DELAFIELD, Wis. (Stockpickr) -- Short-sellers hate being caught short a stock that reports a blowout quarter. When this happens, we often see a tradable short squeeze develop as the bears rush to cover their positions to avoid big losses. Even the best short-sellers know that it's never a great idea to stay short once a bullish earnings report sparks a big short-covering rally.

Read More: 5 Stocks Poised for Big Breakouts

This is why I scan the market for heavily shorted stocks that are about to report earnings. You only need to find a few of these stocks in a year to help enhance your portfolio returns -- the gains become so outsized in such a short time frame that your profits add up quickly.

That said, let's not forget that stocks are heavily shorted for a reason, so you have to use trading discipline and sound money management when playing earnings short-squeeze candidates. It's important that you don't go betting the farm on these plays and that you manage your risk accordingly. Sometimes the best play is to wait for the stock to break out following the report before you jump in to profit off a short squeeze. This way, you're letting the trend emerge after the market has digested all of the news.

Of course, sometimes the stock is going to be in such high demand that you risk missing a lot of the move by waiting. That's why it can be worth betting prior to the report -- but only if the stock is acting technically very bullish and you have a very strong conviction that it is going to rip higher. Just remember that even when you have that conviction and have done your due diligence, the stock can still get hammered if Wall Street doesn't like the numbers or guidance.

If you do decide to bet ahead of a quarter, then you might want to use options to limit your capital exposure. Heavily shorted stocks are usually the names that make the biggest post-earnings moves and have the most volatility. I personally prefer to wait until all the earnings-related news is out for a heavily shorted stock and then jump in and trade the prevailing trend.

With that in mind, here's a look at several stocks that could experience big short squeezes when they report earnings this week.

Read More: 5 Low-Priced Stocks to Trade for Big Gains

Layne Christensen

My first earnings short-squeeze trade idea is water management, construction and drilling services player Layne Christensen (LAYN), which is set to release numbers on Tuesday before the market open. Wall Street analysts, on average, expect Layne Christensen to report revenue of $217.17 million on a loss of 49 cents per share.

The current short interest as a percentage of the float for Layne Christensen is extremely high at 16.3%. That means that out of the 19.45 million shares in the tradable float, 3.17 million shares are sold short by the bears. This is a high short interest on a stock with a very low tradable float. Any bullish earnings news could easily spark a sharp short-covering rally that forces the bears to start covering some of their positions.

From a technical perspective, LAYN is currently trending above its 50-day moving average and well below its 200-day moving average, which is neutral trendwise. This stock has been uptrending a bit over the last month, with shares moving higher off its 52-week low of $10.10 to its recent high of $11.80 a share. During that uptrend, shares of LAYN have been making mostly higher lows and higher highs, which is bullish technical price action. Shares of LAYN have now started to move back above its 50-day moving average and it's quickly moving within range of triggering a big breakout trade post-earnings.

If you're bullish on LAYN, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $11.80 to $12.68 a share with high volume. Look for volume on that move that hits near or above its three-month average volume of 221,491 shares. If that breakout triggers post-earnings, then LAYN will set up to re-test or possibly take out its next major overhead resistance levels at $13.93 to $15.50 a share.

I would simply avoid LAYN or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below some near-term support levels at $10.81 to $10.63 a share and then below its 52-week low of $10.10 a share with high volume. If we get that move, then LAYN will set up to enter new 52-week-low territory, which is bearish technical price action. Some possible downside targets off that move are $9 to $8 a share.

Read More: 12 Stocks Warren Buffett Loves in 2014

Triangle Petroleum

Another potential earnings short-squeeze play is independent oil and gas player Triangle Petroleum (TPLM), which is set to release its numbers on Monday after the market close. Wall Street analysts, on average, expect Triangle Petroleum to report revenue $119.29 million on earnings of 16 cents per share.

The current short interest as a percentage of the float for Triangle Petroleum is extremely high at 15.4%. That means that out of the 75.23 million shares in the tradable float, 11.64 million shares are sold short by the bears. The bears have also been increasing their bets from the last reporting period by 16.2%, or by 1.62 million shares. If the bears get caught pressing their bets into a bullish quarter, then shares of TPLM could easily rip sharply higher post-earnings as the shorts rush to cover some of their positions.

From a technical perspective, TPLM is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been trending sideways and consolidating for the last two months and change, with shares moving between $10.15 on the downside and $12.48 on the upside. Shares of TPLM have now started to move back above its 50-day moving average and it's starting to push within range of triggering a big breakout trade post-earnings above the upper-end of recent sideways trading chart pattern.

If you're in the bull camp on TPLM, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $12.14 a share to its 52-week high at $12.48 a share with high volume. Look for volume on that move that hits near or above its three-month average volume of 1.35 million shares. If that breakout materializes post-earnings, then TPLM will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that move are $15 to $17 a share.

I would simply avoid TPLM or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below its 50-day moving average of $11.39 a share with high volume. If we get that move, then TPLM will set up to re-test or possibly take out its next major support levels at $10.68 to $10.15 a share, or its 200-day moving average of $9.72 a share.

Read More: Warren Buffett's Top 10 Dividend Stocks

Vera Bradley

Another potential earnings short-squeeze candidate is retailer of functional accessories for women Vera Bradley (VRA), which is set to release numbers on Wednesday before the market open. Wall Street analysts, on average, expect Vera Bradley to report revenue of $116.78 million on earnings of 19 cents per share.

The current short interest as a percentage of the float for Vera Bradley is extremely high at 40.8%. That means that out of the 21.83 million shares in the tradable float, 8.9 million shares are sold short by the bears. The bears have also been increasing their bets from the last reporting period by 4.4%, or by 373,000 shares. If the bears get caught pressing their bets into a strong quarter, then shares of VRA could easily trend sharply higher post-earnings as the shorts move to cover some of their positions.

From a technical perspective, VRA is currently trending above its 50-day moving average and just below its 200-day moving average, which neutral trendwise. This stock recently formed a double bottom chart pattern at $18.92 to $18.75 a share. Following that bottom, shares of VRA have started to uptrend, with the stock moving higher from its low of $18.75 to its intraday high of $22.80 a share. That move has now pushed shares of VRA within range of triggering a near-term breakout trade post-earnings.

If you're bullish on VRA, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $23 a share to its 200-day moving average of $24.32 a share with high volume. Look for volume on that move that registers near or above its three-month average action of 457,581 shares. If that breakout begins post-earnings, then VRA will set up to re-test or possibly take out its next major overhead resistance levels at $28 to its 52-week high at $30 a share. Any high-volume move above $30 will then give VRA a chance to trend well north of that level.

I would avoid VRA or look for short-biased trades if after earnings it fails to trigger that breakout and then drops back below its 50-day moving average of $20.46 a share to more near-term support at $19.75 a share with high volume. If we get that move, then VRA will set up to re-test or possibly take out its next major support levels at $18.75 to its 52-week low of $17.27 a share.

Read More: 10 Stocks Carl Icahn Loves in 2014

Titan Machinery

Another earnings short-squeeze prospect is full service agricultural and construction equipment stores operator Titan Machinery (TITN), which is set to release numbers on Tuesday before the market open. Wall Street analysts, on average, expect Titan Machinery to report revenue of $442.37 million on earnings of 10 cents per share.

The current short interest as a percentage of the float for Titan Machinery is extremely high at 28.8%. That means that out of the 16.98 million shares in the tradable float, 4.90 million shares are sold short by the bears. The bears have also been increasing their bets from the last reporting period by 2.2%, or by 107,000 shares. If the bears get caught pressing their bets into a strong quarter, then shares of TITN could easily rip sharply higher post-earnings as the shorts rush to cover some of their trades.

From a technical perspective, TITN is currently trending below both its 50-day and 200-day moving averages, which is bearish. This stock has been downtrending badly for the last three months, with shares moving lower from its high of $18.25 to its recent low of $12.12 a share. During that downtrend, shares of TITN have been consistently making lower high and lower lows, which is bearish technical price action. That said, shares of TITN have now started to rebound modestly off that $12.12 low and it could be setting up for a rebound trade post-earnings off oversold levels.

If you're bullish on TITN, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $14 to $14.73 a share with high volume. Look for volume on that move that hits near or above its three-month average action of 161,872 shares. If that breakout starts post-earnings, then TITN will set up to re-test or possibly take out its next major overhead resistance levels at $16.50 to $18.25 a share.

I would simply avoid TITN or look for short-biased trades if after earnings it fails to trigger that breakout and then takes out its 52-week low of $12.12 a share with high volume. If we get that move, then TITN will set up to enter new 52-week-low territory, which is bearish technical price action. Some possible downside targets off that move are $9 to $8 a share.

Read More: 10 Stocks Billionaire John Paulson Loves in 2014

Francesca's

My final earnings short-squeeze play is retail boutiques chain operator Francesca's (FRAN), which is set to release numbers on Tuesday before the market open. Wall Street analysts, on average, expect Francesca's to report revenue of $99.78 million on earnings of 26 cents per share.

The current short interest as a percentage of the float for Francesca's is very high at 17.8%. That means that out of the 41.85 million shares in the tradable float, 7.46 million shares are sold short by the bears. If the bulls get the earnings news they're looking for, then shares of FRAN could easily rip sharply higher post-earnings as the bears rush to cover some of their bets.

From a technical perspective, FRAN is currently trending above its 50-day moving average and well below its 200-day moving average, which is neutral trendwise. This stock recently formed a double bottom chart pattern at $12.39 to $12.45 a share. Following that bottom, shares of FRAN have started to uptrend, with the stock moving higher from $12.45 to its recent high of $14.90 a share. Shares of FRAN are now starting to trend within range of triggering a major breakout trade above some key near-term overhead resistance levels post-earnings.

If you're in the bull camp on FRAN, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $14.90 to $15.69 a share with high volume. Look for volume on that move that registers near or above its three-month average action of 1.01 million shares. If that breakout develops post-earnings, then FRAN will set up to re-test or possibly take out its next major overhead resistance levels at $17.34 to $19.97 a share.

I would avoid FRAN or look for short-biased trades if after earnings it fails to trigger that breakout, and then drops back below some key near-term support at $13.17 a share with high volume. If we get that move, then FRAN will set up to re-test or possibly take out its 52-week low of $12.39 a share. Any high-volume move below that level will then push shares of FRAN into new 52-week-low territory, which is bearish technical price action.

To see more potential earnings short squeeze plays, check out the Earnings Short-Squeeze Plays portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Rocket Stocks Ready for Blastoff This Week

>>Must-See Charts: How to Trade 5 Huge Stocks

>>5 Breakout Stocks Under $10 Set to Soar

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com.

You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

LONDON (CNNMoney) Europe's top regulator has accused Ireland of striking a deal with Apple back in 1991 that helped the tech giant artificially lower its tax bill for more than 20 years.

LONDON (CNNMoney) Europe's top regulator has accused Ireland of striking a deal with Apple back in 1991 that helped the tech giant artificially lower its tax bill for more than 20 years.  ChinaFotoPress/Getty ImagesEmployees cheer at Alibaba headquartes in China as its stock debuts in New York. At $231 billion, Alibaba Group (BABA) closed Friday with more than twice the market cap of Facebook (FB), three times that of eBay (EBAY), and about 50 percent more than Amazon.com (AMZN). For founder Jack Ma, the run-up means he's now worth more than $20 billion, according to Forbes' estimates. Yahoo (YHOO), meanwhile, is now sitting on a stake that was worth more than $49 billion the day of the initial public offiering -- about $10 billion more than its current market cap.

ChinaFotoPress/Getty ImagesEmployees cheer at Alibaba headquartes in China as its stock debuts in New York. At $231 billion, Alibaba Group (BABA) closed Friday with more than twice the market cap of Facebook (FB), three times that of eBay (EBAY), and about 50 percent more than Amazon.com (AMZN). For founder Jack Ma, the run-up means he's now worth more than $20 billion, according to Forbes' estimates. Yahoo (YHOO), meanwhile, is now sitting on a stake that was worth more than $49 billion the day of the initial public offiering -- about $10 billion more than its current market cap. Apple's new Health app in action. NEW YORK (CNNMoney) The life insurance industry may have a new tool to help determine rates for customers: the iPhone.

Apple's new Health app in action. NEW YORK (CNNMoney) The life insurance industry may have a new tool to help determine rates for customers: the iPhone.  How China's iPhone 6 black market works

How China's iPhone 6 black market works

Watch this 3D printer print makeup NEW YORK (CNNMoney) Can't afford your own 3-D printer? Just head to the UPS Store.

Watch this 3D printer print makeup NEW YORK (CNNMoney) Can't afford your own 3-D printer? Just head to the UPS Store.  Foot traffic is down at Pier 1 stores. NEW YORK (CNNMoney) Pier 1 Imports is the latest retailer to disappoint Wall Street.

Foot traffic is down at Pier 1 stores. NEW YORK (CNNMoney) Pier 1 Imports is the latest retailer to disappoint Wall Street.  Sears 'irrelevant' as losses deepen

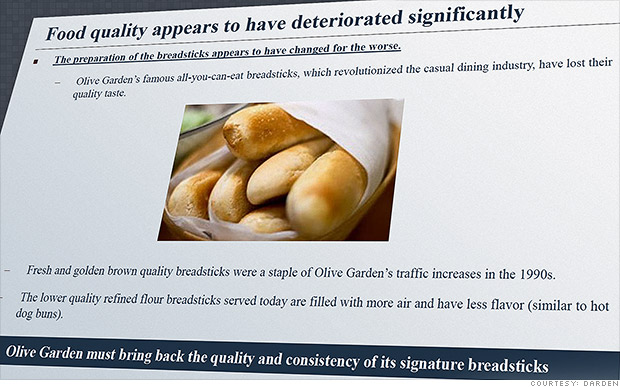

Sears 'irrelevant' as losses deepen  Mangia? Olive Garden investor wants better food NEW YORK (CNNMoney) Olive Garden is trying to attract more customers with a bold publicity stunt: a limited time only Never Ending Pasta pass that quickly sold out and started showing up for sale on eBay.

Mangia? Olive Garden investor wants better food NEW YORK (CNNMoney) Olive Garden is trying to attract more customers with a bold publicity stunt: a limited time only Never Ending Pasta pass that quickly sold out and started showing up for sale on eBay.

$2.1B for coconut shrimp? Red Lobster sold

$2.1B for coconut shrimp? Red Lobster sold  Getty ImagesWhile you should hold off on purchasing some types of insurance, investing in homeowners and auto insurance is a good idea.

Getty ImagesWhile you should hold off on purchasing some types of insurance, investing in homeowners and auto insurance is a good idea.