Best Stocks Broker Blog For 2013, Top Stocks For 2013

Thursday, October 31, 2013

BulletShares Lineup Expands Beyond 2020: Guggenheim ...

This bond ETF launch comes at an opportune time for bargain shoppers seeing as how fixed income securities across the board have endured a rough stretch of profit taking as a result of all the Fed-stimulus fears, which have already faded away for the most part.

Bond Bulls Eyeing New BulletShares ETFsThe new funds which hit the street today are the:

BulletShares 2021 Corporate Bond ETF

BulletShares 2022 Corporate Bond ETF Unlike most fixed income ETFs on the market today, the BulletShares product suite invests in debt securities scheduled to mature in a specific, single calendar year. As that year arrives and the debt begins to mature, proceeds are not reinvested but rather distributed to investors. For this reason, BulletShares ETFs have gained tremendous popularity since launching in 2010 as they more closely replicate the experience of investing in individual bonds while still providing immediate diversification across a basket of securities .

Similar to all of the existing corporate bond BulletShares ETFs, BSCL and BSCM will each charge 0.24% in expense fees.

Currently, the two most popular corporate bonds BulletShares ETFs by AUM targeting corporate bonds are the:

2015 Corporate Bond Fund 2014 Corporate Bond Fund The "junk bond" flavor of BulletShares has been even more successful, as these two High-Yield Bond ETFs dominate their investment grade-counterparts when it comes to total assets under management:

2015 High Yield Corporate Bond Fund 2014 High Yield Corporate Bond Fund Meet The Corporate Bond Fund CompetitionThe new BulletShares funds will join a fairly crowded space, ! comprised of over three dozen offerings with an average expense ratio of 0.22%. Although BulletShares separate themselves from the pack quite nicely by offering exposure that more closely resembles the purchase of an actual bond, BSCL and BSCM will still face stiff competition from more established funds; the Corporate Bonds ETFdb Category is dominated by:

iShares Investment Grade Corproate Bond Fund with $19 billions in AUM

iShares Barclays 1-3 Year Credit Bond Fund with nearly $11 billion in AUMVanguard Short-Term Corporate Bond ETF with over $6 billion in AUMThe new BulletShares products will likely taken on appeal among investors with more specific risk tolerance and current-income goals in mind given their unique, single-year maturity structure.

Follow me on Twitter @SBojinov

Disclosure: No positions at time of writing.

US Stock Futures Down Ahead Of Jobless Claims Data

Pre-open movers

US stock futures fell in early pre-market trade, ahead of jobless claims report. Data on weekly jobless claims will be released at 8:30 a.m. ET, while the Chicago PMI for October will be released at 9:45 a.m. ET. Futures for the Dow Jones Industrial Average tumbled 26 points to 15,527.00, while the Standard & Poor's 500 index futures declined 2.60 points to 1,755.90. Futures for the Nasdaq 100 index dropped 15.25 points to 3,377.00.

A Peek Into Global Markets

European markets were mixed today, with the Spanish Ibex Index gaining 0.66%, London's FTSE 100 index dropping 0.44% and STOXX Europe 600 Index climbing 0.11%. German DAX 30 index fell 0.17% and French CAC 40 Index climbed 0.11%.

Asian markets ended mostly lower today. Japan's Nikkei Stock Average fell 1.20%, China's Shanghai Composite declined 0.87% and Hong Kong's Hang Seng Index tumbled 0.42%. Australia's ASX/S&P500 fell 0.09% and India's Sensex jumped 0.62%.

Broker Recommendation

Analysts at Bank of America upgraded Expedia (NASDAQ: EXPE) from "neutral" to "buy." The target price for Expedia has been raised from $60 to $75.

Expedia's shares jumped 18.80% to $59.35 in pre-market trading.

Breaking news

Time Warner Cable (NYSE: TWC) reported a drop in its third-quarter profit. Time Warner Cable's quarterly profit fell to $532 million, or $1.84 per share, from $808 million, or $2.60 per share, in the year-ago period. To read the full news, click here. Synergy Pharmaceuticals (NASDAQ: SGYP) today announced the start of a phase 2 clinical trial to evaluate the safety and efficacy of SP-333, its second-generation GC-C agonist and once-daily oral treatment, in adult patients with opioid-induced constipation (OIC). To read the full news, click here. Cigna (NYSE: CI) reported a 19% rise in its third-quarter earnings and lifted its full-year earnings outlook. To read the full news, click here. Charm Communications (NASDAQ: CHRM) announced today that the special committee of the Company's board of directors, consisting of independent directors Mr. Zhan Wang, Mr. Andrew J. Rickards and Mr. Gang Chen, has retained China Renaissance Securities (Hong Kong) Limited as its financial advisor and Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, LLP as its legal advisor. To read the full news, click here.Posted-In: Bank of America US Stock FuturesNews Eurozone Futures Global Pre-Market Outlook Markets

(c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Around the Web, We're Loving... Learn to Use Trading Platforms Like Hedge Fund Traders do Rumsfeld: Denial of Benefits to Fallen Soldiers' Families 'Inexcusable' Come See How the Pro's Trade in this Exclusive Webinar Facebook, Baidu Lead Big Caps Beating Shutdown What Should You Know About AMZN? Most Popular IBM Authorizes $0.95 Dividend; Authorizes $15B In Additional Buybacks What is Apple's Tim Cook Hinting at for 2014? Facebook Shares Edge Higher After Hours Following Upgrade to Buy from BTIG's Greenfield Is a Beer Mega-Merger On Tap? Earnings Scheduled For October 30, 2013 Net Optics Announces Pending Acquisition by Ixia for $190M in Cash Related Articles (CI + CHRM) US Stock Futures Down Ahead Of Jobless Claims Data UPDATE: Cigna Posts Higher Q3 Profit, Lifts Full-Year Forecast Charm Communications Special Committee Names Advisers to Evaluate 'Going Private' Proposal Earnings Scheduled For October 31, 2013 UPDATE: Susquehanna Raises PT on CIGNA Corporation Ahead of 3Q Results Report Benzinga's Weekend M&A Chatter View the discussion thread. Partner Network #marketfy-ae-block { display: none; border: 2px solid #0a3f75; overflow: hidden; width: 300px; height: 125px; text-align: center; background-color: #45719E; position: relative; z-index: 1; } #marketfy-ae-block a { display: block; width: 300px; height: 125px; position: relative; z-index: 2; color: #ffffff; text-decoration: none; } #marketfy-ae-block-countdown-text { color: #f9fc99; padding: 0px 0 0 0; font-size: 19px; font-weight: bold; line-height: 19px; } #marketfy-ae-block-countdown-text-start { font-size: 12px; } #marketfy-ae-block-countdown { padding: 5px 0 5px 0; font-size: 26px; } #marketfy-ae-block-signup { padding: 5px 47px; } #marketfy-ae-block-signup:hover { background-color: #457a1a;Tuesday, October 29, 2013

Will An Acquisition Help Nokia?

With shares of Nokia (NYSE:NOK) trading around $3, is NOK an OUTPERFORM, WAIT AND SEE or STAY AWAY? Let's analyze the stock with the relevant sections of our CHEAT SHEET investing framework:

T = Trends for a Stock’s MovementNokia operates as a mobile communications company worldwide. It designs and develops mobile products and services; provides digital map information and related location-based content and services for mobile navigation devices, automotive navigation systems, Internet-based mapping applications; and provides mobile and fixed network infrastructure, communications and networks service platforms, as well as professional services and business solutions, to operators and service providers. Nokia operates in three segments: Devices & Services, HERE, and Nokia Siemens Networks.

Nokia has announced it will acquire the remaining stake it doesn't already own in the Nokia Siemens network. Nokia is buying Siemens's (NYSE:SI) 50 percent of the network for a lower-than-expected 1.7 billion euros. Shares in both companies rose after the announcement. The mobile movement is very hot at the moment and if executed correctly, Nokia may be able to see significant profits. Should Nokia provide more relevant mobile products, look for it to become a major player in the space once again.

T = Technicals on the Stock Chart are MixedNokia stock seen a reasonable amount of selling pressure in recent years. The stock is now rebounding higher on higher highs and higher lows. Analyzing the price trend and its strength can be done using key simple moving averages. What are the key moving averages? The 50-day (pink), 100-day (blue), and 200-day (yellow) simple moving averages. As seen in the daily price chart below, Nokia is trading above its rising key averages which signal neutral to bullish price action in the near-term.

(Source: Thinkorswim)

Taking a look at the implied volatility (red) and implied volatility skew levels of Nokia options may help determine if investors are bullish, neutral, or bearish.

| Implied Volatility (IV) | 30-Day IV Percentile | 90-Day IV Percentile | |

| Nokia Options | 66.11% | 70% | 68% |

What does this mean? This means that investors or traders are buying a significant amount of call and put options contracts, as compared to the last 30 and 90 trading days.

| Put IV Skew | Call IV Skew | |

| July Options | Flat | Average |

| August Options | Flat | Average |

As of today, there is an average demand from call buyers or sellers and low demand by put buyers or high demand by put sellers, all neutral to bullish over the next two months. To summarize, investors are buying a significant amount of call and put option contracts and are leaning neutral to bullish over the next two months.

On the next page, let’s take a look at the earnings and revenue growth rates and the conclusion.

E = Earnings Are Decreasing Quarter-Over-QuarterRising stock prices are often strongly correlated with rising earnings and revenue growth rates. Also, the last four quarterly earnings announcement reactions help gauge investor sentiment on Nokia’s stock. What do the last four quarterly earnings and revenue growth (Y-O-Y) figures for Nokia look like and more importantly, how did the markets like these numbers?

| 2013 Q1 | 2012 Q4 | 2012 Q3 | 2012 Q2 | |

| Earnings Growth (Y-O-Y) | 13.64% | -87.10% | -778.57% | -537.50% |

| Revenue Growth (Y-O-Y) | -23.40% | -20.68% | -23.13% | -29.56% |

| Earnings Reaction | -12.93% | -8.92% | -5.00% | 6.49% |

Nokia has seen mostly decreasing earnings and revenue figures over the last four quarters. From these numbers, the markets have been disappointed with Nokia’s recent earnings announcements.

P = Average Relative Performance Versus Peers and SectorHow has Nokia stock done relative to its peers, Apple (NASDAQ:AAPL), BlackBerry (NASDAQ:BBRY), Ericsson (NASDAQ:ERIC), and sector?

| Nokia | Apple | BlackBerry | Ericsson | Sector | |

| Year-to-Date Return | -2.15% | -23.24% | -12.97% | 13.42% | 2.64% |

Nokia has been an average performer, year-to-date.

ConclusionNokia provides valuable communications products to consumers and companies worldwide. With the recent acquisition of the remaining stake of the Nokia Siemens Network, the company is poised to continue to grow. The stock has struggled in recent years but is now seeing a powerful rebound. Over the last four quarters, investors in the company have been disappointed as earnings and revenue figures have been mostly decreasing. Relative to its weak peers and sector, Nokia has been an average year-to-date performer. WAIT AND SEE what Nokia does this coming quarter.

GBR: High-Flying Stock of the Day

CHARLOTTE, N.C. (Stockpickr) -- Dallas-based New Concept Energy (GBR), formerly known as CabelTel International, is primarily an operator of oil and gas wells, in the U.S. and also owns mineral leases in Ohio and West Virginia. Interestingly, it also leases and operates Pacific Pointe Retirement Inn, a retirement community located in King City, Ore.

At the time of this writing, GBR is up 54% today, trading at $2.22, after trading earlier as high as $2.58.

Fundamentally, the stock indicates at this price level a trailing price-to-earnings ratio of only 2.5. However, a cursory glance reveals no forward guidance provided by the company, so there is no forward P/E figure. Book value per share shows as $3.50.

A glance at the monthly chart shows this stock has undergone several huge and very brief price spikes, historically, with concurrent huge volume spikes, relative to GBR's typically very low volume.

Based solely upon the previous similar occurrences, this current price spike could see significant upside from the current level.

Let the buyer beware, though. As can be seen in the monthly chart, each of these price and volume spikes has been immediately followed by a return to much lower price and volume levels, so I imagine that a number of traders/investors have found themselves trapped in their positions.

So if you decide to try to play this price and volume spike, be nimble.

-- Written by Ben Brinneman in Charlotte, N.C.

Trader Ben Brinneman, featured on MarketWatch, Bloomberg and Reuters, resides in Charlotte, N.C., and is the owner of C Squared Trading. Brinneman started his career trading bonds for U.S. Bancorp and was an analyst for a wealth management firm. Brinneman and his team at C Squared Trading have taught hundreds in a one-on-one mentorship setting via Skype or live in Charlotte.

You can follow some of their free trades and tips on Twitter at @csquaredtrading.

Monday, October 28, 2013

Are These Recent IPOs Still Winners?

The IPO market is looking forward to November 15, 2013. Twitter (TWTR) will no doubt be a hot stock and should also provide the mass media with lots to talk about. The NYSE even performed a test over the weekend to see if it could handle the expected intense volume.

Twitter is one thing... but the health of the IPO market is another. So how has that market been? What are the top performers? Let's take a look.

IPOs This Year

A simple Google search for IPO stories in the media will result in several links to stories of stocks that have doubled on their first day of offering. To avoid duplication of efforts, here are those names that have more than doubled in their first day of trading.

BenefitFocus (BNFT)

Noodles and Co. (NDLS)

Potbelly (PBPB)

Sprouts Farmers Market (SFM)

The stocks listed above all had a huge pop on the first day and three are currently Zacks Rank #3 (Hold) rated stocks. PBPB is not yet ranked as analyst reports have not yet come out. Having a rank of #3 (Hold) soon after an IPO is pretty common as underwriting banks have to wait a period of time before they can initiate coverage. The Zacks Rank tends to move up when there is a positive revision to estimates and that could take some time.

It is clear that if we have four stocks that have doubled on the first day of trading, the market is pretty strong.

Recent IPO's With High Zacks Rank

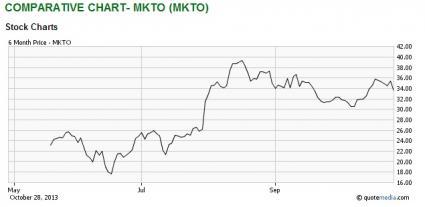

Marketo (MKTO) is a Zacks Rank #2 (Buy) and has been public since late May. That time horizon has allowed analysts a few chances to increase their estimates.

The internet marketing company has had two earnings reports since going public. The first was on July 30 and the company missed that quarter with a wider loss than expected. This has been fairly common on new companies as they have not been able to get the full story to analysts or there is some noise in the first reporting quarter.

Investors easily forgave the company for the 12.7% negative earnings surprise and bid the s! tock higher by 21.5% in the session following its first report.

The next report was much better. A two cent beat of a 6.9% positive earnings surprise helped the stock move higher in the session following the report.

Xoom (XOOM) is also a Zacks Rank #2 (Buy) stock that IPO'ed this year. The stock zoomed higher by a healthy 60% on its first day of trading. The online international money transfer service has been public since February 15 and had an offering price of $16 per share.

Since that time, estimates have soared. When the first research reports were out in March, the Zacks Consensus Estimate for 2013 was calling for a loss of $0.24 per share. By July, the estimate had turned the corner to a gain of $0.01 and following a recent report, the consensus is now looking at $0.11.

A very similar trend exists for 2014, with estimates moving from a loss of $0.06 to a gain of $0.08 over the same time horizon, above for the first two estimates. The 2014 Zacks Consensus is now calling for a gain of $0.18 and that translates to an implied earnings growth rate of 63%.

As Twitter comes to the market there should be a lot of fanfare. This will be the hottest issue of the year and will continuously be compared to Facebook (FB) and its IPO.

Needless to say, the FB IPO was a disaster and caused a great many retail investors to take substantial losses. Over time, the stock recovered and is now well above the IPO price and first trade.

It might be of interest to learn that Facebook is a Zacks Rank #2 (Buy). TheFace! book as i! t used to be called (at least that is what I learned from the movie "The Social Network") has seen 2 straight positive earnings surprises.

The most recent one came on July 24th and it propelled the stock higher by 31% after investors saw a 44% positive earnings surprise. They also saw a glimpse of how the company plans to monetize the $1B+ investment in Instagram as well.

Buy what will Twitter's Rank Be? As we have seen from other IPOs, it will take some time to get research reports from covering analysts in. Then it will take some more time before they have an opportunity to increase estimates ... so don't be surprised if the company has no Zacks Rank its first day of trading, or even no Rank a month or more after its public debut.

FACEBOOK INC-A (FB): Free Stock Analysis Report

MERKETO INC (MKTO): Free Stock Analysis Report

POTBELLY CORP (PBPB): Get Free Report

SPROUTS FMR MKT (SFM): Free Stock Analysis Report

XOOM CORP (XOOM): Free Stock Analysis Report

Source: Are These Recent IPOs Still Winners?Safety in Numbers With This Pipeline Play

Source: Wikimedia Commons.

They say two (or more) is better than one, and that seems to be the case for these companies that are working together to accomplish a common goal.

A foursome

Enterprise Products Partners (NYSE: EPD ) , Anadarko Petroleum (NYSE: APC ) , and DCP Midstream, a joint venture between Spectra Energy (NYSE: SE ) and Phillips 66 (NYSE: PSX ) , are about to complete the Front Range pipeline, which will run from the DJ Basin down to the Texas Express pipeline. It will be able to carry 150,000 bpd of natural gas liquid (NGL) with the possibility to increase that to 230,000 bpd if production keeps increasing. Front Range is expected to come online in the forth quarter of 2013.

This pipeline venture is a great idea for several reasons. Anadarko needs to get its NGL to a buyer, so it needs to be able to ship its NGL to refineries on the coast. Enterprise Products Partners is seeking growth by building new pipelines, so it's happy to invest with an E&P player to help Anadarko out and profit at the same time. For DCP, Spectra needs NGL to move/store and Phillips 66 needs NGL to process into a final project.

All four players benefit from this project and stand to profit from the creation of the pipeline. There is no reason why it always has to be a dog-eat-dog world; companies are fully capable of working together to achieve a mutually beneficial goal.

Add in one more

The purpose of the Front Range pipeline is to connect the DJ Basin to Texas, but it only goes part of the way. To get the NGL all the way there, Enterprise Products Partners, Anadarko, Phillips 66, Spectra (through DCP), and Enbridge Energy Partners (NYSE: EEP ) are working together to build the Texas Express pipeline.

Texas Express will carry NGL all the way down to Texas to be processed and is expected to come online in the forth quarter of 2013, in conjunction with the Front Range pipeline. The Texas Express will have the capacity to move 280,000 bpd of NGL, with the possibility to increase that to 400,000 bpd as market conditions dictate.

All five of these players want the same thing, to get NGL to Texas. They all stand to see significant increases in their cash flow as a result. Whether it's the fees to move the NGL, the ability to sell NGL for the highest price possible, or having more NGL to process into a final product, all of these companies rely on each other.

Going solo

Enterprise Products Partners is also building out pipeline capacity by itself. Rising production from the Rocky Mountain region means more pipeline capacity needs to be brought online to move the additional output.

Enterprise Products Partners is going to increase the capacity of its NGL Mid-America Pipeline from 275,000 bpd to approximately 350,000 bpd, and the increased capacity will come online in the second quarter of 2014. The pipeline transports NGL down to Texas to be refined. The additional capacity will enable Enterprise Products Partners to capitalize on multiple NGL plays and will increase its cash flow as well. That will allow it to continue to increase its capacity around America and boost its 7% distribution.

Final thoughts

America is a great country, built on the back of competition. Sometimes, though, companies can work together to boost their bottom lines and increase cash flows. This is the case for these energy companies, and the several joint ventures that they are invested in will increase value for shareholders.

More ways to profit from America's energy boom

Record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

NOV Stomps on Estimates

As odd as it is to see an article pertaining to quarterly earnings on our site, I just couldn't resist. National Oilwell Varco (NOV) has officially put up some pretty impressive numbers. On Oct. 25, 2013, the company reported that for the third quarter ending on Sept. 30, 2013, it earned a net income of $636 million ($1.49 per share). If we compare this to last quarter, which earned a net income of $531 million, we can see that in just one quarter NOV experienced almost a 20% increase in revenue. Even if we take away the $10 million in pre-tax transaction charges and the $102 million in pre-tax gains that are results from the settlement of an outstanding legal claim, net income has still increased almost 8%. Part of this is due to operating profit increasing 3% (to 15% of sales) for the quarter.

From a long term investor's standpoint, that's not the most impressive statistic that I took from the recent release. Most impressive to me is NOV's constantly increasing backlog. As of Sept. 30, 2013, the company's Rig Technology segment reached a record backlog level of $15.15 billion. This is a super impressive increase of 9% since the end of the second quarter of 2013, and a 30% increase from the same time last year (September 30, 2012). The company had $3.31 billion worth of new orders for the quarter, which represents over 21% of their backlog. This is mathematical proof of the strong demand for oilfield equipment.

Here's what Pete Miller, chairman and CEO of National Oilwell Varco, had to say about the company's most recent achievements:

"Outstanding execution enabled the Company to achieve solid results again this quarter. All three segments posted higher sequential revenues and margins, and collectively reduced the Company's working capital requirements, which ultimately led to a quarterly record of $1 billion in cash flow from operations. We also added! significant new bookings to our capital equipment backlog for the Rig Technology segment during the third quarter, as the industry's demand for our suite of technologies remains strong.

We are excited about our recently announced plans to spin-off the Company's distribution business from the remainder of the Company, creating two stand-alone, publicly traded corporations. We believe that the contemplated spin-off is very consistent with NOV's strategy and commitment to continue to grow the Company and create significant shareholder value. As separate companies, the distribution business and the remainder of NOV will each be better positioned and have the enhanced operational flexibility to focus on their specific products, services and customers."

Here is the recent quarterly comparison of consolidated statements of income.

[ Enlarge Image ]

The share price for NOV has increased 13% since my previous, and very brief, article about the company was written on Aug. 27, 2013. I believe that with the increasing demand for NOV's services, as well as the impressive management, the company is poised for more. What are your thoughts? What do these impressive results mean to you?

End Notes

Disclosure: Currently long NOV.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

Sunday, October 27, 2013

Why WGL Holdings's Earnings May Not Be So Hot

Although business headlines still tout earnings numbers, many investors have moved past net earnings as a measure of a company's economic output. That's because earnings are very often less trustworthy than cash flow, since earnings are more open to manipulation based on dubious judgment calls.

Earnings' unreliability is one of the reasons Foolish investors often flip straight past the income statement to check the cash flow statement. In general, by taking a close look at the cash moving in and out of the business, you can better understand whether the last batch of earnings brought money into the company, or merely disguised a cash gusher with a pretty headline.

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on WGL Holdings (NYSE: WGL ) , whose recent revenue and earnings are plotted below.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. FCF = free cash flow. FY = fiscal year. TTM = trailing 12 months.

Over the past 12 months, WGL Holdings burned $13.8 million cash while it booked net income of $157.1 million. That means it burned through all its revenue and more. That doesn't sound so great. FCF is less than net income. Ideally, we'd like to see the opposite.

All cash is not equal

Unfortunately, the cash flow statement isn't immune from nonsense, either. That's why it pays to take a close look at the components of cash flow from operations, to make sure that the cash flows are of high quality. What does that mean? To me, it means they need to be real and replicable in the upcoming quarters, rather than being offset by continual cash outflows that don't appear on the income statement (such as major capital expenditures).

For instance, cash flow based on cash net income and adjustments for non-cash income-statement expenses (like depreciation) is generally favorable. An increase in cash flow based on stiffing your suppliers (by increasing accounts payable for the short term) or shortchanging Uncle Sam on taxes will come back to bite investors later. The same goes for decreasing accounts receivable; this is good to see, but it's ordinary in recessionary times, and you can only increase collections so much. Finally, adding stock-based compensation expense back to cash flows is questionable when a company hands out a lot of equity to employees and uses cash in later periods to buy back those shares.

So how does the cash flow at WGL Holdings look? Take a peek at the chart below, which flags questionable cash flow sources with a red bar.

Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. TTM = trailing 12 months.

When I say "questionable cash flow sources," I mean items such as changes in taxes payable, tax benefits from stock options, and asset sales, among others. That's not to say that companies booking these as sources of cash flow are weak, or are engaging in any sort of wrongdoing, or that everything that comes up questionable in my graph is automatically bad news. But whenever a company is getting more than, say, 10% of its cash from operations from these dubious sources, investors ought to make sure to refer to the filings and dig in.

With 27.8% of operating cash flow coming from questionable sources, WGL Holdings investors should take a closer look at the underlying numbers. Within the questionable cash flow figure plotted in the TTM period above, other operating activities (which can include deferred income taxes, pension charges, and other one-off items) provided the biggest boost, at 19.4% of cash flow from operations. Overall, the biggest drag on FCF came from capital expenditures.

A Foolish final thought

Most investors don't keep tabs on their companies' cash flow. I think that's a mistake. If you take the time to read past the headlines and crack a filing now and then, you're in a much better position to spot potential trouble early. Better yet, you'll improve your odds of finding the underappreciated home-run stocks that provide the market's best returns.

Can your retirement portfolio provide you with enough income to last? You'll need more than WGL Holdings. Learn about crafting a smarter retirement plan in "The Shocking Can't-Miss Truth About Your Retirement." Click here for instant access to this free report.

We can help you keep tabs on your companies with My Watchlist, our free, personalized stock tracking service.

Add WGL Holdings to My Watchlist.Saturday, October 26, 2013

Ford’s Mulally dispels Microsoft CEO rumors

"I love serving Ford and have nothing new to add to (my) plans to continue serving Ford," he said in an exclusive interview with USA TODAY.

Mulally was at the University of Georgia Tuesday to participate in the 16th USA TODAY CEO Forum.

Over the last several weeks, media reports have mentioned Mulally as the leading candidate to succeed Ballmer as the software giant's CEO.

Mulally is known for his ability to turnaround troubled companies. Before coming to Ford in 2006, Mulally spent 37 years at Boeing where he helped outflank competitor Airbus with the Boeing 777 jetliner. At Ford, he ushered in transparency and transformed the car maker into a leaner company.

Even though Ford had a record loss in 2008, the company avoided government bailout loans given to GM and Chrysler. The company reported a profit the next year and has had 16 consecutive profitable quarters. On Tuesday, Ford also announced that the company's September sales were the best since 2006.

Mulally has said he will stay at Ford through 2014, but the board of directors has indicated it would not stand in his way if he chooses to leave earlier.

With Microsoft, Ford co-developed the Sync infotainment system that lets drivers connect their smartphones in Ford vehicles. Mulally called Microsoft "a great company" and "a great partner."

He downplayed rumors early last month and Mulally's heir apparent, current chief operating officer Mark Fields dismissed reports that resurfaced last week.

But the public speculation helps confirm Ford's ascendance as a technology company, Mulally admits. "Clearly, we have been leading this and it's very important to consumers," he said. "We just love the response they have to our vehicles."

Why Leap Wireless Shares Leapt Higher

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of Leap Wireless (NASDAQ: LEAP ) have leapt higher today by more than double, up by 116% at the high, following news that AT&T (NYSE: T ) has agreed to acquire the pre-paid carrier.

So what: Ma Bell has offered $15 per share in cash, valuing Leap at $1.2 billion. In addition, Leap shareholders will receive the net proceeds from the sale of spectrum in Chicago, which Leap purchased last year for $204 million. That partially explains why shares traded as high as $17.25 this morning.

Now what: The proposed merger will bolster AT&T's spectrum position, although it will also attract regulatory scrutiny for the same reason. AT&T will also acquire Leap's customer base of approximately 5 million prepaid subscribers, strengthening its numbers in that market segment. The transaction will face the usual hurdles of shareholder votes, regulatory approvals, and other customer closing conditions, but AT&T hopes to seal the deal within six to nine months.

Interested in more info on Leap Wireless? Add it to your watchlist by clicking here.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

Friday, October 25, 2013

Now Is The Time To Buy PennWest

Editors' Note: This article discusses micro-cap stocks. Please be aware of the risks associated with these stocks.

PennWest (PWE), a Canadian oil and gas producer, has been underperforming due to poor asset management. In the last one year, the return on its stock is negative 15%. However, PennWest has laid down some concrete plans to usher its revival. The company has focused on the development of its acreage in the Cardium and Viking formations. With plans in place for development and production increase from these formations, we believe PennWest provides significant opportunity of growth for its investors.

Cardium Trend transitions

PennWest has around 600,000 net acres in the Cardium Trend in the Alberta region. The Cardium Trend formation lies beneath the Western Canadian Sedimentary Basin and contains reserves of oil and natural gas. The Cardium Trend formation stretches between the Canadian provinces of Alberta and British Columbia. The locations where Penn West is focusing to develop the Cardium Trend are Alder Flats, Lodgepole, and Crimson Lake. According to a study by Deloitte, the contingent reserve in the area under PennWest is around 1,007,721 million barrels of oil equivalent, or mboe. Contingent reserve is an estimation of the amount of petroleum that could be recovered and could be commercially developed.

PennWest is planning to increase the oil extraction from the Cardium Trend formation by increasing the use of secondary oil production techniques. Secondary recovery techniques happen after primary recovery techniques. Primary recovery techniques happen where hydrocarbons naturally rise to the surface. In the case of secondary production techniques, oil and natural gas are lifted by injecting water or gas into the wells and to increase reservoir productivity.

In the first half of this year, PennWest completed wells at selective places in the Alder Flats area using "slick water fracture" techniques, which resulted in more than 30% of well cost sav! ing over the first half of the previous year. The company plans on multiple programs in the region. "Slick water fracturing" techniques use a solution for fracturing layers by using fluids, which contains around 99.5% water and the rest is chemical added to the water to reduce friction, corrosion, and bacterial growth. Slick water fracturing results in fast and economic drilling because of injecting fluid into the well bore at high speed.

As the company has already tested well drilling capabilities in the Cardium Trend formation, it will give the company a better position to drill additional wells in the formation and increase its productivity. The company has around 3,000 net unrisked locations in the Cardium formation. Net unrisked locations refer to the total number of locations, including the ones where PennWest has partial interest, where production of oil and natural gas can be achieved. To exploit the potential of this region, PennWest is carrying out three water flood projects in the Cardium Trend by the end of this year. Water flooding is a secondary production technique to extract petroleum in which water is used to create pressure inside the reservoirs and extract petroleum. We expect that the water flood projects will continue to drive down well drilling and completion costs by the end of this year.

One of the major players in the Cardium formation is Bonterra Energy Corporation (OTC:BNEYF). The company has around 193.7 net sections in the Cardium formation with proved and probable reserves of around 70.5 mboe. Net sections are the total number of sections in a region that the company holds, including the ones in which the company has partial interests. In order words, it denotes the net operating area for a company that includes both productive and unproductive locations. The company plans to produce around an average of 12,000 boepd this year. The company produces around 75% oil and 25% of gas from the Cardium reservoirs with operating costs of around $13 per barrel o! f oil equ! ivalent, or BOE. With WTI prices around $100 per barrel, this results in a very high netback for the company. Netback measures the profit on a barrel when sold. During the second quarter ending in June, the company realized a netback of $43.52 per boe, which was a 15% increase quarter over quarter.

Playing in the Viking

PennWest is also focusing on growth from its Viking formation acreage. The Viking formation also lies in the Western Canadian Sedimentary Basin and stretches between Alberta and Saskatchewan. PennWest has around 822,680 gross acres in this region with around 1,000 net sections. According to the same study by Deloitte, the acreage owned by PennWest in the Viking play has a contingent reserve of around 170,997 mboe.

PennWest also plans to drill around 50 wells- 60 wells in this region by the end of this year. According to a study by the National Energy Board, or NEB, the depth of the Viking formation ranges between 600m to 900m; this is shallower than the other formations, which are found at depths more than 800m. We believe that the shallower depth of the Viking formation will lead to a lesser cost of well drilling due to the lower depth, which will be beneficial for the company. Also, the Viking formation has been reported to have around 9 million barrels of oil. The comparative low cost of drilling with a significant reserve will provide a platform for future growth to the company. The cost of a well in the Viking formation is around $1 million. The company estimates its drill completion equipment and tie-in cost of a well is around $1.1 million. At this, the well costs of PennWest are competitive with the market.

PennWest plans to continue with its primary recovery techniques as well as start with secondary production techniques in the Viking formation. Similar to its Cardium Trend plans, the company will initiate water flooding techniques in the Viking formation. We believe that the company's plan of a gradual transition into secondary production techniques wil! l help it! enhance its production from the Viking play over the coming quarters.

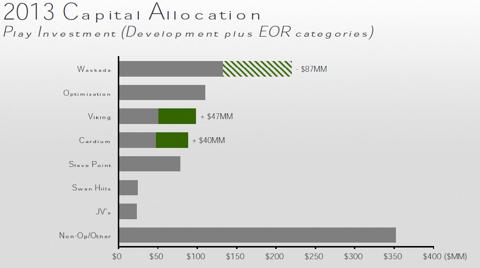

Looking at the potential of the two plays, we believe that it will provide PennWest with substantial room for growth. The company has reallocated it capital expenditure in the Cardium Trend as well as in the Viking Play. It has allocated around an additional $47 million in the Viking Play and $40 million in the Cardium Trend. This is as shown in the graph below:

(click to enlarge)

The capital reallocation will thus provide a boost to the development and production plans in both the Cardium Trend and Viking formations. We feel the company is allocating its capital more efficiently, which would result into better returns.

A focused player in the Viking formation is Raging River Exploration (OTC:RRENF). The company has a significant position in the Viking formation with around 84,000 net acres of land and around 600 net drilling locations. The company is focused on producing light oil from the Viking play. Raging River Exploration has already drilled around 100 wells out of the 140 wells it has planned for this year. The company increased its capital expenditure in this region from around $20 million to around $145 million for this year. With an increase in capital spending, the company has also increased the production target from this region around 4,850 barrels of oil equivalent per day, boepd, to around 5150 boepd, and around 95% of the production is oil.

Showing positive signals

PennWest currently has a return on asset, or ROA, of negative 1.41%, and its return on equity, or ROE, is around negative 2.90%. Though both ratios indicate a negative return, we believe that this is only transitional. On a medium to long-term basis, the company will reverse its revenue trend. As we have discussed PennWest's assets in the Cardium formation and in the Viking formation, which hold significant reserves for supp! orting pr! oduction growth. Additionally, PennWest has laid down plans to implement secondary production techniques to increase the productivity from its reserves. With further reallocation of capital in the Cardium and the Viking formation, the company has expedited the process of development in these two formations. We believe PennWest is looking for a turnaround of its returns from these assets.

Source: Now Is The Time To Buy PennWestDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Fusion Research is a team of equity analysts. This article was written by Madhu Dube, one of our research analysts. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.

Thursday, October 24, 2013

Diversification Drives Nasdaq's Q3 Earnings, Future Outlook

NASDAQ OMX (NASDAQ:NDAQ) was already one of the most diversified exchange players in the U.S. prior to its acquisitions over the past year. Following these acquisitions, it is now an entity that is almost unaffected by the weakness in its most recognizable division, U.S. cash equity trading. NASDAQ reported its earnings for the third quarter on October 23, and recorded a 23% jump in its net revenue, primarily driven by the acquisitions. Organically, its revenue grew by 4% year-on-year as the U.S. cash equity trading business continued to lose market share and remained a drag.

Below we provide our take on the most important data released during the conference call. Our price estimate for the company’s stock is around $31, and we will update our model shortly.

Good Progress On Capital Plan

NASDAQ has spent over $1 billion in the last year to acquire fixed income platform eSpeed and Thomson Reuters’ corporate solutions business. The company had to take on a significant amount of debt for these deals, which initially raised concerns about its credit ratings. In Q2, its long-term debt obligations increased by $807 million from the end of 2012.

However, the company is committed to reducing its debt at an accelerated pace, and seems to be doing well on this front. It paid back $98 million of debt during the quarter, and remains on track to return to its long-term gross debt-to-EBITDA target of around 2.5x. As debt reduces, we expect NASDAQ’s financial flexibility to return, and the company is then likely to restart its share buyback program (read: NASDAQ Escapes Moody’s Review Without A Downgrade).

New Acquisitions Provide Diversification…

The hefty sum paid for Thomson Reuters’ business and eSpeed definitely seems to be benefiting NASDAQ in terms of diversification. Whereas the Thomson Reuters’ corporate business acquisition has strengthened its non-transaction based revenue, eSpeed has helped diversify transaction-bas! ed income by contributing fixed income revenues.

At the moment, cash equities trading accounts for just 9% of NASDAQ’s net revenue, while derivatives, fixed income, and access and broker services account for 14%, 4% and 13% respectively. Together, these segments comprise NASDAQ’s Market Services division, which is responsible for 40% of its topline. The other 60% comes from Technology Solutions (26% of revenue) and Information Services (23% of total net revenues), both of which provide recurring revenue from long-term client relationships (Press release, NASDAQ OMX, October 23, 2013). We expect the share of non-transaction based revenues to further increase as NASDAQ continues to roll out new products in the data and technology markets.

…And Are Likely To Drive Growth

In addition to providing diversification, the two new acquisitions also provide NASDAQ interesting growth opportunities.

According to NASDAQ’s management, the majority of its clients are currently using only one or two of its products in the corporate solutions market. With the acquisition of Thomson Reuters’ businesses, it has an opportunity cross sell to its clients and increase its revenue per client. The company has already started integrating Thomson’s platforms with its own, and is reorganizing its sales team to better serve its 10,000 customers globally. We expect NASDAQ’s corporate solutions revenue to grow rapidly as some of these initiatives start to have an impact.

The opportunity in the fixed income space is also large. With the acquisition of eSpeed, NASDAQ is now one of the leaders in the electronic government bond trading markets. During the quarter, over $3 trillion worth of U.S. fixed income products were traded on its platform every month, and the figure is likely to increase as it attracts new clients and launches new products. Since the close of the eSpeed acquisition, NASDAQ has already enrolled four new customers and expects to e! nroll ano! ther four by the end of 2013. The pace of new client enrollments could further increase once it finishes work on improving eSpeed’s responsiveness, a stated short-term goal.

Disclosure: No positions.

Source: Diversification Drives Nasdaq's Q3 Earnings, Future OutlookWednesday, October 23, 2013

In Their Own Words: How 8 Homebuilder CEOs Feel About the Housing Industry

Housing is making a big comeback. The numbers are hard to argue with. For years, we've built fewer homes than are needed to keep up with population growth, soaking up excess inventory from last decade's bubble and then some. Now, homebuilders have the wind at their back as construction booms. Housing starts are up more than 30% year over year.

But don't take my word for it. Here's what eight CEOs of the nation's biggest homebuilders said in conference calls that took place in the last three months.

Stuart Miller, CEO, Lennar (NYSE: LEN ) :

While production continues to lag the need, we are experiencing supply shortages against a growing demand. While some have argued that increased demand is being driven by low interest rates, we believe that it's being driven by a generally improving economy, driving household formation and a decoupling of households under one roof. New families are seeking to find independent shelter. Where attractive financing is available and obtainable, households seek for-sale product. But in the absence of a for-sale option, they seek rentals. But that just increases demand for rentals and drives up the rental rates, making for-sale monthly payments even more attractive. The bottom line is that there are too few dwellings for a growing population and for normalized household formation.

Larry Nicholson, CEO, Ryland Group:

Not a lot has been keeping me up at night. The interest rate thing ... as long as the economy continues to move forward on solid ground, I think we are fine. A year ago I was worried about Fannie and Freddie, but today I am not. There is mortgage availability. So I am not real concerned with a whole lot right now. I think that pricing will continue to move up. If you look at peak-to-trough pricing and you look at where we are today, we still got room to move. So I think there is a lot of things still playing to our favor today.

Donald Tomnitz, CEO, DR Horton (NYSE: DHI ) :

We're dramatically improving our margins. We think we're in a wonderful position. There is a shortage of finished homes on the marketplace. So not only with our good inventory of specs that we consistently have maintained in this company, we will continue to push price as well as volume. Clearly we've said before, our goal is, improve the bottom line better than we improve the top line. But nevertheless, we are in a position where we can do both.

Jeffrey Mezger, CEO, KB Homes (NYSE: KBH ) :

Let me address the recent concerns many have raised regarding the recent uptick in mortgage rates and its potential impact on housing. In my view, there is no question that housing dynamics are significantly better than they were a year ago. At the same time, in my view, we are still in the early innings of a recovery that is continuing to accelerate. The positive factors underpinning the current housing recovery remain fully in place and will continue to drive favorable market fundamentals.

There is substantial pent-up demand driven by population growth, job growth, an increase in household formation and record affordability. At the same time, in most areas of the country, there is a shortage of supply and monthly mortgage payments for a typical home are lower than rent; further reinforcing the appeal of homeownership. Despite the recent rise in rates, affordability is still at extraordinary levels, and demand is significantly outpacing supply in every market we serve. Anecdotally, we are hearing from the sales floor that the uptick in rates has actually created an increased sense of urgency, as buyers don't want to miss out on this incredible opportunity.

Larry Mizel, CEO, MDC Holdings (NYSE: MDC ) :

So I think that the United States is in a unique place where it's a safe haven for capital. As we look around the world, there's not a lot of safe havens. And so housing benefits from the pent-up demand. It benefits from the low interest rates. And the home value and the affordability, as you know that the affordability is well imbalanced, and there seems to be room to run between the cost and what the affordability index would anticipate. And so I think the industry is working hard to expand to meet the demand and the needs of the buyer. We're creating jobs, which is great for our country. We're helping the GDP, which is certainly lacking in many areas. So I think the aggregate impact of providing housing and value is working out very well for everyone.

Richard Dugas, CEO, PulteGroup (NYSE: PHM ) :

In a number of communities across the country, demand has been so strong that we have taken action to slow the overall pace of sales. While I would expect that everyone listening to the call today is aware of builders taking such action in Phoenix, Tampa and Washington D.C., we are now seeing this in cities as diverse as Austin, Cleveland and Seattle. In fact, while it's tough to get precise data, a recent survey of our division president suggests that we have taken steps to purposefully slow sales to varying degrees in 25% or more of our communities. I am sure that most of you know the answer, but why would we limit sales? Given the lack of land development during the 6 years of housing market downturn, finished lots in the better submarkets are scarce. Accelerating sales pace means that we sellout a neighborhood sooner and have to look to the next community which may not have been developed yet. Although less of an influence, labor constraints in certain markets can also make it prudent to meter the sales pace to help ensure build times are not extended too far into the future.

Ara Hovnanian, CEO, Hovnanian (NYSE: HOV ) :

In the majority of the situations, we have been able to raise our home prices more than the construction costs have increased, thereby increasing gross margin. Southern and Northern California, as well as Phoenix, certainly have many communities that fall into that category. In other markets, we've been able to raise prices -- home prices equal to construction cost increases. Houston and Dallas are examples of that. And finally in some markets, the construction cost increases have actually risen ahead of our community home price increases. This is in a minority of the markets, but Minneapolis comes to mind in this category. Fortunately, home prices are gaining momentum here as well. In the aggregate, our home price increases have more than offset any increases in construction costs that we have seen to date, helping contribute to our gross margin increase.

Ara Hovnanian, CEO, Hovnanian:

While the housing market is clearly recovering, we have not yet reached the level of the previous lows of 1 million starts. All of the excess production of mid-decade has now been wiped out by the deficit production plus a little. In fact, on Slide 26, we show the excess starts from the last decade and stack them -- excess above the average, stack them on top of the deficit reduction of the last 5 years, and what you see is that the -- we are still far below the average production for the decade. As has often happened, the market has overcorrected, and on -- in this case, on the downside. In addition, like the '70s, most demographers are projecting higher housing needs this particular decade, based on population and household growth. The Harvard Joint Center for Housing Studies, Moody's and others, are projecting housing starts between 1.6 million and 1.9 million new home starts per year for the entire decade. This exacerbates the current underproduction issues.

Steve Hilton, CEO, Meritage Homes:

As much as prices have gone up, affordability is still at a historic low, of course a lot of that is because of interest rates. Sooner or later rates are going to go up, and so we have to be mindful that and I think we are, and that's why we are focused on more A&B locations than going into the outer markets. I think the thing that people aren't really talking a lot about is that the entry level business, at least from my vantage point, really has been recovered to the degree that the mover market is and the interest and see what happens out there, but affordability is one metric to watch, and we still feel very good about it.

Hat tip to SeekingAlpha.com for providing conference call transcripts.

More from the Motley Fool

Interested in more about the economy? My new free report, "Everything You Need to Know About the National Debt," walks you through with step-by-step explanations about how the government spends your money, where it gets tax revenue from, the future of spending, and what a $16 trillion debt means for our future. Click here to read it.

Tuesday, October 22, 2013

Tile Shop Holdings (TTS): Ready to Crack or a Short Squeeze? LL, HD & LOW

The shorts appear to be trying to crack small cap Tile Shop Holdings, Inc (NASDAQ: TTS) – meaning it might be worth taking a realistic look at the stock and any potential problems surrounding it plus the performance of other home improvement retailers or peers like Lumber Liquidators Holdings Inc (NYSE: LL), which is not into tiles, and The Home Depot, Inc (NYSE: HD) and Lowe's Companies, Inc (NYSE: LOW) which would be into tiles.

What is Tile Shop Holdings?Small cap Tile Shop calls itself a leading specialty retailer of manufactured and natural stone tiles, setting and maintenance materials and related accessories in the United States. Specifically, the Tile Shop says it offers a wide selection of products, good value and enhanced customer service in a unique showroom setting. As of June 30, The Tile Shop operated 80 stores in 25 states, with stores having an average footprint of 23,000 square feet.

What You Need to Know About Tile Shop HoldingsOn Monday, an anonymous author calling him or herself the Infitialis Research Collective, published an article on Seeking Alpha entitled: The Tile Shop: Poisoned Tile, Bad Actors, Unsustainable Margins, And A Stock Ready To Crack. The numerous accusations hurled at the company included:

Independent laboratory testing results indicating that a "significant number of The Tile Shop products have DANGEROUS lead contaminations, up to 13,900% greater than the United States' Consumer Product Safety Commission limits for products that come in contact with children." The company's current management team is "wholly unfit for public company stewardship with a Founder/CEO convicted of FRAUD and the SVP of Operations is presently out on PROBATION." The Chan Brothers, with their "dubious and notorious lineage in Hong Kong real estate, have been selling down their ~30% ownership stake." Unsustainable margins for a commodity product.Of course and while the report looks pretty slick and is crammed full of "facts," info or just plain insinuations, the article also comes with the disclosure "I am short TTS," which might tell you everything you need to know about the motivations of the author. In addition, the name of the independent lab is not mentioned (you can bet if there is smoke, we will soon see some fire in the form of press releases from trial lawyers and consumer or "shareholder rights activists" investigating the company) while The Home Depot and Lowe's Companies would also be sourcing tiles and probably sourcing them from the same overseas sources (meaning they would face the same potential lead liabilities).

Investors can read the report from Infitialis Research Collective and form their own opinion but here are some facts that we do know about Tile Shop Holdings:

Insiders were selling shares for much of last summer according to Yahoo! Finance data, but the last transaction was a buy at the beginning of the month. There is no trailing P/E but the company's forward P/E is 36.60 according to Yahoo! Finance data. The company does have aggressive growth plans as the number of new stores expected to open in 2013 was raised to 20 from 17 (in the last earnings call). In 2014, the company anticipates opening approximately 25 stores. The last time the company reported earnings, comp store sales were up 14.3% in the second quarter and total sales were up 25.59% with two-thirds of the sales growth driven by ticket and the other third by increased store traffic.In the last earnings call (the transcript is available on Seeking Alpha here), the SVP of retail noted:

Our strategy for continuing to grow sales in built on four pillars, first opening stores in market with suitable demographics. Second, leveraging our strength to take market share from the competition. Third, offering a vast selection of products incredibly presented to grab consumers from the moment they walk through our doors, and fourth, early training our sales managers and their associates to deliver exceptional customer service.

Share Performance: Tile Shop Holdings vs. LL, HD and LOWOn Monday, small cap Tile Shop Holdings fell 8.04% to $23.79 (TTS has a 52 week trading range of $12.00 to $30.88 a share) for a market cap of $1.32 billion but the stock is up is up 40.3% since the start of the year, up 61.8% over the past year and up 94.2% since August 2012.

Here is a quick look at Tile Shop Holdings' performance verses that of Lumber Liquidators Holdings and mass market home improvement stores The Home Depot and Lowe's Companies:

As you can see from the above chart, both the Tile Shop Holdings and Lumber Liquidators Holdings have far outperformed both The Home Depot and Lowe's Companies over the long term albeit the performance of TTS has come back down to earth.

Finally, here is a look at the latest technical charts for all four home improvement stocks:

The Bottom Line. Again, investors should be cautious about acting on a report (no matter how good it looks) written by someone shorting a stock just like they should also be careful about buying a stock based on a report written by a shareholder, but it will be interesting to see how the company responds to the article. With that said and while Tile Shop Holdings has put in a pretty good performance verses other home improvement stocks, it may not be compelling enough to get into right now – other than to squeeze shorts like the Infitialis Research Collective.

Stocks breaking the all-time high barrier

All told, 106 stocks in the Standard & Poor's 500 are at or within 2% of their all-time highs, a commentary on how the market isn't being held up by just a few runaway winners, but a swell of companies from a swath of industries that are hitting their strides.

Seeing broad leadership instead of just a few darlings comes as the S&P 500 on Tuesday hit another all-time high, the fourth in a row, capping a 23% gain this year. "We are nowhere near a market top because this rally has real internal strength in it," says Ken Winans of Winans Investments. "This bull run has room to run."

STOCKS: S&P rises to fourth consecutive record close

ASK MATT: Is S&P 500 good place to start investing?

A closer look at the companies at or approaching highs show that:

• Well-known consumer brands are big winners. Disney, Chipotle Mexican Grill and Starbucks are among the stocks that have blown the furthest into record ground. All three set new all-time highs Tuesday.

• The number of stocks hitting highs is at historic levels. More than 800 stocks trading on the New York Stock Exchange and the Nasdaq are at their highest levels over the past year, Winans says. Seeing that many stocks hit 52-week highs at the same time has only happened five other times since 1974, including 1982, 1986, 1997, 2003 and 2010, Winans says. Each of these periods were followed with powerful rallies.

• They're not just the individual investor darlings. The companies that are blazing with the most gusto aren't the high-profile tech stocks that individual investors have been infatuated with, but lesser-known companies such as industrial coatings maker PPG, hard drive makers Seagate and Western Digital, shipper United Parcel Service, defense company Northrop Grumman and discount retailers TJX and Dollar Tree. On the other ! hand, Apple, a favorite stock among individual investors, is still 26% away from its all-time high of $705 set last year.

• Former stars of last market high left out. Stocks such as Cisco Systems, JDS Uniphase and Yahoo were the pace leaders when the market last raced to new highs in the late 1990s. But all these stocks are nowhere near their all-time highs, remaining 72%, 99% and 73% away from new ground, respectively. Some former darlings, though, have returned for encore performances, including online retailers Amazon.com, which set an all-time high Tuesday, and Priceline.com, which is 2% away from its high.

Seeing so many companies hit all-time highs "is a very healthy sign and one that should encourage further buying," says Jack Ablin of BMO Private Bank.

S&P 500 stocks up the most from their previous all-time highs:

• PPG Industries, 1.8%

• Walt Disney, 1.6%

• Chipotle Mexican Grill, 1.6%

• Scripps Networks Interactive, 1.4%

• FedEx, 1.4%

Source: S&P Capital IQ, USA TODAY research

DIRECTV Stock Goes for a Hulu Boost

The Hulu sweepstakes is intensifying, and at least one source claims that DIRECTV (NASDAQ: DTV ) is the leading bidder. Digital journalist Quartz is reporting that the country's leading satellite television provider has the inside track on the winning bid for the TV-centric streaming service provider, and the pairing makes sense.

DIRECTV stock is trading closer to its all-time high than its low these days, but it will face challenges in the near future for which Hulu would come in handy.

DIRECTV isn't just the largest satellite television service in the Americas. It also happens to be the most expensive. Over the past year, the average stateside subscriber has gone from paying $91.99 to $96.05 a month. Its closest rival -- DISH Network (NASDAQ: DISH ) -- commands monthly average ransoms of just $78.54 a month.

A key differentiator for DIRECTV is its exclusivity among satellite and cable providers with the NFL to provide every game during the regular season with its Sunday Ticket package. However, as NFL fees continue to spike, there are no guarantees that the deal will be renewed after the 2014 season. DIRECTV will want to start beefing up its proprietary offerings outside NFL Sunday Ticket, and offering Hulu Plus access to subscribers at no additional cost would be one way to command a premium over similar pay-TV alternatives.

Analysts see revenue at DIRECTV growing at a nearly 8% clip this year and again in 2014. It's a different story at DISH, with those same pros targeting top-line growth in the low single digits. If DIRECTV loses football exclusivity, what will it do to keep people paying up for its service come 2015?

The move would also give DIRECTV a service that it could use to defend itself against Netflix (NASDAQ: NFLX ) . It's not a coincidence that Netflix chose Latin America and the Caribbean as its first expansion market outside North America for its streaming service a couple of years ago. DIRECTV is the top dog through Latin America.

It's a different game for DIRECTV in Latin America, as average revenue per user breaks down to just $54.23. Currency fluctuations aside, the annual increases aren't the same in Latin America, as it reaches out beyond the affluent for middle-market customers. We're not at the point where cord-cutting is a trend in Latin America, but DIRECTV doesn't want to be on the wrong end of the digital trend if streaming video becomes a difference-maker. Acquiring Hulu -- and naturally beefing up its Spanish and Portuguese licensed content -- would help it compete with Netflix's platform.

Paying too much for Hulu may sting some potential bidders, but DIRECTV stock would probably move higher if the company does indeed emerge victorious, because it makes tactical sense.

DIRECTV stock can't ignore the future

The television landscape is changing quickly, with new entrants such as Netflix disrupting traditional networks. The Motley Fool's new free report "Who Will Own the Future of Television?" details the risks and opportunities in TV. Click here to read the full report!

Monday, October 21, 2013

10 Best Energy Stocks To Invest In 2014

On Wednesday, Chesapeake Energy (NYSE: CHK ) will release its latest quarterly results. The key to making smart investment decisions on stocks reporting earnings is to anticipate how they'll do before they announce results, leaving you fully prepared to respond quickly to whatever inevitable surprises arise. That way, you'll be less likely to make an uninformed knee-jerk reaction to news that turns out to be exactly the wrong move.

Chesapeake has been a major natural gas and oil producer for years, but it has faced several controversial episodes with its founder and former CEO Aubrey McClendon along the way. Now that McClendon has stepped down, investors are wondering which direction the company will move. Let's take an early look at what's been happening with Chesapeake Energy over the past quarter and what we're likely to see in its quarterly report.

Stats on Chesapeake Energy

Analyst EPS Estimate

10 Best Energy Stocks To Invest In 2014: National-Oilwell Inc.(NOV)

National Oilwell Varco, Inc. designs, constructs, manufactures, and sells systems, components, and products used in oil and gas drilling and production; provides oilfield services and supplies; and distributes products, and provides supply chain integration services to the upstream oil and gas industry worldwide. Its Rig Technology segment offers offshore and onshore drilling rigs; derricks; pipe lifting, racking, rotating, and assembly systems; rig instrumentation systems; coiled tubing equipment and pressure pumping units; well workover rigs; wireline winches; wireline trucks; cranes; and turret mooring systems and other products for floating production, storage and offloading vessels, and other offshore vessels and terminals. The company?s Petroleum Services & Supplies segment provides various consumable goods and services to drill, complete, remediate, and workover oil and gas wells and service pipelines, flowlines, and other oilfield tubular goods. It also manufacture s, rents, and sells products and equipment for drilling operations, including drill pipe, wired drill pipe, transfer pumps, solids control systems, drilling motors, drilling fluids, drill bits, reamers and other downhole tools, and mud pump consumables. In addition, this segment provides oilfield tubular services comprising the provision of inspection and internal coating services; equipment for drill pipe, line pipe, tubing, casing, and pipelines; and coiled tubing pipes and composite pipes. Its Distribution Services segment sells maintenance, repair and operating supplies, and spare parts to drill site and production locations. The company primarily serves drilling contractors, shipyards and other rig fabricators, well servicing companies, pressure pumping companies, oil and gas companies, supply stores, and pipe-running service providers. National Oilwell Varco, Inc. was founded in 1862 and is based in Houston, Texas.

Advisors' Opinion:- [By Chris Neiger]

1. National Oilwell Varco (NYSE: NOV ) -- Diversity score of 15: This oil and gas component and equipment company received the third-lowest rating in the report, partly because it was one of only two companies in the study that doesn't have any diversity on its board of directors. In addition, National Oilwell Varco has no women or minorities in the C-suite, as a Forbes overview on the report noted earlier this year. . When it comes to diversity, oil and gas companies typically tend to fall behind other industries.

- [By Harlan Kessler]

Whenever you see a company that is undervalued with plenty of competitive advantages and financial strength, you are looking at a winner. The company that meets these specifications in the energy business is National Oilwell Varco (NOV). The company supplies drillers and producers with anything they need ranging from rigs to drilling parts and also provides a range of services, whether it is piping inspection or the training of drilling crew in the use of sophisticated systems. It exerts such a profound influence that, according to a Morningstar estimate, it has a 60% share in the market for rig equipment and 90% of all rigs carry some of its equipment. It also operates in over 700 locations across the world. We should remember that the folks who made the real money in the Gold Rush were the suppliers of picks and shovels.

- [By Selena Maranjian]

Among holdings in which Fred Alger Management increased its stake were Two Harbors Investment (NYSE: TWO ) and National Oilwell Varco (NYSE: NOV ) . The company reduced its stake in lots of companies, including Questcor�and Weatherford. Two Harbors is a mortgage REIT, or "mREIT," recently yielding a gargantuan 11.4%. It's a "hybrid" mREIT, though, investing in both government agency-backed mortgages and ones that are not so backed. Thus, it has more flexibility than some of its peers. Some worry about rising interest rates and prepayments on loans, but Two Harbors has apparently hedged against some of that. Insiders and institutions�have been buying shares in recent months.

10 Best Energy Stocks To Invest In 2014: Whitehaven Coal Ltd (WHITF)

Whitehaven Coal Limited (Whitehaven) is engaged in the development and operation of coal mines in New South Wales. During the fiscal year ended 30 June 2012 (fiscal 2012), Whitehaven Coal Limited and its controlled entities continued development at the Narrabri underground mine. The Company operates in two segments: Open Cut Operations and Underground Operations. The Company�� Gunnedah operations include the Tarrawonga (70% owned by Whitehaven), Rocglen (100% owned by Whitehaven), and Sunnyside (100% owned by Whitehaven) open cut mines and the Gunnedah coal handling and preparation plant and train load out facility (CHPP��(100% owned by Whitehaven). The Werris Creek mine is 100% owned by Whitehaven. During fiscal 2012, the Company produced 4.28 million tons per annum of saleable coal. On May 1, 2012, the Company acquired Boardwalk Resources Limited. On May 2, 2012, the Company acquired Aston Resources Limited. On June 20, 2012, it acquired Coalworks Limited.Top 5 Energy Companies To Watch In Right Now: Statoil ASA (STO)

Statoil ASA (Statoil), incorporated on September 18, 1972, is an integrated energy company primarily engaged in oil and gas exploration and production activities. As of December 31, 2011, the Company had business operations in 41 countries and territories. Effective from January 1, 2011, the Company�� segments were Development and Production Norway; Development and Production International; Marketing, Processing and Renewable Energy; Fuel & Retail, Other. As of 31 December 2011, the Company had proved reserves of 2,276 million barrels (mmbbl) and 3,150 billion cubic meters (bcm) (equivalent to 17,681 trillion cubic feet (tcf)) of natural gas, corresponding to aggregate proved reserves of 5,426 mmboe. In December 2011, the Company acquired Brigham Exploration Company. On April 14, 2011, Statoil's formation of a joint venture and sale of 40% of the Peregrino field off the coast of Brazil to the Sinochem Group was closed. With effect from January 2011, Statoil formed a joint venture with PTTEP of Thailand in its oil sands business and, as part of that transaction, sold PTTEP a 40% interest in the leases in Alberta, Canada. Statoil retains 60% ownership and operatorship of the oil sands project. In June 2012, the Company divested its 54% interest in Statoil Fuel & Retail ASA to Alimentation Couche-Tard.

Development and Production Norway

Development and Production Norway (DPN) consists of the Company�� field development and operational activities on the Norwegian continental shelf (NCS). Development and Production Norway is the operator of 44 developed fields on the NCS. Statoil's equity and entitlement production on the NCS was 1.316 mmboe per day in 2011, which was about 71% of Statoil's total production. Acting as operator, DPN is responsible for approximately 72% of all oil and gas production on the NCS. In 2011, its average daily production of oil and natural gas liquids (NGL) on the NCS was 693 mboe, while its average daily gas production on the NCS was 99.1 mmcm (3.5 b! illion cubic feet (bcf)). The Company has an ownership interests in exploration acreage throughout the licensed parts of the NCS, both within and outside its production areas. It participates in 227 licenses on the NCS and is the operator for 171 of them. As of 31 December 2011, Statoil had a total of 1,369 mmbbl of proved oil reserves and 444 bcm (15.7 tcf) of proved natural gas reserves on the NCS. Total entitlement liquids and gas production in 2011 amounted to 1,316 mmboe per day.

Statoil's NCS portfolio consists of licenses in the North Sea, the Norwegian Sea and the Barents Sea. It has organized its production operations into four business clusters: Operations South, Operations North Sea West, Operations North Sea East and Operations North. The Operations South and Operations North Sea West and East clusters cover its licenses in the North Sea. Operations North covers the Company�� licenses in the Norwegian Sea and in the Barents Sea, while partner-operated fields cover the entire NCS and are included internally in the Operations South business cluster. During 2011, it two Statoil-operated oil discoveries: the Aldous discovery (PL265) in the North Sea and the Skrugard discovery (PL532) in the Barents Sea. The Aldous Major South discovery in PL265 on the Utsira Height in the Sleipner area is situated 140 kilometers west of Stavanger and 35 kilometers south of the Grane field. The Skrugard discovery is located about 250 kilometers off the coast from the Melkoya LNG plant in Hammerfest.

As of December 31, 2011, the Company�� fields under development included the Gudrun, Valemon, Visund South, Hyme, Stjerne, Vigdis North-East, Skuld, Vilje South, Skarv, and Marulk. In 2011, the Company�� total entitlement oil and NGL production in Norway was 252 mmbbl, and gas production was 36.2 bcm (1,287 bcf). The main producing fields in the Operations South area are Statfjord, Snorre, Tordis, Vigdis, Sleipner and partner-operated fields. Operations North Sea East is a gas area tha! t also co! ntains quantities of oil. The area includes the Troll, Fram, Vega, Oseberg and Tune fields. The Company�� producing fields in the Operations North area are Asgard, Mikkel, Yttergryta, Heidrun, Kristin, Tyrihans, Norne, Urd, Alve, Njord, Snohvit and Morvin.

Development and Production International