DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for $10 a share or less don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

>>5 Blue-Chip Stocks to Trade for Gains: Must-See Charts

Just take a look at some of the big movers in the under-$10 complex from Thursday, including New Concept Energy (GBR), which is exploding higher by 29%; Golden Minerals (AUMN), which is ripping to the upside by 27%; StemCells (STEM), which is soaring higher by 20%; and Swisher Hygiene (SWSH), which is moving up by 17%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

One low-priced stock that's ripping to the upside today is American Apparel (APP), which I highlighted in May 30's "5 Stocks Ready to Break Out" at around 60 cents per share. I mentioned in that piece that shares of American Apparel were starting to bounce higher right off its 50-day moving average. That bounce was starting to push shares of APP within range of triggering a big breakout trade above a key downtrend line that was acting as resistance for over a month.

>>5 Stocks With Big Insider Buying

Guess what happened? Shares of American Apparel finally triggered that breakout today after the stock consolidated and hug its 50-day moving average for a few weeks. This stock spiked sharply higher at the open tagging an intraday high of 78 cents per share with massive upside volume. That represents a large gain of 30% for anyone who bought this stock at around 60 cents per share in anticipation of that breakout. As you can see, trading small-cap stocks can lead to massive profits in a very short timeframe.

Traders should continue to watch shares of APP here, since this stock could still be in the early stages of making a much larger move to the upside. The next key resistance levels to watch for a potential breakout trade are at today's intraday high of 81 cents to more resistance at 82 cents per share.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

>>5 Stocks Set to Soar on Bullish Earnings

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

Himax Technologies

One under-$10 semiconductor player that's starting to move within range of triggering a near-term breakout trade is Himax Technologies (HIMX), which provides display imaging processing technologies to consumer electronics worldwide. This stock has been destroyed by the sellers so far in 2014, with shares off sharply by 54%.

>>4 Big Stocks to Trade (or Not)

If you glance at the chart for Himax Technologies, you'll notice that this stock has been downtrending badly for the last three months and change, with shares falling from its high of $16.08 to its recent low of $5.89 a share. During that downtrend, shares of HIMX have been making mostly lower highs and lower lows, which is bearish technical price action. That said, shares of HIMX have now started to rebound a bit off that $5.89 low and it's starting to push within range of triggering a near-term breakout trade.

Traders should now look for long-biased trades in HIMX if it manages to break out above some near-term overhead resistance levels at $6.80 to $7.05 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average action of 6.86 million shares. If that breakout gets underway soon, then HIMX will set up to re-test or possibly take out its next major overhead resistance levels at its 50-day moving average of $7.74 a share to $8.04 a share. Any high-volume move above those levels will then give HIMX a chance to tag $9 to $9.50 a share.

Traders can look to buy HIMX off weakness to anticipate that breakout and simply use a stop that sits right around some key near-term support levels at $6.12 to $5.89 a share. One can also buy HIMX off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Imris

Another under-$10 health care player that's starting to move within range of triggering a near-term breakout trade is Imris (IMRS), which designs, manufactures and sells image-guided therapy solutions that enable surgeons to obtain information and make decisions during the course of procedures. This stock has been slammed hard by the bears so far in 2014, with shares off sharply by 31%.

>>3 Big-Volume Stocks to Trade for Breakouts

If you take a look at the chart for Imris, you'll see that this stock has been downtrending badly for the last three months and change, with shares moving lower from its high of $2.90 to its recent low of 79 cents per share. During that downtrend, shares of IMRS have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of IMRS have now started to rebound sharply higher off that 79 cents per share low and it's now starting to move within range of triggering a near-term breakout trade.

Market players should now look for long-biased trades in IMRS if it manages to break out above its 50-day moving average of $1.16 a share and then once it takes out some more key overhead resistance at $1.20 a share with high volume. Look for a sustained move or close above those levels with volume that registers near or above its three-month average volume of 271,398 shares. If that breakout materializes soon, then IMRS will set up to re-test or possibly take out its next major overhead resistance levels at $1.33 to $1.52 a share, or even its 200-day moving average of $1.59 a share.

Traders can look to buy IMRS off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support at $1 a share. One can also buy IMRS off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Bebe Stores

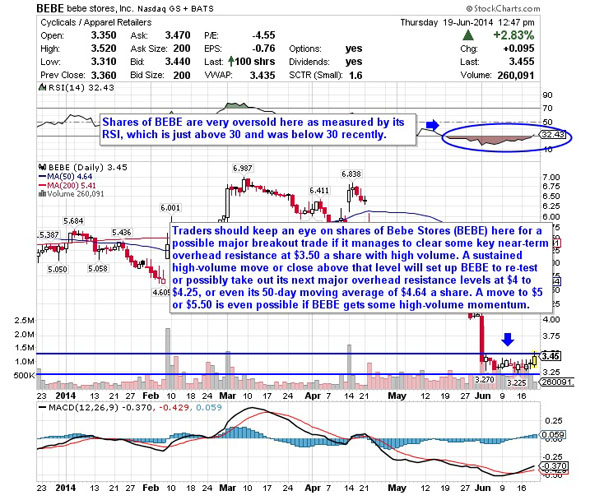

One under-$10 apparel stores player that's starting to move within range of triggering a major breakout trade is Bebe Stores (BEBE), which designs, develops and produces a line of women's apparel and accessories. This stock has been destroyed by the sellers over the last three months, with shares down huge by 47%.

>>4 Stocks Under $10 to Trade for Breakouts

If you take a glance at the chart for Bebe Stores, you'll see that this stock has been downtrending badly for the last two months and change, with shares moving lower from its high of $6.84 to its recent low of $3.22 a share. During that downtrend, shares of BEBE have been consistently making lower highs and lower lows, which is bearish technical price action. That said, shares of BEBE have started to consolidate and trend sideways over the last few weeks and this stock is now starting to push within range of triggering a major breakout trade.

Traders should now look for long-biased trades in BEBE if it manages to break out above some key near-term overhead resistance at $3.50 a share with high volume. Look for a sustained move or close above that level with volume that hits near or above its three-month average volume of 456,428 shares. If that breakout hits soon, then BEBE will set up to re-test or possibly take out its next major overhead resistance levels at $4 to $4.25, or even its 50-day moving average of $4.64 a share. A move to $5 or $5.50 is even possible if BEBE gets some high-volume momentum.

Traders can look to buy BEBE off weakness to anticipate that breakout and simply use a stop that sits right below its 52-week low of $3.22 a share. One can also buy BEBE off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Orbcomm

Another under-$10 data communications player that's starting to trend higher and move within range of triggering a big breakout trade is Orbcomm (ORBC), which provides machine-to-machine communication solutions primarily in the U.S., Japan and the Middle East. This stock has is down notably over the last three months, with shares off by 12%.

>>5 Toxic Stocks You Should Sell This Summer

If you look at the chart for Orbcomm, you'll see that this stock has been uptrending a bit over the last two months, with shares moving higher from its low of $5.68 to its recent high of $6.77 a share. During that uptrend, shares of ORBC have been making mostly higher lows and higher highs, which is bullish technical price action. Shares of ORBC are now starting to spike higher today right off both its 50-day and 200-day moving averages. That spike is starting to push shares of ORBC within range of triggering a big breakout trade above some key near-term overhead resistance levels.

Market players should now look for long-biased trades in ORBC if it manages to break out above some near-term overhead resistance levels at $6.57 to $6.77 a share and then once it takes out more resistance levels at $6.80 to $7.01 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 185,998 shares. If that breakout begins soon, then ORBC will set up to re-test or possibly take out its next major overhead resistance levels at $8 to its 52-week high at $8.21 a share.

Traders can look to buy ORBC off weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $6.16 or at $6 a share. One can also buy ORBC off strength once it starts to move above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Unwired Planet

One final under-$10 application software player that looks ready to trigger a major breakout trade is Unwired Planet (UPIP), which develops patents that allow mobile devices to connect to the Internet. This stock has been red hot so far in 2014, with shares up a whopping 65%.

If you take a glance at the chart for Unwired Planet, you'll notice that this stock has been uptrending over the last month and change, with shares moving higher from its low of $1.95 to its recent high of $2.38 a share. During that uptrend, shares of UPIP have been consistently making higher lows and higher highs, which is bullish technical price action. Shares of UPIP are now starting to spike higher right above its 50-day moving average and it's quickly moving within range of triggering a major breakout trade above some key near-term overhead resistance levels.

Traders should now look for long-biased trades in UPIP if it manages to break out above some near-term overhead resistance levels at $2.38 to its 52-week high of $2.44 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 1.10 million shares. If that breakout kicks off soon, then UPIP will set up to enter new 52-week-high territory, which is bullish technical price action. Some possible upside targets off that breakout are $3 to $3.50 a share, or even $4 a share.

Traders can look to buy UPIP off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support levels at $2.12 to $2.05 a share, or even $2 a share. One can also buy UPIP off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>5 Retail Stocks to Trade for Gains in June

>>5 Stocks Poised for Breakouts

>>Move Into Hedge Funds' 5 Favorite REITs This Summer

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.

No comments:

Post a Comment