Fastenal (Nasdaq: FAST ) is expected to report Q2 earnings around July 10. Here's what Wall Street wants to see:

The 10-second takeaway

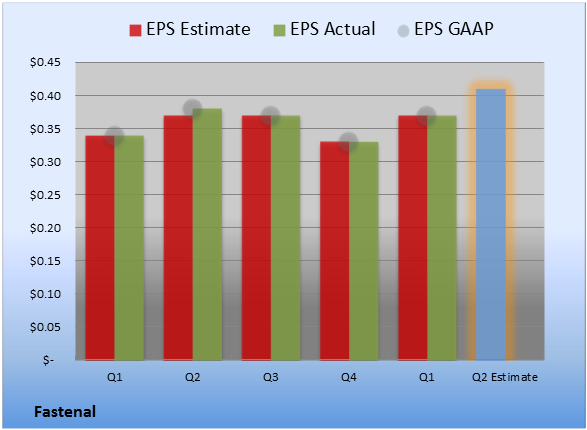

Comparing the upcoming quarter to the prior-year quarter, average analyst estimates predict Fastenal's revenues will increase 6.5% and EPS will grow 7.9%.

The average estimate for revenue is $857.1 million. On the bottom line, the average EPS estimate is $0.41.

Revenue details

Last quarter, Fastenal reported revenue of $806.3 million. GAAP reported sales were 4.9% higher than the prior-year quarter's $768.9 million.

Source: S&P Capital IQ. Quarterly periods. Dollar amounts in millions. Non-GAAP figures may vary to maintain comparability with estimates.

EPS details

Last quarter, EPS came in at $0.37. GAAP EPS of $0.37 for Q1 were 8.8% higher than the prior-year quarter's $0.34 per share.

Source: S&P Capital IQ. Quarterly periods. Non-GAAP figures may vary to maintain comparability with estimates.

Recent performance

For the preceding quarter, gross margin was 52.3%, 100 basis points better than the prior-year quarter. Operating margin was 21.6%, 60 basis points better than the prior-year quarter. Net margin was 13.5%, 50 basis points better than the prior-year quarter.

Looking ahead

The full year's average estimate for revenue is $3.40 billion. The average EPS estimate is $1.59.

Investor sentiment

Of Wall Street recommendations tracked by S&P Capital IQ, the average opinion on Fastenal is outperform, with an average price target of $50.29.

If you're interested in companies like Fastenal, you might want to check out the jaw-dropping technology that's about to put 100 million Chinese factory workers out on the street – and the 3 companies that control it. We'll tell you all about them in "The Future is Made in America." Click here for instant access to this free report.

Add Fastenal to My Watchlist.

No comments:

Post a Comment