President Trump Friday announced the enactment of 25% tariffs on $50 billion worth of Chinese goods imported into the United States. Trump said the goods contain industrially significant technologies as defined by section 301 of the Trade Act of 1974.

The list of items products subject to the tariffs announced this morning numbers 1,102. U.S. Customs and Border Protection agents will begin collecting tariffs July 6 on the first $34 billion worth of 818 imported products. Tariffs on the remaining 284 items are still being reviewed and the Office of the U.S. Trade Representative (USTR) will issue a final determination on additional duties on these products once the review is completed.

U.S. Trade Representative Ambassador Robert Lighthizer said:

We must take strong defensive actions to protect America’s leadership in technology and innovation against the unprecedented threat posed by China’s theft of our intellectual property, the forced transfer of American technology, and its cyber attacks on our computer networks. China’s government is aggressively working to undermine America’s high-tech industries and our economic leadership through unfair trade practices and industrial policies like ‘Made in China 2025.’ Technology and innovation are America’s greatest economic assets and President Trump rightfully recognizes that if we want our country to have a prosperous future, we must take a stand now to uphold fair trade and protect American competitiveness.

Top 10 China Stocks To Own Right Now: Clean Diesel Technologies Inc.(CDTI)

Advisors' Opinion:- [By Stephan Byrd]

Here are some of the media stories that may have impacted Accern Sentiment’s analysis:

Get Molecular Templates alerts: Trading Center: Watching the Levels for Molecular Templates, Inc. (:MTEM): Move of 0.02 Since the Open (stocknewscaller.com) Molecular Templates (MTEM) Announces Clinical Data at 2018 ASCO Meeting (streetinsider.com) Gallbladder Cancer Treatment Sales Market Size by Players, Regions, Type, Application and Forecast to 2025 (exclusivereportage.com) ATR in spotlight EnSync, Inc. (NYSE:ESNC), CDTi Advanced Materials, Inc. (NASDAQ:CDTI), Molecular Templates, Inc … (stocksnewspoint.com)MTEM has been the subject of several research analyst reports. ValuEngine lowered shares of Molecular Templates from a “hold” rating to a “sell” rating in a research report on Thursday, March 1st. Zacks Investment Research raised shares of Molecular Templates from a “sell” rating to a “hold” rating in a research report on Thursday, June 7th. Four analysts have rated the stock with a hold rating and one has given a buy rating to the stock. The company has a consensus rating of “Hold” and an average price target of $5.20.

- [By Logan Wallace]

Shares of CDTi Advanced Materials Inc (NASDAQ:CDTI) hit a new 52-week low during mid-day trading on Wednesday . The stock traded as low as $0.33 and last traded at $0.36, with a volume of 500 shares trading hands. The stock had previously closed at $0.36.

Top 10 China Stocks To Own Right Now: ATA Inc.(ATAI)

Advisors' Opinion:- [By Paul Ausick]

ATA Inc. (NASDAQ: ATAI) traded down about 14% Monday to set a new 52-week low of $0.82, based on revalued shares that closed at $0.72 on Friday but traded up about 250% on Monday at $2.53. Volume was more than 200 times the daily average of around 42,000. You’re on your own here to figure this one out.

Top 10 China Stocks To Own Right Now: Netease.com Inc.(NTES)

Advisors' Opinion:- [By Lisa Levin]

NetEase, Inc. (NASDAQ: NTES) is expected to post quarterly earnings at $2.19 per share on revenue of $2.18 billion.

China Distance Education Holdings Limited (NYSE: DL) is estimated to post earnings for its second quarter.

- [By ]

NetEase Inc (NYSE: NTES) is the largest online services provider in China with revenue from its e-commerce platform and online gaming. Sales on its e-commerce platform surged 157% last year to support slower growth in gaming which accounts for about 75% of total revenue. The company is also starting to monetize its gaming segment with movies and mini-series based on the characters in the games.

- [By Ethan Ryder]

California Public Employees Retirement System lowered its stake in NetEase (NASDAQ:NTES) by 26.8% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 128,173 shares of the technology company’s stock after selling 46,859 shares during the period. California Public Employees Retirement System owned approximately 0.10% of NetEase worth $35,938,000 as of its most recent SEC filing.

- [By Stephan Byrd]

Alibaba Group (NASDAQ: NTES) and NetEase (NASDAQ:NTES) are both large-cap retail/wholesale companies, but which is the superior investment? We will compare the two businesses based on the strength of their institutional ownership, dividends, risk, earnings, profitability, analyst recommendations and valuation.

Top 10 China Stocks To Own Right Now: Renesola Ltd.(SOL)

Advisors' Opinion:- [By Joseph Griffin]

These are some of the media headlines that may have impacted Accern’s scoring:

Get ReneSola alerts: ReneSola Sells North Carolina Solar Project To Greenbacker (solarindustrymag.com) ReneSola (SOL) Rating Increased to Neutral at Roth Capital (americanbankingnews.com) ReneSola (SOL) Q1 Earnings in Line, Revenues Top Estimates (zacks.com) ReneSola’s (SOL) CEO Xianshou Li on Q1 2018 Results – Earnings Call Transcript (seekingalpha.com) ReneSola (SOL) Releases Earnings Results (americanbankingnews.com)Shares of ReneSola traded up $0.08, hitting $2.76, during trading on Friday, Marketbeat.com reports. The stock had a trading volume of 124,969 shares, compared to its average volume of 108,565. The firm has a market capitalization of $102.11 million, a PE ratio of 21.23 and a beta of 2.05. The company has a current ratio of 1.17, a quick ratio of 1.17 and a debt-to-equity ratio of 0.36. ReneSola has a 12 month low of $2.12 and a 12 month high of $3.79.

- [By Max Byerly]

Sola Token (CURRENCY:SOL) traded 17.9% lower against the dollar during the 1-day period ending at 16:00 PM E.T. on October 11th. One Sola Token token can now be bought for about $0.0054 or 0.00000087 BTC on cryptocurrency exchanges including Tidex and OpenLedger DEX. Sola Token has a total market cap of $153,306.00 and $1,856.00 worth of Sola Token was traded on exchanges in the last 24 hours. In the last seven days, Sola Token has traded down 12.2% against the dollar.

- [By Max Byerly]

Sola Token (CURRENCY:SOL) traded up 26.7% against the US dollar during the 24 hour period ending at 22:00 PM E.T. on September 28th. One Sola Token token can currently be bought for $0.0085 or 0.00000131 BTC on popular exchanges including Tidex and OpenLedger DEX. Sola Token has a market capitalization of $0.00 and approximately $3,239.00 worth of Sola Token was traded on exchanges in the last 24 hours. During the last week, Sola Token has traded flat against the US dollar.

- [By Logan Wallace]

Get a free copy of the Zacks research report on ReneSola (SOL)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Top 10 China Stocks To Own Right Now: Baidu Inc.(BIDU)

Advisors' Opinion:- [By Motley Fool Staff]

Vena: Right. iQiyi, when they started developing this original content, keep in mind that they were still owned by Baidu (NASDAQ:BIDU), which spun them off earlier this year. Now, Baidu has a lot of similarities to Google. They are the major search engine in China. They have a lot of data. They've been at the forefront of artificial intelligence. So, one of the things that iQiyi said in their IPO filing with the SEC is that they view that data and their ability to analyze that data using artificial intelligence as one of their competitive advantages. So, they have used that to generate shows that Chinese consumers just really love.

- [By Joseph Griffin]

Baidu (NASDAQ:BIDU) was upgraded by analysts at Zacks Investment Research from a strong sell rating to a hold rating. According to Zacks, “Baidu, Inc., formerly Baidu.com, Inc. is a Chinese-language Internet search provider and is based in Beijing, the People’s Republic of China.The company offers a Chinese language search platform and conducts its operations principally through Baidu Online Network Technology Co., Ltd. , a network of third-party Web sites and software applications. Further, the company offers Japanese search services, including Web search, image search, video search, and blog search capabilities. It also offers online marketing services to its customers directly and through other distribution networks. “

- [By Leo Sun]

Baidu (NASDAQ:BIDU), Alibaba (NYSE:BABA), and Tencent (NASDAQOTH:TCEHY) are considered fierce rivals in China's tech market. Baidu owns the country's top search engine, Alibaba's owns its biggest e-commerce marketplace, while Tencent dominates the social media and video gaming markets.

- [By Nicholas Rossolillo, Chuck Saletta, and Daniel Miller]

Nevertheless, China is still growing, and it would appear that a truce with the U.S. is coming. Stocks of China-based companies have been rallying as a result, but many are still down double-digits from a year ago. Three worth watching right now are Tencent Holdings (NASDAQOTH:TCEHY), Baidu (NASDAQ:BIDU), and NIO (NYSE:NIO).

- [By Max Byerly]

Baidu (NASDAQ:BIDU) received a $297.00 price objective from investment analysts at KeyCorp in a research report issued to clients and investors on Wednesday. The brokerage currently has a “buy” rating on the information services provider’s stock. KeyCorp’s target price would suggest a potential upside of 28.87% from the stock’s current price.

Top 10 China Stocks To Own Right Now: Focus Media Holding Limited(FMCN)

Advisors' Opinion:- [By Stephan Byrd]

An issue of Focus Media Holding Limited (NASDAQ:FMCN) debt fell 1.1% against its face value during trading on Tuesday. The debt issue has a 7.5% coupon and is set to mature on April 1, 2025. The debt is now trading at $97.63 and was trading at $98.50 last week. Price changes in a company’s debt in credit markets sometimes anticipate parallel changes in its stock price.

- [By Stephan Byrd]

An issue of Focus Media Holding Limited (NASDAQ:FMCN) bonds fell 0.9% against their face value during trading on Monday. The high-yield debt issue has a 7.25% coupon and will mature on April 1, 2023. The bonds in the issue are now trading at $99.13 and were trading at $98.13 last week. Price moves in a company’s bonds in credit markets sometimes anticipate parallel moves in its share price.

- [By Stephan Byrd]

An issue of Focus Media Holding Limited (NASDAQ:FMCN) debt fell 1.7% against its face value during trading on Friday. The high-yield debt issue has a 7.5% coupon and is set to mature on April 1, 2025. The debt is now trading at $94.25 and was trading at $96.38 one week ago. Price changes in a company’s debt in credit markets sometimes predict parallel changes in its share price.

WARNING: “Focus Media (FMCN) Bond Prices Fall 1.7%” was first published by Ticker Report and is the sole property of of Ticker Report. If you are reading this piece of content on another site, it was illegally copied and reposted in violation of US & international trademark and copyright legislation. The correct version of this piece of content can be read at https://www.tickerreport.com/banking-finance/4207523/focus-media-fmcn-bond-prices-fall-1-7.html.About Focus Media (NASDAQ:FMCN)

Top 10 China Stocks To Own Right Now: Top Image Systems Ltd.(TISA)

Advisors' Opinion:- [By Ethan Ryder]

Get a free copy of the Zacks research report on Top Image Systems (TISA)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Joseph Griffin]

Get a free copy of the Zacks research report on Top Image Systems (TISA)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Shane Hupp]

Get a free copy of the Zacks research report on Top Image Systems (TISA)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Money Morning Staff Reports]

Before we get to our latest pick, here are last week's top-performing penny stocks:

Penny Stock Sector Current Share Price Last Week's Gain Melinta Therapeutics Inc. (NASDAQ: MLNT) Healthcare $1.74 104.01% Pernix Therapeutics Holdings Inc. (NASDAQ: PTX) Healthcare $0.83 84.40% Top Image Systems Ltd. (NASDAQ: TISA) Healthcare $0.82 59.85% Jason Industries Inc. (NASDAQ: JASN) Healthcare $2.21 58.99% Maxwell Technologies Inc. (NASDAQ: MXWL) Financial $4.66 51.79% Marathon Patent Group Inc. (NASDAQ: MARA) Healthcare $0.52 51.47% Forward Pharma A/S (NASDAQ: FWP) Basic Materials $1.53 43.57% Dixie Group Inc. (NASDAQ: DXYN) Healthcare $1.40 42.86% Trevena Inc. (NASDAQ: TRVN) Services $1.41 39.60% Alliance MMA Inc. (NASDAQ: AMMA) Healthcare $4.95 36.18%Don't Miss Out: The Treasury is sitting on an $11.1 billion cash pile, and a loophole entitles Americans to a sizable portion. Some are collecting $1,795, $3,000, or $5,000 every month thanks to this powerful investment…

Top 10 China Stocks To Own Right Now: Sina Corporation(SINA)

Advisors' Opinion:- [By Logan Wallace]

Get a free copy of the Zacks research report on SINA (SINA)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

- [By Leo Sun]

Shares of SINA (NASDAQ:SINA) fell 7% on Aug. 8 after the Chinese internet company reported its second quarter earnings. Yet the decline, which brought SINA to a 52-week low, seemed unjustified, as the company easily beat analyst estimates.

- [By Leo Sun]

Shares of SINA (NASDAQ:SINA) and Weibo (NASDAQ:WB) have both tumbled this year, mainly due to escalating trade tensions between the United States and China. Yet their sell-offs seem overdone, since both tech companies are well insulated from a potential trade war.

- [By Jack Delaney]

SINA Corp. (Nasdaq: SINA) operates Weibo Corp. (Nasdaq: WB), a social media platform with 411 million monthly active users (MAUs) as of Q1 2018.

It's considered the Twitter Inc. (NYSE: TWTR) of China.

Apple Day was a game changer for its customers, not Wall Street, Jim Cramer says 2 Hours Ago | 13:36

Apple Day was a game changer for its customers, not Wall Street, Jim Cramer says 2 Hours Ago | 13:36

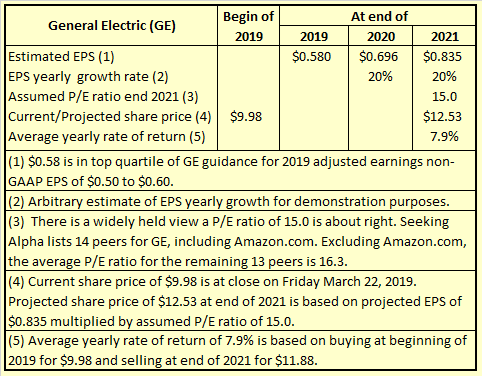

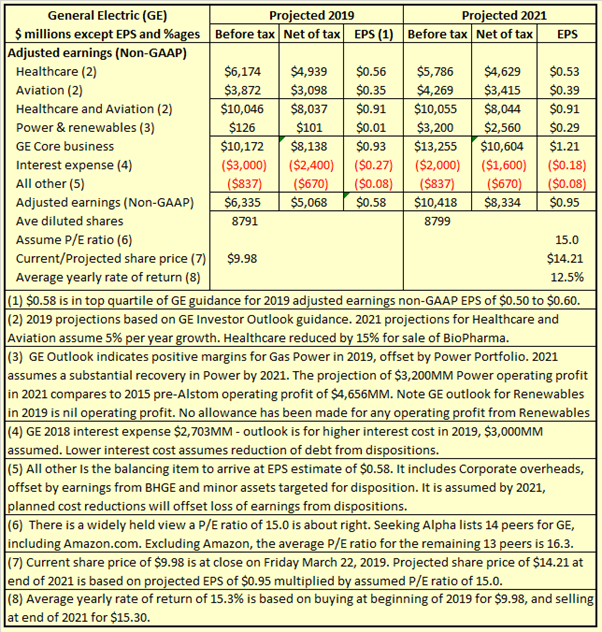

"The Hydrogen Generation: These Gas Turbines Can Run On The Most Abundant Element In the Universe". I recommend the article as a must read for any present or intending GE investor. I urge those interested to read the whole article, to see how presently wasted hydrogen emissions from various coke, oil and gas, and other plants, can be easily captured and used in GE gas turbines. In addition, at times of excess electricity generation, this need not be wasted, but can be converted to hydrogen and mixed with natural gas in natural gas pipelines for fuel for gas turbines. These excerpts from the article give some idea of the potential savings in CO2 emissions,

"The Hydrogen Generation: These Gas Turbines Can Run On The Most Abundant Element In the Universe". I recommend the article as a must read for any present or intending GE investor. I urge those interested to read the whole article, to see how presently wasted hydrogen emissions from various coke, oil and gas, and other plants, can be easily captured and used in GE gas turbines. In addition, at times of excess electricity generation, this need not be wasted, but can be converted to hydrogen and mixed with natural gas in natural gas pipelines for fuel for gas turbines. These excerpts from the article give some idea of the potential savings in CO2 emissions, dashboards to allow scenario testing for tickers of interest. You are welcome to Register today for an absolutely no obligation 14-day free trial. Analysts' Corner takes advantage of market sentiment and company fundamentals, to objectively target rates of return, rather than make purely qualitative assessments based on imperfect and inappropriate data. Register now to join in the discussions on GE's possible involvement in the hydrogen-electrical supergrid.

dashboards to allow scenario testing for tickers of interest. You are welcome to Register today for an absolutely no obligation 14-day free trial. Analysts' Corner takes advantage of market sentiment and company fundamentals, to objectively target rates of return, rather than make purely qualitative assessments based on imperfect and inappropriate data. Register now to join in the discussions on GE's possible involvement in the hydrogen-electrical supergrid.

Adam Jeffery | CNBC Kevin Murphy, CEO of Acreage Holdings.

Adam Jeffery | CNBC Kevin Murphy, CEO of Acreage Holdings.

BlackRock Inc. increased its holdings in shares of Liberty Sirius XM Group Series C (NASDAQ:LSXMK) by 8.2% in the fourth quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 12,170,640 shares of the technology company’s stock after purchasing an additional 925,302 shares during the quarter. BlackRock Inc. owned 5.66% of Liberty Sirius XM Group Series C worth $450,070,000 as of its most recent filing with the SEC.

BlackRock Inc. increased its holdings in shares of Liberty Sirius XM Group Series C (NASDAQ:LSXMK) by 8.2% in the fourth quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 12,170,640 shares of the technology company’s stock after purchasing an additional 925,302 shares during the quarter. BlackRock Inc. owned 5.66% of Liberty Sirius XM Group Series C worth $450,070,000 as of its most recent filing with the SEC.