BALTIMORE (Stockpickr) -- Put down the 10-K filings and the stock screeners. It's time to take a break from the traditional methods of generating investment ideas. Instead, let the crowd do it for you.

>>5 Hated Earnings Stocks You Should Love

From hedge funds to individual investors, scores of market participants are turning to social media to figure out which stocks are worth watching. It's a concept that's known as "crowdsourcing," and it uses the masses to identify emerging trends in the market.

Crowdsourcing has long been a popular tool for the advertising industry, but it also makes a lot of sense as an investment tool. After all, the market is completely driven by the supply and demand, so it can be valuable to see what names are trending among the crowd.

While some fund managers are already trying to leverage social media resources like Twitter to find algorithmic trading opportunities, for most investors, crowdsourcing works best as a starting point for investors who want a starting point in their analysis. Today, we'll leverage the power of the crowd to take a look at some of the most active stocks on the market today.

>>Where's the S&P Headed From Here? Higher!

These "most active" names are the most heavily-traded names on the market -- and often, uber-active names have some sort of a technical or fundamental catalyst driving investors' attention on shares. That's especially true now that earnings season is officially underway. And when there's a big catalyst, there's often a trading opportunity.

Without further ado, here's a look at today's stocks.

Corning

Nearest Resistance: $17.50

Nearest Support: $17

Catalyst: Technical Setup

>>5 Stocks With Big Insider Buying

Shares of glassmaker Corning (GLW) are working to hold $17 support after an outlook miss for the first quarter shoved shares lower last week. For now, GLW seems to be able to catch a bid at that $17 price level, but for buyers looking for an opportunity to get into this name, it makes sense to wait for a move through $17.50. That's a show of strength that will indicate buyers have regained control of shares.

Until then, Corning is a fundamental bargain that's looking technically weak at the moment.

Cisco Systems

Nearest Resistance: $22.50

Nearest Support: $20.50

Catalyst: Downgrade

>>5 Big Trades to Profit During the Fed's QE Pay Cut

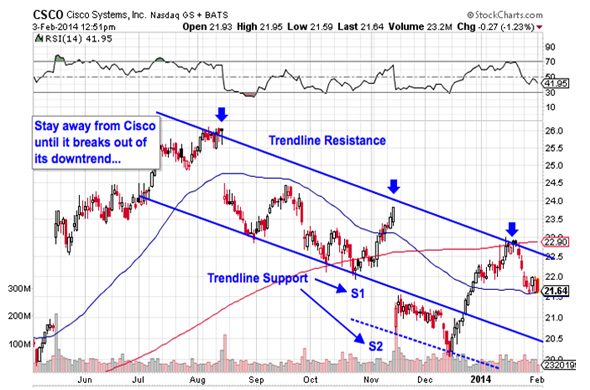

Cisco Systems (CSCO) is trading lower this afternoon after a downgrade from JPMorgan. Shares are down 1.25% on high volume this afternoon, an amount that's really not game-changing for shares. Cisco's chart has been hugely bearish since this past summer – so while today's trading session doesn't change anything, it's far from a buying opportunity.

In fact, Cisco has been in a textbook downtrending channel since late July, and shares have been swatted lower on every test of trendline resistance. I'd recommend staying away from the long side of Cisco until it breaks out of the downtrend. There isn't a trade to be made here.

Ariad Pharmaceuticals

Nearest Resistance: $10

Nearest Support: $6

Catalyst: Technical Setup

>>4 Health Care Stocks Under $10 to Watch

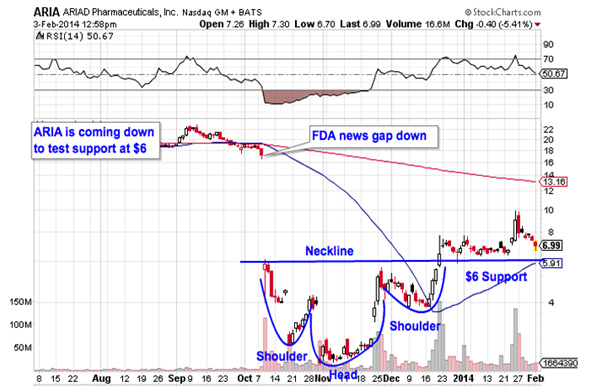

Ariad Pharmaceuticals (ARIA) has been a supremely volatile name ever since FDA concerns shoved shares dramatically lower back in October. Since then, ARIA has looked pretty bullish. A deep inverse head and shoulders pattern in shares broke out in late December, triggering a buy at $6 that ultimately moved up to $10. Now shares are coming back down on high volume to re-test support at $6.

If shares can catch a bid at that support level, expect a tradable bounce higher. Don't try to anticipate the support bounce. Instead, react to it, which will ensure that buying pressure exists at $6 before you put cash on this trade.

It's important to remember that ARIA's price action is made up of some big swings. Even a small day can yield some big performance. But I'd recommend that novice traders avoid this name for the same reasons.

To see these stocks in action, check out the at Most-Active Stocks portfolio on Stockpickr.

-- Written by Jonas Elmerraji in Baltimore.

RELATED LINKS:

>>3 Stocks Spiking on Unusual Volume

>>5 Short-Squeeze Stocks That Could Pop in February

>>2 Stocks Under $10 Moving Higher

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Jonas Elmerraji, CMT, is a senior market analyst at Agora Financial in Baltimore and a contributor to

TheStreet. Before that, he managed a portfolio of stocks for an investment advisory returned 15% in 2008. He has been featured in Forbes , Investor's Business Daily, and on CNBC.com. Jonas holds a degree in financial economics from UMBC and the Chartered Market Technician designation.Follow Jonas on Twitter @JonasElmerraji

No comments:

Post a Comment