Despite a lot of improvement since the financial crisis, many banks still aren't paying much of a dividend. With the next round of stress tests coming up in March, which bank is most likely to get the green light to raise its payout?

Source: 401kcalculator.org via Flickr

We asked three of our financial sector analysts which banks they think are most likely to raise their dividends, and here is what they had to say.

John Maxfield: While it's tempting to answer this question with a company like Bank of America, which has one of the smallest dividend payouts in the industry, I believe the banks with the best chance of growing their payouts are actually the ones that are already distributing a considerable share. For instance, Wells Fargo (NYSE: WFC ) .

I say that because the decision of whether to raise a quarterly payout is no longer solely up to the underlying bank. Thanks to laws passed in response to the financial crisis, the Federal Reserve now has veto power over capital allocation decisions. And that includes dividends.

Consequently, another way to frame the question would be this: Which bank has the best chance of getting the Fed's approval to raise its dividend? And the answer to that is: Banks with airtight reputations and, to use Jamie Dimon's phrase, fortress balance sheets.

With this in mind, it seems safe to assume that Wells Fargo has as good of a chance as any to get approval this upcoming March to raise it quarterly payout for the fifth year in a row.

Jordan Wathen: Capital One Financial (NYSE: COF ) raised its dividend in 2007, only to slash it during the financial crisis. And though it raised its dividend with the Fed's approval in 2013, a confluence of factors lead me to believe that a dividend hike could be around the corner.

First, Capital One Financial's payout ratio -- roughly 16% last year -- is well under the 30% or so "standard" limit for big banks. In addition, its preference for repurchases over dividends may turn upside down now that shares trade at prices significantly higher prices than last year. Capital One has a $2.5 billion repurchase plan in place, and it intends to buy back $1 billion of shares in the next two quarters. That pile of cash will buy substantially fewer shares than before.

Finally, one has to consider the company's investment opportunities within its own business. Yields on car loans are down as competition heats up. Meanwhile, credit card balances are growing only slightly faster than their average snail-like pace since the end of the recession. Opportunities to deploy capital in new lending are fewer and less interesting than before.

Given these realities, I think it's possible that Capital One considers an increased dividend alongside a smaller share repurchase plan when it sends its capital plans off to the Federal Reserve later this year.

Matt Frankel: I think the time has come for Citigroup's (NYSE: C ) to finally begin to rise. The company recently reported a very strong quarter, with a 9% year-over-year revenue increase that handily beat analysts' estimates.

And, the strong performance can be seen in virtually every aspect of Citigroup's business. Trading revenue, global consumer banking, and institutional client revenues were all higher. The only part of the business that shrunk was the loan portfolio, and this was due to the continued winding down of the Citi Holdings legacy assets. Without that, the company's core loan portfolio actually grew by 3%.

However, despite all of the growth, Citigroup's ability to raise its dividend is dependent on the approval of Federal regulators, who haven't allowed the company to do so yet. Now, the bank's capital levels might finally be high enough to persuade them, with the Basel III supplementary leverage ratio of 6% improved significantly from 5.1% a year ago.

After reading Citigroup's quarterly report, I am very confident in the bank's ability to perform well on its next "stress test" and finally start returning more capital to shareholders.

The best stocks that already pay great dividends

The smartest investors know that dividend stocks simply crush their non-dividend paying counterparts over the long term. That's beyond dispute. They also know that a well-constructed dividend portfolio creates wealth steadily, while still allowing you to sleep like a baby. Knowing how valuable such a portfolio might be, our top analysts put together a report on a group of high-yielding stocks that should be in any income investor's portfolio. To see our free report on these stocks, just click here.

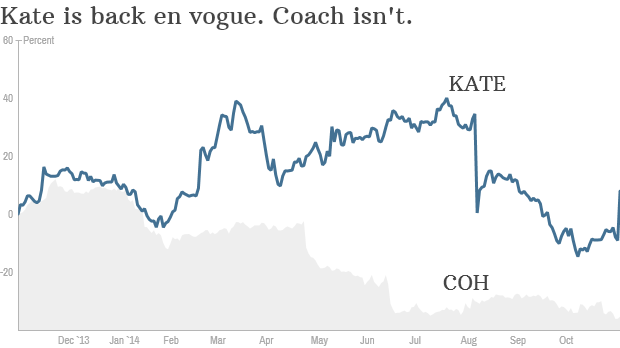

Kate Spade is on track to be a billion dollar business by the end of the year. NEW YORK (CNNMoney) Kate Spade just fired one heck of a good looking shot in the "handbag wars."

Kate Spade is on track to be a billion dollar business by the end of the year. NEW YORK (CNNMoney) Kate Spade just fired one heck of a good looking shot in the "handbag wars."

The people who created InTrade are back with Pivit. NEW YORK (CNNMoney) Wall Street loved using InTrade to predict election outcomes, but regulators took the wagering site away last year.

The people who created InTrade are back with Pivit. NEW YORK (CNNMoney) Wall Street loved using InTrade to predict election outcomes, but regulators took the wagering site away last year.  Getty Images You know you need homeowners insurance, but what you may not know is how many different types of discounts that your carrier offers. According to Bankrate.com, there are at least 11 types -- and chances are, most will be a surprise to you. That's because, unless you seem like you're about to jump ship and hand your money over to someone else, an insurance agent has no incentive to tell you about them. Agents typically are paid commissions on policies, so the more you pay, the more they make. "They don't really want to give that information out," Crissinda Ponder, Bankrate.com insurance analyst, told DailyFinance. "They don't have to, either. Some homeowners might not know they need to be asking these questions. It's up to consumers to take the initiative." There are two main principles at work. One is that the less risk you seem to be, the less the insurer can afford to charge you. The other is once the insurance company has signed you up, they know there's a statistically good chance you'll be paying them for a long time, and they want that business.

Getty Images You know you need homeowners insurance, but what you may not know is how many different types of discounts that your carrier offers. According to Bankrate.com, there are at least 11 types -- and chances are, most will be a surprise to you. That's because, unless you seem like you're about to jump ship and hand your money over to someone else, an insurance agent has no incentive to tell you about them. Agents typically are paid commissions on policies, so the more you pay, the more they make. "They don't really want to give that information out," Crissinda Ponder, Bankrate.com insurance analyst, told DailyFinance. "They don't have to, either. Some homeowners might not know they need to be asking these questions. It's up to consumers to take the initiative." There are two main principles at work. One is that the less risk you seem to be, the less the insurer can afford to charge you. The other is once the insurance company has signed you up, they know there's a statistically good chance you'll be paying them for a long time, and they want that business.