Editors' Note: This article discusses micro-cap stocks. Please be aware of the risks associated with these stocks.

PennWest (PWE), a Canadian oil and gas producer, has been underperforming due to poor asset management. In the last one year, the return on its stock is negative 15%. However, PennWest has laid down some concrete plans to usher its revival. The company has focused on the development of its acreage in the Cardium and Viking formations. With plans in place for development and production increase from these formations, we believe PennWest provides significant opportunity of growth for its investors.

Cardium Trend transitions

PennWest has around 600,000 net acres in the Cardium Trend in the Alberta region. The Cardium Trend formation lies beneath the Western Canadian Sedimentary Basin and contains reserves of oil and natural gas. The Cardium Trend formation stretches between the Canadian provinces of Alberta and British Columbia. The locations where Penn West is focusing to develop the Cardium Trend are Alder Flats, Lodgepole, and Crimson Lake. According to a study by Deloitte, the contingent reserve in the area under PennWest is around 1,007,721 million barrels of oil equivalent, or mboe. Contingent reserve is an estimation of the amount of petroleum that could be recovered and could be commercially developed.

PennWest is planning to increase the oil extraction from the Cardium Trend formation by increasing the use of secondary oil production techniques. Secondary recovery techniques happen after primary recovery techniques. Primary recovery techniques happen where hydrocarbons naturally rise to the surface. In the case of secondary production techniques, oil and natural gas are lifted by injecting water or gas into the wells and to increase reservoir productivity.

In the first half of this year, PennWest completed wells at selective places in the Alder Flats area using "slick water fracture" techniques, which resulted in more than 30% of well cost sav! ing over the first half of the previous year. The company plans on multiple programs in the region. "Slick water fracturing" techniques use a solution for fracturing layers by using fluids, which contains around 99.5% water and the rest is chemical added to the water to reduce friction, corrosion, and bacterial growth. Slick water fracturing results in fast and economic drilling because of injecting fluid into the well bore at high speed.

As the company has already tested well drilling capabilities in the Cardium Trend formation, it will give the company a better position to drill additional wells in the formation and increase its productivity. The company has around 3,000 net unrisked locations in the Cardium formation. Net unrisked locations refer to the total number of locations, including the ones where PennWest has partial interest, where production of oil and natural gas can be achieved. To exploit the potential of this region, PennWest is carrying out three water flood projects in the Cardium Trend by the end of this year. Water flooding is a secondary production technique to extract petroleum in which water is used to create pressure inside the reservoirs and extract petroleum. We expect that the water flood projects will continue to drive down well drilling and completion costs by the end of this year.

One of the major players in the Cardium formation is Bonterra Energy Corporation (OTC:BNEYF). The company has around 193.7 net sections in the Cardium formation with proved and probable reserves of around 70.5 mboe. Net sections are the total number of sections in a region that the company holds, including the ones in which the company has partial interests. In order words, it denotes the net operating area for a company that includes both productive and unproductive locations. The company plans to produce around an average of 12,000 boepd this year. The company produces around 75% oil and 25% of gas from the Cardium reservoirs with operating costs of around $13 per barrel o! f oil equ! ivalent, or BOE. With WTI prices around $100 per barrel, this results in a very high netback for the company. Netback measures the profit on a barrel when sold. During the second quarter ending in June, the company realized a netback of $43.52 per boe, which was a 15% increase quarter over quarter.

Playing in the Viking

PennWest is also focusing on growth from its Viking formation acreage. The Viking formation also lies in the Western Canadian Sedimentary Basin and stretches between Alberta and Saskatchewan. PennWest has around 822,680 gross acres in this region with around 1,000 net sections. According to the same study by Deloitte, the acreage owned by PennWest in the Viking play has a contingent reserve of around 170,997 mboe.

PennWest also plans to drill around 50 wells- 60 wells in this region by the end of this year. According to a study by the National Energy Board, or NEB, the depth of the Viking formation ranges between 600m to 900m; this is shallower than the other formations, which are found at depths more than 800m. We believe that the shallower depth of the Viking formation will lead to a lesser cost of well drilling due to the lower depth, which will be beneficial for the company. Also, the Viking formation has been reported to have around 9 million barrels of oil. The comparative low cost of drilling with a significant reserve will provide a platform for future growth to the company. The cost of a well in the Viking formation is around $1 million. The company estimates its drill completion equipment and tie-in cost of a well is around $1.1 million. At this, the well costs of PennWest are competitive with the market.

PennWest plans to continue with its primary recovery techniques as well as start with secondary production techniques in the Viking formation. Similar to its Cardium Trend plans, the company will initiate water flooding techniques in the Viking formation. We believe that the company's plan of a gradual transition into secondary production techniques wil! l help it! enhance its production from the Viking play over the coming quarters.

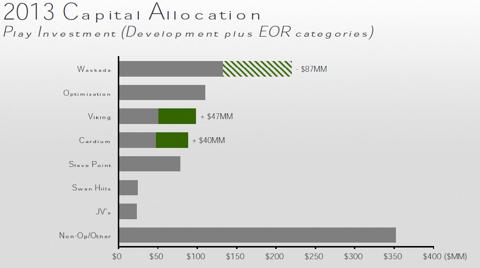

Looking at the potential of the two plays, we believe that it will provide PennWest with substantial room for growth. The company has reallocated it capital expenditure in the Cardium Trend as well as in the Viking Play. It has allocated around an additional $47 million in the Viking Play and $40 million in the Cardium Trend. This is as shown in the graph below:

(click to enlarge)

The capital reallocation will thus provide a boost to the development and production plans in both the Cardium Trend and Viking formations. We feel the company is allocating its capital more efficiently, which would result into better returns.

A focused player in the Viking formation is Raging River Exploration (OTC:RRENF). The company has a significant position in the Viking formation with around 84,000 net acres of land and around 600 net drilling locations. The company is focused on producing light oil from the Viking play. Raging River Exploration has already drilled around 100 wells out of the 140 wells it has planned for this year. The company increased its capital expenditure in this region from around $20 million to around $145 million for this year. With an increase in capital spending, the company has also increased the production target from this region around 4,850 barrels of oil equivalent per day, boepd, to around 5150 boepd, and around 95% of the production is oil.

Showing positive signals

PennWest currently has a return on asset, or ROA, of negative 1.41%, and its return on equity, or ROE, is around negative 2.90%. Though both ratios indicate a negative return, we believe that this is only transitional. On a medium to long-term basis, the company will reverse its revenue trend. As we have discussed PennWest's assets in the Cardium formation and in the Viking formation, which hold significant reserves for supp! orting pr! oduction growth. Additionally, PennWest has laid down plans to implement secondary production techniques to increase the productivity from its reserves. With further reallocation of capital in the Cardium and the Viking formation, the company has expedited the process of development in these two formations. We believe PennWest is looking for a turnaround of its returns from these assets.

Source: Now Is The Time To Buy PennWestDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Fusion Research is a team of equity analysts. This article was written by Madhu Dube, one of our research analysts. We did not receive compensation for this article (other than from Seeking Alpha), and we have no business relationship with any company whose stock is mentioned in this article.

No comments:

Post a Comment