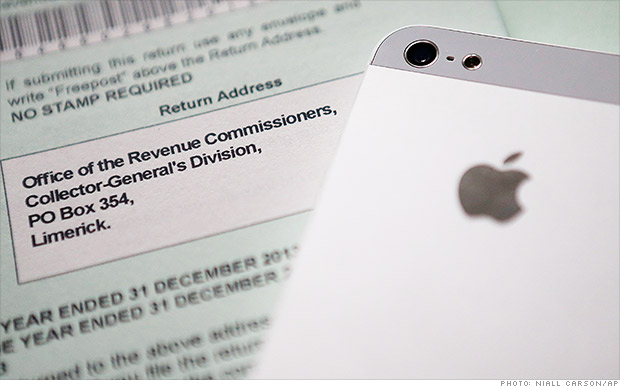

LONDON (CNNMoney) Europe's top regulator has accused Ireland of striking a deal with Apple back in 1991 that helped the tech giant artificially lower its tax bill for more than 20 years.

LONDON (CNNMoney) Europe's top regulator has accused Ireland of striking a deal with Apple back in 1991 that helped the tech giant artificially lower its tax bill for more than 20 years. The European Commission published details of its case Tuesday after announcing in June that it was probing tax arrangements between Apple (AAPL, Tech30) and Ireland, and Starbucks (SBUX) and the Netherlands.

Apple has paid as little as 2% on profits attributed to its subsidiaries in Ireland, where the top rate of corporate tax is 12.5%.

The European Union's investigation continues, and Apple will have a chance to challenge the allegations. But if the EU concludes that the tax deal broke rules on state aid, Ireland will have to recover billions of dollars in tax owed by Apple.

The Irish government says it did not break the law on state aid and has addressed "misunderstandings" with the European Commission.

"Ireland welcomed that opportunity to clarify important issues about the applicable tax law in this case and to explain that the company concerned did not receive selective treatment and was taxed fully in accordance with the law," said the Irish finance department in a statement Monday.

Apple said in June that it had paid everything it owed, and that its taxes in Ireland had increased tenfold since the launch of the iPhone in 2007.

The European Commission will release details of its case against Starbucks soon.

No comments:

Post a Comment