This article is expressly not intended to spark a debate on global warming, climate change, melting ice caps, shrinking sea ice, ocean acidification, rising sea levels, cooling of the stratosphere, or any other actual or perceived effects/symptoms of increased and increasing CO2 emissions. This article does assume: (1) it is highly desirable, and a matter of urgency, to limit and reduce CO2 emissions, and other related emissions from fossil fuels, wherever possible; and (2) the best way to achieve that is to concentrate specifically on that task, rather than on endless and futile debates about the effects/symptoms. Despite still comprising relatively low percentages of the total energy mix, renewables are running up against what is termed, "energy curtailment", whereby at times of peak generation they are producing more electricity than the demand at the time. Installing more renewables generation cannot solve this problem, only exacerbate it. At the same time, during periods of low renewables power generation, fossil fuel based power generation is required to maintain power supply. In order to encourage greater investment in renewables generation, there are mandates in place to give preference to "green" power over fossil fuel based power when there is a surplus of availability. This can lead to gas fired and other fossil fuel based power plants being utilised intermittently depending on whether the sun is shining or the wind is blowing. This intermittent use can be by the minute, by the hour, by the day and over long periods. This leads to high maintenance costs as well as low utilisation, which adversely affects the economics of these plants. This is a strong deterrent to investment in newer, high efficiency fossil fuel based generation to replace ageing, low efficiency plants, with high CO2 and other emissions per unit of power generated. The answers to the foregoing issues involve both new and improved electricity grids, enabling wider distribution of excess energy, and a means of storing energy generated in excess of requirements for later use. I believe the most likely form of storing energy will be in the form of hydrogen, produced using excess electricity generated by both renewables, and presently under utilised capacity of high efficiency gas turbines. The Ingrid project in Puglia, Italy is an example of the use of hydrogen to balance out power supply and demand.

GE: Investment ThesisIn a press release on March 14, 2019, General Electric (GE) guided for 2019 adjusted EPS (non-GAAP) of $0.50 to $0.60. In my article, "GE: Culp Brings Simplification And Value Creation, Share Price Will See $20 Before $10", I wrote,

Aviation and the remainder of Healthcare are performing well and can be expected to continue to perform well in the future. It is the Power segment, starting from a very low base, where Culp has the possibility of achieving very large increments in operating profits. It is my belief the markets for Power and Renewable Energy segments' profits have been severely affected by distortions related to the political approach to CO2 emissions. I can see some sanity returning to these markets as the politics are forced to change as reality sets in. I believe GE can have a major role in influencing these necessary changes and can benefit from the changes. Contingent on the politics of CO2 undergoing a change, I can see Power and Renewable Energy segments becoming increasingly profitable, hence my more optimistic outlook on the share price.

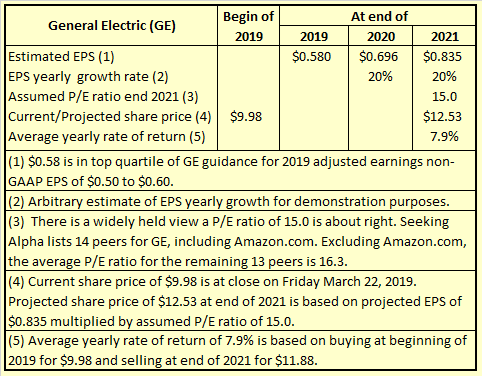

To put the above into perspective, let us assume an above mid-point EPS guidance of $0.58 for 2019. Now, if we simplistically assume the $0.58 will increase by 20% per year through end of 2021, we arrive at 2021 projected EPS of $0.835, which at a 15.0 P/E ratio would give a share price of $12.53 as per TABLE 1 below.

TABLE 1

There is still a considerable degree of actual and perceived risk associated with an investment in GE shares. Buying today at $9.98 for an average return of 7.9% per year, as indicated by TABLE 1, does not appear to be an attractive option. Despite the assumed 20% per year growth rate for EPS, indicating rapid improvement in GE's financial position, it is not nearly enough to justify an investment in GE at the current share price.

Looking At GE Potential EPS Growth From A Different Angle

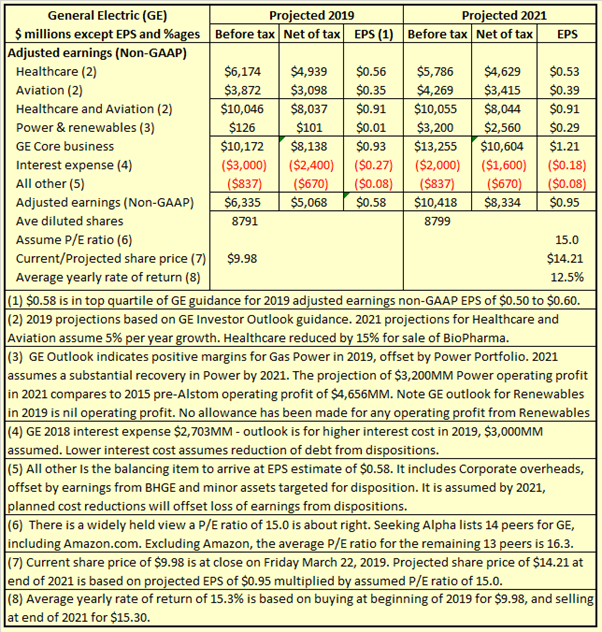

GE provided more comprehensive guidance by segment on March 14, 2019, in the 2019 GE Investor Outlook - Presentation. Utilising assumptions from that presentation, I have compiled TABLE 2 below.

TABLE 2

It is clear from TABLE 2, Power is critical to a turn around for GE. Pre Alstom in 2015, GE Power segment operating profit was $4.656 billion. TABLE 2 shows just getting back to a Power segment operating profit of $3.2 billion by 2021, could see the share price increase to over $14. That does not allow for any operating profit at all from Renewables segment in 2019 or for 2021. Getting Renewables segment back on track and profitable is another significant opportunity for GE. If the politics surrounding CO2 emissions are sorted out, and I expect they will be, I believe an EPS of $0.95 for GE and a share price of $14.21 by end of 2021 could prove incredibly conservative.

The War On CO2 Needs To Be A War On CO2, Not A War On Fossil FuelsSadly, climate activists have focused on an impossible goal of the immediate elimination of fossil fuel for base load electricity generation, rather than exploring every possible means available to actually reduce CO2 emissions. In addition, policies favoring renewable-based electricity over fossil fuel-based electricity, when there is excess supply, has adversely affected the economics of fossil fuel-based electricity, even though both forms of electricity production are essential in the overall mix. The vilification of fossil fuels has resulted in an unwillingness of financiers and operators to invest in new, improved, low emissions, fossil fuel-based power generation technology, including natural gas fired turbines, to replace ageing high emissions plants. I believe these are the major cause of the reduction in markets for GE's Power segment products. I also believe we are reaching a tipping point in the politics surrounding CO2 emissions reduction.

GE: Embracing The Hydrogen GenerationThis article by GE's Chris Noon appeared on January 7, 2019 in "The Hydrogen Generation: These Gas Turbines Can Run On The Most Abundant Element In the Universe". I recommend the article as a must read for any present or intending GE investor. I urge those interested to read the whole article, to see how presently wasted hydrogen emissions from various coke, oil and gas, and other plants, can be easily captured and used in GE gas turbines. In addition, at times of excess electricity generation, this need not be wasted, but can be converted to hydrogen and mixed with natural gas in natural gas pipelines for fuel for gas turbines. These excerpts from the article give some idea of the potential savings in CO2 emissions,

"The Hydrogen Generation: These Gas Turbines Can Run On The Most Abundant Element In the Universe". I recommend the article as a must read for any present or intending GE investor. I urge those interested to read the whole article, to see how presently wasted hydrogen emissions from various coke, oil and gas, and other plants, can be easily captured and used in GE gas turbines. In addition, at times of excess electricity generation, this need not be wasted, but can be converted to hydrogen and mixed with natural gas in natural gas pipelines for fuel for gas turbines. These excerpts from the article give some idea of the potential savings in CO2 emissions,

For example, in both 2015 and 2016, Germany and the U.K. together recorded around 5 terawatt-hours of "curtailed" wind power — electricity that could have been produced but wasn't, due to lack of demand and other factors. That's enough to power all of India for an entire day. But what if all that wasted wind power could instead be used for electrolyzing water, a process that uses an electric current to split water —H2O — into its constituent atoms and generate oxygen and hydrogen. This way, you can have hydrogen, a potent fuel with zero-carbon emissions that has itself been produced by harnessing carbon-free wind power that would otherwise have been wasted.

and

For instance, using a 5 percent blend of hydrogen in the natural gas supply to GE's 9F.03 gas turbine reduces its annual CO2 emissions by nearly 19,000 metric tons. A 50 percent blend saves 281,000 tons, while a 95 percent blend cuts CO2 emissions by a whopping 1.04 million tons. That's equivalent to the annual carbon footprint of nearly 70,000 Americans. "The beauty of these turbines is their fuel flexibility," Goldmeer says. "They're part of the solution."

To put this in perspective, GE has an installed base of 7,000+ gas turbines.

GE: Towards Meaningful CO2 Emissions ReductionIn a previous article, referenced above, I summarised sentiments expressed by Hillary Clinton, "do your best to make what appears impossible possible. But, recognize if there is a gap between expectations and reality, and be inspired to do something about that gap". When that principle is recognized at climate summits, hopefully in the near future, I believe there will be a resurgence in GE's Power segment. This will likely extend beyond coal-fired and gas-fired generation technology, to extension of lives of existing nuclear plants, and construction of new nuclear plants, as well as massive upgrades to electricity grids. And that will result in a reduction in the gap between actual CO2 emissions, and target CO2 emissions. I believe GE must also start to think beyond introducing hydrogen to natural gas lines and investigate building capabilities in the area of pure gaseous and liquid hydrogen storage and distribution, to assist to eliminate CO2 emissions from motor transport. Hydrogen is a far cleaner technology than batteries, which I believe will create huge disposal problems in the future. The more GE can facilitate the conversion of excess electricity generation to hydrogen, the greater the potential utilization of gas power plants and windpower installations. Greater utilization can significantly improve the economics and lead to more sales. At Analysts' Corner, we are currently discussing GE's potential involvement in the hydrogen-electrical supergrid, something that requires the influence of a GE, together with other large corporations, and the cooperation of government, to bring to fruition. It will transform the future for GE, and the whole of the USA, and ultimately the world and its war on CO2 emissions.

If you wish to be notified of future articles, please click "Follow" next to my name at the top of this article.

Or become an Analysts' Corner member. Share investing ideas with a like-minded group. Access 1View∞Scenarios dashboards to allow scenario testing for tickers of interest. You are welcome to Register today for an absolutely no obligation 14-day free trial. Analysts' Corner takes advantage of market sentiment and company fundamentals, to objectively target rates of return, rather than make purely qualitative assessments based on imperfect and inappropriate data. Register now to join in the discussions on GE's possible involvement in the hydrogen-electrical supergrid.

dashboards to allow scenario testing for tickers of interest. You are welcome to Register today for an absolutely no obligation 14-day free trial. Analysts' Corner takes advantage of market sentiment and company fundamentals, to objectively target rates of return, rather than make purely qualitative assessments based on imperfect and inappropriate data. Register now to join in the discussions on GE's possible involvement in the hydrogen-electrical supergrid. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. I do not recommend that anyone act upon any investment information without first consulting an investment advisor and/or a tax advisor as to the suitability of such investments for their specific situation. Neither information nor any opinion expressed in this article constitutes a solicitation, an offer, or a recommendation to buy, sell, or dispose of any investment, or to provide any investment advice or service. An opinion in this article can change at any time without notice.

No comments:

Post a Comment