gearing | 32% | -10% (net cash) |

Vodafone plunged into a loss in the first half of this year, thanks to a hefty 5.9 billion pounds impairment on the value of its operations in Spain and Italy.

However, the firm's underlying operations remain profitable, and Vodafone was able to pay a four pence per share special dividend last year, on top of its standard dividend, giving shareholders a bumper payout that would give a yield of 6.9% at today's 195 pence share price.

Excluding these special dividends, both companies have similar historic yields, and BAE's dividend has grown faster than Vodafone's over the last five years. The defence company is also cheaper on a P/E basis, and benefits from having net cash of 387 million pounds, thanks to strong cash inflows last year.

What's next?

Analysts' forecasts are notoriously unreliable, but FTSE 100 companies generally get the benefit of the most comprehensive analysis, and tend to deliver fewer surprises than smaller companies.

With that in mind, let's take a look at the latest 2013 forecasts for Vodafone and BAE Systems:

| Forecast P/E ratio | 12.7 | 9.1 |

| Forecast dividend yield | 5.4% | 5.3% |

| Forecast dividend growth | 10.6% | 4% |

| Forecast earnings growth | 7.5% | 23.2% |

A Vodafone special dividend seems unlikely this year, because the firm has said that it will use the majority of the money from the 2.4 billion pounds from the Verizon Wireless dividend it received late last year to fund a share buyback.

BAE continues to look cheaper than Vodafone on a forward P/E basis, and analysts expect stronger adjusted earnings growth from the defence firm, too.

Which share should I buy?

Both Vodafone and BAE have been the subject of recent merger stories, but while BAE's failed merger with Airbus manufacturer EADS is now a closed book, Vodafone's situation is much less certain.

It seems increasingly likely that Vodafone will negotiate some kind of deal to sell its 45% stake in Verizon Wireless to its parent firm Verizon. Although this would provide a windfall for Vodafone, Verizon Wireless is the most profitable part of its business, creating some uncertainty as to how well it would fare without its U.S. arm.

Both firms offer similar dividend yields, but Vodafone's price has been pushed up by the recent bid speculation. Today, I would rather take advantage of BAE's low price and cash-rich status, and top up my holding in the U.K.'s largest defence company.

The best FTSE 100 dividends?

BAE and Vodafone are both decent income buys, but there are a number of other attractive, high-yielding alternatives elsewhere in the FTSE 100

Indeed, I can tell you that neither of these companies were chosen by The Motley Fool's team of analysts for their latest special report, "5 Shares To Retire On."

If you would like to know the identity of these five top-rated dividend investments, click here now to download your copy of this report. It's free, but availability is strictly limited, so don't delay.

Electric Vehicles Speed Ahead

Electric vehicles (EVs) are generating a lot of buzz lately. At this week's Bloomberg New Energy Finance Summit, influential characters repeatedly spoke of the EV revolution with gleeful enthusiasm. Meanwhile, the Shanghai Motor Show is opening up the throttle right this minute, and EVs have a lot to do with it. This is a glittery bandwagon, folks. Jump on?

Who likes EVs and why?

Michael Liebreich, Chief Executive of Bloomberg New Energy Finance, or BNEF, told me that he sees a real opportunity for EVs as we transition to the energy system of the 21st century. David Crane, CEO of NRG Energy, sees EVs as an integral part of the electricity distribution system of the future. Bill Richardson, former U.S. Energy Secretary, declared that EVs are "booming." Rick Geiger, executive director of utilities and smart grid at Cisco Systems, described the electric vehicle battery as the poster child for distributed energy resources. And Daniel Poneman, Acting U.S. Energy Secretary, described EVs as a critical element of electric grid modernization. Phew! That's a whole lotta love.

Here's the critical point: We cannot assess EVs in a vacuum. Honestly, we cannot assess anything in a vacuum, but certainly not anything to do with energy. As our society as a whole deals more directly with the massive challenges before it -- climate change, population growth, water scarcity -- we necessarily embark on a new energy paradigm that lightens our carbon output and improves our resilience to natural disasters. The only way to view the EV is as a part of this complex web. It's about mobility, yes, but it's more about energy.

This is the reason David Crane described EVs and solar -- together -- as catalysts for sustainable developments in grid architecture. Rooftop solar and EVs are both especially centered on the home. The former generates extra energy during peak demand; the latter stores it during off-peak times. They are complementary in managing the stressors on our modern grid.

Who's got nitrous in the tank?

There have been several announcements this week in the EV space. At the BNEF Summit, General Motors (NYSE: GM ) announced that its Chevrolet Spark EV is setting a new benchmark for efficiency with an EPA-estimated 119 MPGe (miles per gallon gasoline equivalent), and a range of 82 miles. Pam Fletcher, chief engineer of General Motors and so-called "Queen of the Volt," acknowledged the extent to which consumers hold off on EVs because of range anxiety -- the fear that an EV will die far from a charging station -- but said GM had solved this problem with its range-extender technology.

GM's new Spark EV at the BNEF Summit. Photo credit: Sara E. Murphy.

General Motors has some experience in this arena, having launched the Chevy Volt. Fletcher said the Volt represented a step change in consumers' perceptions of what an EV really has to offer. She said that with 100% torque on demand, Volts are fun, and a pleasure to drive. According to GM surveys, 92% percent of Volt owners would buy another Volt.

Fletcher said GM is bringing its Cadillac ELR extended range electric coupe to market at the end of this year. She said the Caddy will employ the same technology as the Volt, taking the best of the Volt's all-electric propulsion with extended range, then wrapping a luxury coupe around it.

Meanwhile, at this year's Shanghai Motor Show, newly re-emerged Detroit Electric announced its partnership with China's Geely Automobile to develop EVs for the Chinese market. Lamentably, I incorrectly predicted that Detroit Electric would be hitching its wagon to BYD. I got that one wrong, but Geely is no less interesting. Geely owns Sweden's Volvo Cars, and recently withdrew as a potential bidder for Fisker Automotive, the failing California green-car start-up. It will be interesting to see if this tie-up gives Tesla (NASDAQ: TSLA ) a run for its money.

Speaking of Tesla, its founder Elon Musk tweeted on Thursday that the company would be announcing a new strategy on Friday. His exact words were, "Announcement of new @TeslaMotors strategy tomorrow. Tesla owners will like this." Wall Street got all twitterpated, and Tesla shares were up more than 3% at Thursday's closing.

Ali Izadi-Najafabadi, senior advanced transport analyst at BNEF, said Tesla had built its brand value and customer base by making "cool" cars, irrespective of their EV qualities. Be that as it may, he was enthusiastic about the EV space, in general. He noted that, as we change vehicles' drivetrain, we get more optionality on the fuel side, paving the way for new approaches like Tesla's.

Tesla has a partnership with SolarCity (NASDAQ: SCTY ) -- another Elon Musk vehicle -- to provide Tesla drivers with solar-fueled battery-recharging stations. As I said above, EVs are complementary to renewable-energy deployment, particularly solar. In the new energy ecosystem, such partnerships will be critical to ongoing resilience.

Watch the EV space, folks, and consider getting some skin in the game. A lot of smart people think this is just the beginning for a very promising space.

Near-faultless execution has led Tesla Motors to the brink of success, but the road ahead remains a hard one. Despite progress, a looming question remains: Will Tesla be able to fend off its big-name competitors? The Motley Fool answers this question and more in our most in-depth Tesla research available for smart investors like you. Thousands have already claimed their own premium ticker coverage, and you can gain instant access to your own by clicking here now.

Will Angry Birds Become the Next FarmVille?

Nobody could have predicted that Angry Birds would dominate the world of mobile gaming. But it does, and it's all thanks to one company: Rovio. The Finnish gaming business' creation has been downloaded over a billion times, and 30 million users play daily.

Rumor has it that Rovio could go public one day, taking a page out of fellow gaming company Zynga's (NASDAQ: ZNGA ) playbook. Zynga is a much larger company with a more diverse roster of games, including Farmville and Words with Friends, but not long after the company's IPO, its stock dropped like a rock. Could Rovio be next?

Financials with friends

Rovio might be privately owned for now, but it has still revealed a few crucial tidbits about its income statement. The company hit Angry Birds pay dirt in 2009, and recently Rovio announced that its revenue in 2012 had doubled from 2011 to 152 million euros, or $199 million. Its net profit was impressive as well -- at $71.1 million, it held a healthy 35% margin, up 57% from last year.

2012's numbers were not so pleasant for Zynga, on the other hand. In March its stock reached a high of $14.69, but the company suffered a negative annual net income, after spending 86% of its revenue on research and development, as well as selling, general, and administrative expenses.

So what's the difference between these two companies? Are they simply at different points on the same trip to failure, or could Rovio avoid Zynga's fall?

Friending companies vs. friending consumers

Size isn't the only big difference between these two companies. Their strategies for generating revenue are surprisingly dissimilar as well. In 2012, Zynga gathered the bulk of its sales from its online gaming purchases and advertising, and thanks to its presence on Facebook, these revenues were staggering.

Rovio has of course made dough off of its games and ads, as well. However, there's one huge revenue generator that separates this company from Zynga: merchandise. From plush toys to Halloween costumes to hoodies, if you can think of it, there's an Angry Birds product for it. This accounted for 45% of the company's revenue last year, and Rovio has no plans to stop anytime soon. Chief Financial Officer Herkko Soininen recently expressed plans to create new entertainment offerings, including cartoons to feature films.

Selling merch is by no means a new tactic for gaming companies. Nintendo has sold paraphernalia based around its iconic plumber Mario for decades. Through this strategy, Rovio can focus less on the volatile world of mobile gaming and more on the promotion of beloved characters. If the company can continue reaping profits through merchandise while creating new games (and new characters to capitalize on), its moat could become wider than Zynga's.

That doesn't necessarily mean Rovio should go public. Angry Birds may be iconic, but there's no telling how popular any of Rovio's next offerings will be, and this kind of endeavor could take a lot of time and money to see through. An IPO may look tempting when a company needs capital, but Rovio's attentions would be spread too thin if it simultaneously focused on moving into video entertainment and appeasing shareholders. Still, Rovio's merchandise success proves that classic revenue-generating tactics can still be effective in a modern, mobile environment.

And then there's Zynga. This company's post-IPO performance has been dreadful, and investors are beginning to wonder if it's "game over" for this company. Turns out, being so closely tied to the world's largest social network can be a blessing and a curse. You can learn everything you need to know about Zynga and whether it's a buy or a sell in our new premium research report. Don't even think about picking up shares before you read what our top analysts have to say about Zynga. Click here to access your copy.

Thursday, April 25, 2013

The Day the Mobile Revolution Really Started

On this day in economic and business history...

First came the brick, then the flip -- phone, that is. The world's first "flip" phone, and thus the first truly modern mobile phone, the Motorola MicroTAC, hit the market on April 25, 1989. It was a big step forward for an industry that was at the time still largely defined by phones like Motorola's own DynaTAC, the first commercial mobile phone, which had been released six years earlier. The DynaTAC resembled nothing so much as a big plastic brick with an antenna and some buttons on one side and was sorely lacking in both style and portability.

If the brick defined telecom tech cred in the '80s, the flip phone became a symbol of the '90s, showing up everywhere on television and film before the decade was out. The MicroTAC's dramatic reduction in size over its predecessor also signaled an inflection point for wider mobile adoption, regardless of design. A contemporary Los Angeles Times review shows just how far Motorola pushed the industry when it launched the MicroTAC:

The device, half the size of any other portable cellular model, is about as wide and long as a checkbook. It is about as thick as a fat wallet at the earpiece while tapering down to half the thickness of a deck of cards at the mouthpiece. ...

The device, called the Micro Tac Personal Telephone, is expected to retail for $2,995 and be available six weeks after being ordered. Motorola officials said they were taking orders immediately.

"This is a new category of cellular -- the personal cellular," said Jim Bernhart, vice president and director of distribution for Motorola's cellular subscriber group. "We view it as the wave of the future."

Officials of the ... company would not reveal development costs for the new device, but said [it] had invested about $350 million in development of cellular telephones.

True to the Motorola exec's expectations, the flip style became a huge success in the market, but its smaller form factor was ultimately more important to the push for widespread mobile adoption. There were roughly 2 million cellular subscribers in the U.S. at the time of the MicroTAC's launch in 1989. A decade later, there were 86 million subscribers, representing a growth rate of 45% per year. Not all of these new subscribers used flip phones -- the style eventually lost popularity due to its fragility -- but device sizes continued to shrink throughout the decade and beyond, and virtually every cellphone on the market in 1999 was as small as or smaller than than the MicroTAC.

Motorola scored the first smash hit of the mobile era with the StarTAC, a flip-phone descendant of the MicroTAC that launched in 1996 and reached 60 million sales. By the late 1990s, however, Nokia (NYSE: NOK ) had risen to compete with Motorola for mobile dominance, with many mini-bricks at the top of its sales charts. Nokia's simple designs, particularly the 3210 and 3310 models, were enormously successful. Both of these phones enjoyed more than 125 million sales throughout the world during their production runs.

After the turn of the century, Motorola briefly revived the flip style with the enormously popular RAZR line, which sold an estimated 130 million units during its production run. This total can't compete with that of the simple-but-functional pre-smartphone Nokia 1110, a low-cost mini-brick released in 2005 that claims more than 250 million unit sales. In the end, a fast-changing industry left Motorola in the dust, and it was acquired by Google (NASDAQ: GOOG ) for little more than the sum of its patent parts in 2011.

Heating up the Dow

The Dow Jones Industrial Average (DJINDICES: ^DJI ) closed at more than 13,000 points for the first time in its history on April 25, 2007. The markets were racing full steam ahead into the final days of a debt-fueled bull market that had inflated corporate profits to record highs. Companies from metals to e-commerce soared on strong earnings that day, prompting further optimism for the trading days ahead. The Dow's big winners were aluminum bellwether Alcoa, which gained 5% on news that it might sell off its Reynolds Wrap division, and IBM, which announced plans for a $15 billion share buyback while also increasing its dividend payout. These two stocks were hardly alone in their upward charge: All but one of the Dow's 30 components posted gains for the day.

The Dow's eventual close of 13,089.89 points was a reasonable 1% gain over April 24th's closing value, leading David Straus of Johnston Lemon to tell Reuters:

We are definitely in a bull market here. We had a lot of hesitation at the round number of 13,000, but then it went through and we attracted some volume. ... Earnings expectations had been beaten down so much, [but] they are coming through.

However, the bull run would not last much longer. The Dow had only 8% more to rise before peaking in early October, and from there it would suffer the worst collapse since the Great Depression. There were some warning signs even at Dow 13,000, but you'd have to squint to make them out. Earnings expectations, as Straus said, had been diminished, but housing data was already starting to show cracks as well: New-home sales did increase for the prior month, though at a slower rate than expected.

Interested in Google?

As one of the most dominant Internet companies ever, Google has made a habit of driving strong returns for its shareholders. However, like many other Web companies, it's also struggling to adapt to an increasingly mobile world. Although it gained an enviable lead with its Android operating system, the market isn't sold. That's why it's more important than ever to understand each piece of Google's sprawling empire. In The Motley Fool's new premium research report on Google, we break down the risks and potential rewards for Google investors. Simply click here now to unlock your copy of this invaluable resource.

Why Lexmark Shares Popped

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Lexmark (NYSE: LXK ) have popped today by greater than 17% following the company's first-quarter earnings release.

So what: Revenue in the quarter came in at the high end of guidance at $884 million, topping the consensus estimate of $873.6 million. The same is true for Lexmark's non-GAAP earnings per share of $0.88, which was more than the $0.87 per share adjusted profit that investors were expecting. CEO Paul Rooke said Lexmark continues to transition from a hardware-centric model to a solutions-centric approach, which is underscored by the recent acquisitions of two software companies and the sale of the inkjet business.

Now what: Lexmark said it's sticking by its capital allocation policy of returning over 50% of free cash flow to investors on average. In the first quarter, the company paid $19 million in dividends, or $0.30 per share, and repurchased $21 million in shares. The current share repurchase authorization has $230 million remaining. Not everyone was impressed, as Barclays subsequently downgraded shares from "equalweight" to "underweight."

Interested in more info on Lexmark? Add it to your watchlist by clicking here.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

Wednesday, April 24, 2013

Don't Get Too Worked Up Over West Pharmaceutical Services's Earnings

Although business headlines still tout earnings numbers, many investors have moved past net earnings as a measure of a company's economic output. That's because earnings are very often less trustworthy than cash flow, since earnings are more open to manipulation based on dubious judgment calls.

Earnings' unreliability is one of the reasons Foolish investors often flip straight past the income statement to check the cash flow statement. In general, by taking a close look at the cash moving in and out of the business, you can better understand whether the last batch of earnings brought money into the company, or merely disguised a cash gusher with a pretty headline.

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on West Pharmaceutical Services (NYSE: WST ) , whose recent revenue and earnings are plotted below.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. FCF = free cash flow. FY = fiscal year. TTM = trailing 12 months.

Over the past 12 months, West Pharmaceutical Services generated $56.1 million cash while it booked net income of $80.7 million. That means it turned 4.4% of its revenue into FCF. That sounds OK. However, FCF is less than net income. Ideally, we'd like to see the opposite.

All cash is not equal

Unfortunately, the cash flow statement isn't immune from nonsense, either. That's why it pays to take a close look at the components of cash flow from operations, to make sure that the cash flows are of high quality. What does that mean? To me, it means they need to be real and replicable in the upcoming quarters, rather than being offset by continual cash outflows that don't appear on the income statement (such as major capital expenditures).

For instance, cash flow based on cash net income and adjustments for non-cash income-statement expenses (like depreciation) is generally favorable. An increase in cash flow based on stiffing your suppliers (by increasing accounts payable for the short term) or shortchanging Uncle Sam on taxes will come back to bite investors later. The same goes for decreasing accounts receivable; this is good to see, but it's ordinary in recessionary times, and you can only increase collections so much. Finally, adding stock-based compensation expense back to cash flows is questionable when a company hands out a lot of equity to employees and uses cash in later periods to buy back those shares.

So how does the cash flow at West Pharmaceutical Services look? Take a peek at the chart below, which flags questionable cash flow sources with a red bar.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. TTM = trailing 12 months.

When I say "questionable cash flow sources," I mean items such as changes in taxes payable, tax benefits from stock options, and asset sales, among others. That's not to say that companies booking these as sources of cash flow are weak, or are engaging in any sort of wrongdoing, or that everything that comes up questionable in my graph is automatically bad news. But whenever a company is getting more than, say, 10% of its cash from operations from these dubious sources, investors ought to make sure to refer to the filings and dig in.

With 17.7% of operating cash flow coming from questionable sources, West Pharmaceutical Services investors should take a closer look at the underlying numbers. Within the questionable cash flow figure plotted in the TTM period above, stock-based compensation and related tax benefits provided the biggest boost, at 8.3% of cash flow from operations. Overall, the biggest drag on FCF came from capital expenditures, which consumed 70.1% of cash from operations. West Pharmaceutical Services investors may also want to keep an eye on accounts receivable, because the TTM change is 2.0 times greater than the average swing over the past 5 fiscal years.

A Foolish final thought

Most investors don't keep tabs on their companies' cash flow. I think that's a mistake. If you take the time to read past the headlines and crack a filing now and then, you're in a much better position to spot potential trouble early. Better yet, you'll improve your odds of finding the underappreciated home-run stocks that provide the market's best returns.

Looking for alternatives to West Pharmaceutical Services? It takes more than great companies to build a fortune for the future. Learn the basic financial habits of millionaires next door and get focused stock ideas in our free report, "3 Stocks That Will Help You Retire Rich." Click here for instant access to this free report.

We can help you keep tabs on your companies with My Watchlist, our free, personalized stock tracking service.

Add West Pharmaceutical Services to My Watchlist.Winmark's Leasing Takes Off

One of my favorite businesses, Winmark (NASDAQ: WINA ) , reported earnings this week. Earnings boosted 14% compared to the prior year's first quarter. Though the company continues to franchise its range of secondhand stores, the most compelling growth comes from the leasing division, which saw revenues jump by 30%. The company is underfollowed yet has been paying attractive special dividends while giving investors two-year capital appreciation of roughly 50%. As the company moves forward and pushes its leasing business to new heights, should you get in now?

Earnings recap

Winmark's core business is franchising secondhand-goods stores -- Plato's Closet (women's apparel), Play It Again Sports, Music Go Round, and Once Upon A Child. As of this past quarter, the company had nearly 1,000 franchised locations. Secondhand-goods stores tend to do great in rough economic times, and pretty good in boom times. Winmark has slowly and steadily grown the business over the years. This quarter, royalties from sales hit nearly $8.5 million, up from $8.22 million in the prior year's quarter. Now, 3.3% growth isn't too thrilling, especially for a business that isn't the most thrilling to begin with, but there were much more interesting figures from this quarter's earnings.

John Morgan, the founder and CEO, is a small- and mid-size-business leasing pro -- having founded and exited a very successful, very similar business prior to his time at Winmark. While it hasn't been the face of the company, Winmark's leasing business is where the growth is rapidly increasing.

For the quarter, Winmark's lease revenue topped $3.4 million, up from $2.4 million in the year-ago quarter. While the retail segment's 3.3% growth may be forgettable, 30% growth from leasing is certainly an eye-catcher. The growth came from a larger lease portfolio than in the past, and continued performance of prior loans. With the larger portfolio came an increase in leasing expense, but at half the growth rate of the corresponding income.

Not cheap, but so good

Winmark is a business I would love to own. Its CEO is its largest shareholder -- owning nearly a third of the business. It's an unsexy, neglected-by-the-Street company. It has many of the prerequisites for the fundamentals-centric investor, except the most important: price. Even with its recent hiccup in February due to an impaired investment charge, Winmark remains a pricey stock. Does that mean it won't continue to outperform the market in coming years?Not at all. I like management and I see the leasing business continuing to grow at an attractive clip, but at 24 times last year's earnings and an EV/EBITDA of 10.53, the company would need some pretty substantial growth year after year.

Keep an eye on this company long-term; any big dips may be a buy opportunity. With a return on equity of 75%, you know management is a smart capital allocator, and the business itself is cash-printing. For better or worse, Winmark remains one of my favorite stocks I don't own.

More from The Motley Fool

The retail space is in the midst of the biggest paradigm shift since mail order took off at the turn of last century. Only those most forward-looking and capable companies will survive, and they'll handsomely reward those investors who understand the landscape. You can read about the 3 Companies Ready to Rule Retail in The Motley Fool's special report. Uncovering these top picks is free today; just click here to read more.

4 Things That Will Surprise You About Retirement

Retirement is supposed to be a time of leisure, when folks who've worked and saved their whole lives get to enjoy the fruits of their labors.

The reality is a lot more stressful. Consider just this one stat: Some 45% of Americans enter retirement still paying off their house. With no more earnings coming in the door, that puts a further strain on savings accounts.

In the video below, senior editor Dayana Yochim and Robert Brokamp, a Certified Financial Planner and advisor of Motley Fool Rule Your Retirement, discuss four of the most surprising things about retirement.

The best investing approach is to choose great companies and stick with them for the long term. The Motley Fool's free report "3 Stocks That Will Help You Retire Rich" names stocks that could help you build long-term wealth and retire well, along with some winning wealth-building strategies that every investor should be aware of. Click here now to keep reading.

1 Silver Lining for Intel Investors

What can Intel offer investors as it struggles to diversify from the PC market? In this video, Andrew Tonner suggests that dividend growth is one thing to look at.

The stock has declined 18% over the past year and has been flat for the past five, but the company currently pays a 4% dividend, and that dividend has grown by 14% over the past few years.

Intel will bring on a new CEO to help it navigate its way into the mobile market, and it's struggling to find other business outside the PC market. While those things play out, Andrew says, investors can pocket the 4% dividend plus whatever future dividend growth may come, making the Intel investment a bit less painful during the transition.

When it comes to dominating markets, it doesn't get much better than Intel's position in the PC microprocessor arena. However, that market is maturing, and Intel finds itself in a precarious situation longer term if it doesn't find new avenues for growth. In this premium research report on Intel, our analyst runs through all of the key topics investors should understand about the chip giant. Click here now to learn more.

Tuesday, April 23, 2013

Halliburton's Shine Suddenly Brightens

It's now two to one among the big oil-field services companies regarding the North American oil and gas markets. Through Monday, Schlumberger (NYSE: SLB ) , the largest company in the sector had expressed concern about the market and its short-term prospects, while Halliburton (NYSE: HAL ) , the second-biggest member of the group, joined Baker Hughes (NYSE: BHI ) in assessing our continent's activity levels more positively.

One loud beat

Before considering Halliburton's sentiment regarding its markets, it's worth noting that the company reported a loss of $18 million, or $0.02 per share, for the quarter on Monday. However, adjusting for a $637 million charge related to the 2010 Macondo accident in the Gulf of Mexico, the per-share number pops up to $0.67, trouncing the $0.57 consensus expectation from the analysts who follow the company. Revenues expanded by 1.5% year over year to a record $7.0 billion.